January Monthly ETF Rotation System Results – $SCHH, $RWO, $IYR, $IWM

The performance pages for the ETF Rotation Systems have been updated. January was a good month for both systems, but the Schwab Commission Free system continues to outperform the Basic System.

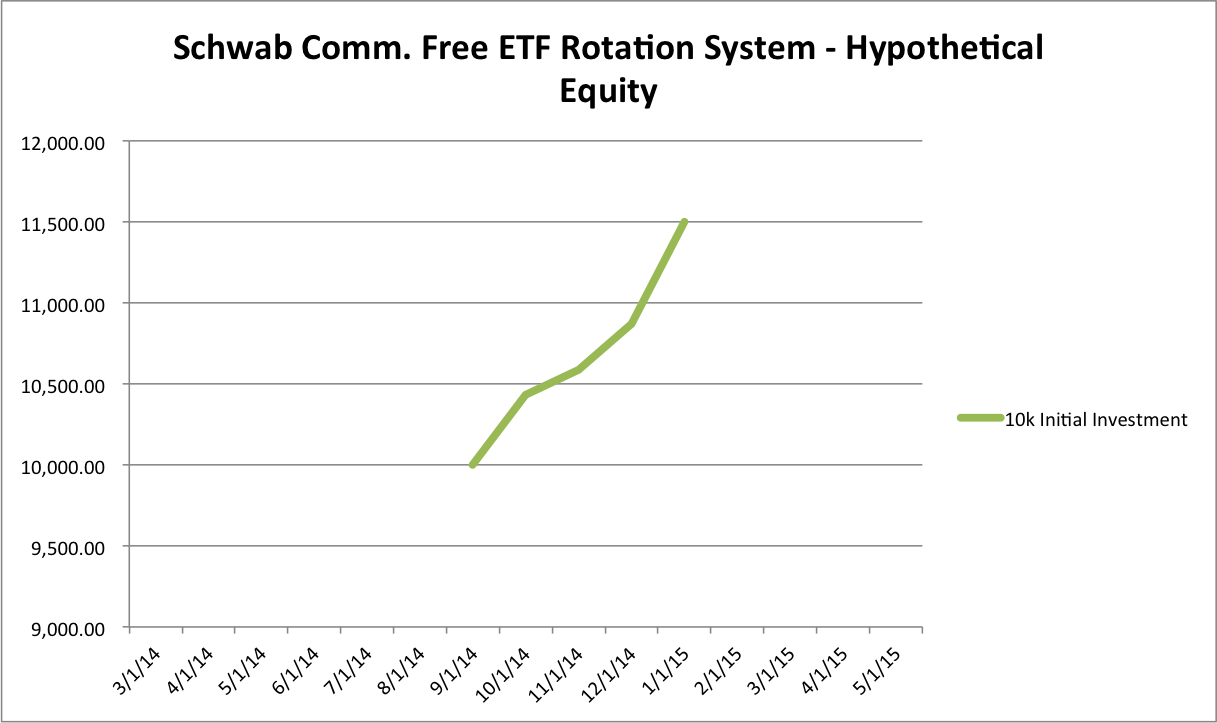

Schwab Commission Free ETF Rotation System Results:

In January the Schwab system held positions in Real Estate ($SCHH) and International Real Estate ($RWO). Despite the down day on the last trading day of January, both positions ended the month in positive territory. The hypothetical return for $SCHH was 6.23% and the $RWO return came in at 5.38%. Needless to say, it was a good month to have exposure to Real Estate.

The Schwab system has been taking positions in the top two ranked markets for the past few months, however, going into February it will hold the top 3. The reason for the change is that holding the top 3 provides a more conservative allocation and a little bit of contrast to the Basic System that holds the top 2 assets. For the month of February, the system is holding Real Estate ($SCHH), International Real Estate ($RWO), and Long Term Treasury Bonds ($TLO).

An image of the hypothetical equity curve is shown below and additional information on the system can be found on the Results and Newsletter pages.

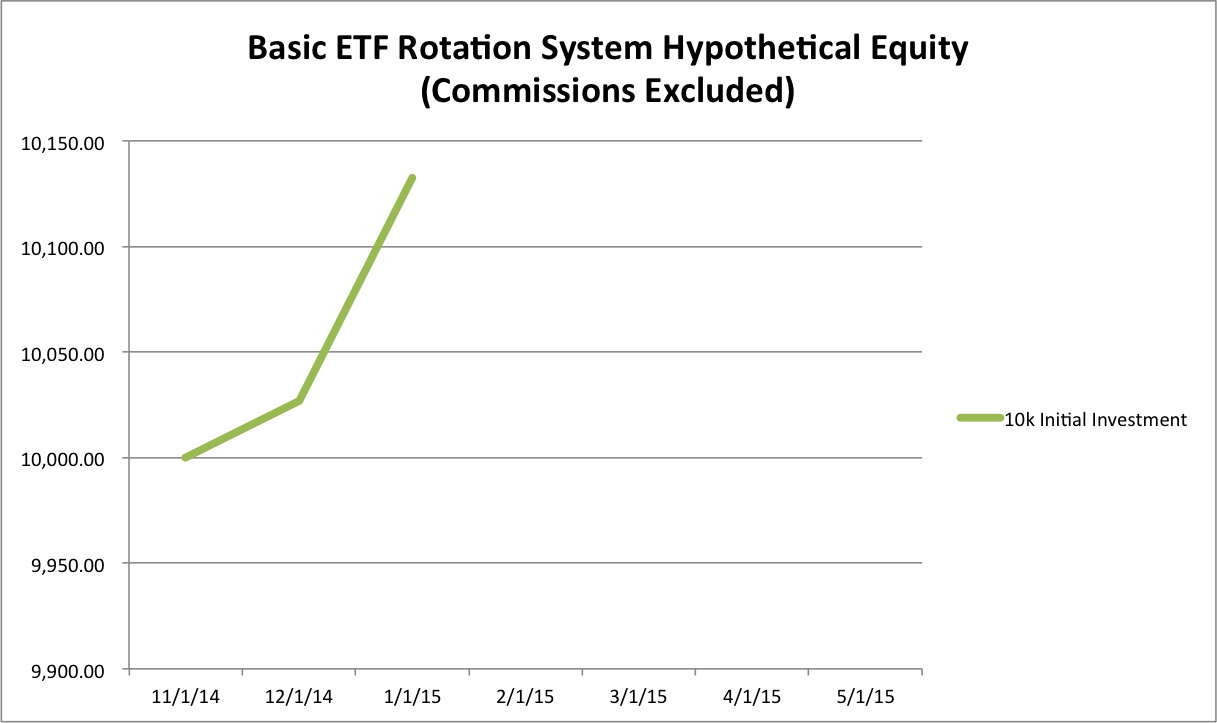

Basic ETF Rotation System Results:

The Basic ETF Rotation System has underperformed the Schwab system since inception and January continued that trend. During the month of January the Basic system held positions in Real Estate ($IYR) and the Russell 2000 ($IWM). The hypothetical return in Real Estate was 5.38% while the Russell exposure was -3.27%. Overall the system ended the month positive, but the results were more muted than the Schwab system results. For the month of February, the system is holding positions in Real Estate ($IYR) and Long Term Treasury Bonds ($TLT).

An image of the hypothetical equity curve is shown below and additional information on the Basic system can be found on the results and newsletter pages.

Thanks for reading and be sure to follow me on Twitter.