Investing. Here’s a plan to stop doing it wrong.

What is investing anyway?

I haven’t spoken much about investing on the blog and, honestly, there’s a good reason. I’m not a very active “investor” and I have a tendency to get bored with the whole concept of investing. That being said, investing is an area that I’ve really wanted to understand better and also something I know I need to spend some time thinking about. This is me telling you that we’re going to start talking about it a little more often.

In my mind, the entire purposes of investing using ETF’s, stocks, and mutual funds is to own assets that will appreciate in price. Ideally, that appreciation will exceed the real inflation rate and we’ll be left owning assets that are worth more than the initial purchase price both in nominal and real terms.

Screw 60/40 and all that stuff:

One of the challenges that I see in investing is that most people view being long stocks or long stocks and bonds as a legitimate strategy. The premise is that by holding the investments long enough, over time asset prices will rise and your investments will grow. That philosophy has always seemed like a genuinely poor idea to me because while it’s true that asset prices have risen over time, there is no guarantee that they will continue to rise and periods of rising prices are usually accompanied by periods of decline.

One of the challenges that I see in investing is that most people view being long stocks or long stocks and bonds as a legitimate strategy. The premise is that by holding the investments long enough, over time asset prices will rise and your investments will grow. That philosophy has always seemed like a genuinely poor idea to me because while it’s true that asset prices have risen over time, there is no guarantee that they will continue to rise and periods of rising prices are usually accompanied by periods of decline.

The trend follower in me always prefers to owns expensive things that are going up in price rather than inexpensive things that are going down in price. I guess it has something to do with wanting to make money. God forbid.

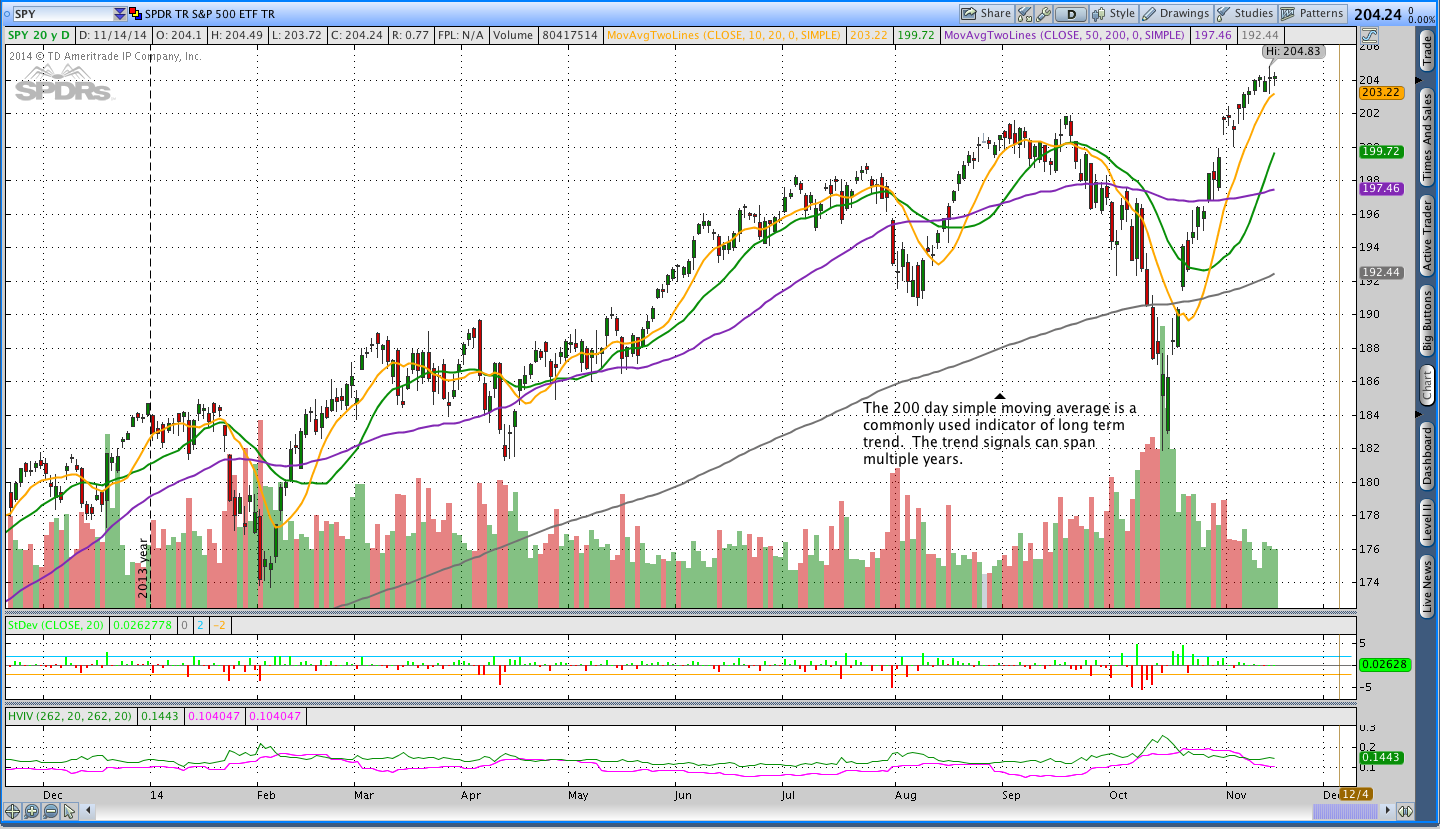

As a result of the desire to own assets that are increasing in value, it’s necessary to come up with an objective way to determine whether the trend is higher, lower, or sideways. If we wanted to take a trend following approach to investing, we could simply slow down the indicators to increase the holding periods and decrease the number of trades. For example, using a longer term Donchian Channel would work, but it would require us to monitor the markets more regularly and most investors (myself included) don’t want to worry about investment decisions very often. Essentially, what we’re looking for is some sort of low maintenance plan for investing.

On the mistakes most investors make:

If the goal of investing is to increase the value of the assets being invested, it makes sense to take steps that will lead to that outcome. There are a wide range of investment models that we know work and the biggest challenge is choosing a model that fits with our personalities and maintaining the discipline to follow the rules of the system. In other words, most investors tend to get in the way of their own success.

Individual investors, as a whole, tend to underperform the indexes of their primary investments. They tend to buy and sell at the wrong times and the patterns of behavior tend to persist over time. The persistence of wrong choices in the investment process leads to under-performance. I wish I was making this stuff up, but Dalabar issues studies on the performance of investors so we know it’s researched and true.

In order to avoid becoming a Dalbar statistic, we need to have an investment plan that we follow. Ideally that investment plan (think system) provides a return that exceeds index returns with less portfolio volatility. For example, one of the simplest long term trend following investment systems uses the 200 day moving average as a signal for being long or flat stocks. I’m not going to go down the road of discussing that system here, but a little time on Google should validate the system if you have any doubts about it “working.” That being said, the challenge for most people will be monitoring the indicator and both holding stocks the entire way up (not selling early) and getting out when the time comes.

What about momentum and rotation?

Momentum investing is another simple system that has been proven to work and, in my opinion, is easy to execute. Most momentum systems use some sort of look-back period to measure to measure rate of change for a group of assets. The assets are then ranked and positions are taken in the top performing asset classes. There are numerous rotation systems discussed online. Some of the rotation investing systems use sector mutual funds, some use ETF’s, but my preferred rotation system uses a group of uncorrelated markets. The use of uncorrelated markets makes the rotation system similar to a Donchian Channel trend following system with different entry and exit criteria.

In his book, The Ivy Portfolio, Mebane Faber discussed the diversified rotation system. The rotation system described by Faber takes five different asset classes and ranks them based on rate of change. The asset classes Faber chose were intended to mirror the investible asset classes used by Ivy League University endowments. What Faber found in his testing is that ranking a diversified group of asset classes based on momentum and investing in the top few asset classes outperformed the performance of simply buying a basket of all assets. Additionally, he found that the many different periods of time worked for momentum rankings, but my preferred ranking uses a composite rate of change. The composite averages the rate of change for 3, 6, and 12 months. By using a composite, the rankings consider a longer term significant trend (12 months) while being a little more short term biased (3 and 6 months).

Faber identifies a few broad asset classes used by the endowments. He ten translated those asset classes into ETF’s that are available to individual investors. The asset classes include: US Stocks ($VTI), Foreign Stocks ($VEU), Government Bonds ($IEF – note that this is the 10 year), Real Estate ($VNQ), and Commodities ($DBC). His book provides additional portfolios that break down the asset classes in more detail. For example, rather than just using a broad measure for US Stocks, you would consider multiple markets like small cap, mid cap, and large cap. Essentially, the model is tweaked to increase granularity in asset classes.

The table below lists the basic markets described in The Ivy Portfolio. When I first looked at the markets, it was clear that the investment decisions made by the Ivy League endowments are similar to a trend following system. For example, Donchian channel breakout systems tend to allocate into similar asset classes, but use futures and have greater exposure and granularity in commodities and currencies. In other words, the investments are made in wide range of markets, which provides true diversification and theoretically uncorrelated asset classes.

| Basic Ivy Portfolio Markets ETF | Description | Exposure |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | US Stocks |

| VEU | FTSE - All World Ex US ETF | Foreign Stocks |

| IEF | iShares Barclays 7-10 Year Treasury Bond Fund | US Government Bonds |

| VNQ | Vanguard REIT Index | Real Estate |

| DBC | PowerShares DB Commodity Index Tracking Fund | Commodities |

What I like about rotation models for investing is that they have clearly defined times to take a position, which is generally on a monthly basis. A potential shortcoming of the model is that the position sizes aren’t volatility adjusted. Each position is based on a fixed amount of account equity rather than considering how much the individual markets move and sizing the positions based on risk. The reason I describe that as a potential shortcoming is that I haven’t tested the impact of using volatility adjusted position sizing in a rotation system, but it’s an interesting consideration.

Is this new?

What Faber is doing in the Ivy Portfolio is taking momentum based investing and applying it to asset classes that mirror Ivy League University endowment asset classes. However, the merits of momentum based investing are fairly well documented and aren’t really “new.” I do, however, think Faber did an excellent job of presenting an actionable approach to Momentum Investing that is easy to understand. While his book acts like a cook book for investing, most people have a hard time following an objective system for a considerable period of time. Similarly, trend following strategies are well documented and typical systems are widely available online and in books. Again, the real challenge is sticking with the systems over long periods of time and especially through drawdowns.

So where does this leave us?

On the Theta Trend blog, I’m going to start tracking a monthly rotation system. I’ll actually be investing a portion of my retirement account in the system so I’ll have a vested interest in the performance. I’ll be using commission free ETF’s at Schwab because my retirement accounts are held at Schwab and I’d prefer not to pay commissions. I will note that Schwab seems to have the best selection of commission free ETF’s with the fewest restrictions. Nice.

The primary reason I prefer a rotation system for investing rather than the Donchian Channel system is that I can make decisions on a monthly basis and then let it sit for a month. In other words, during the month I don’t want to be thinking about taking new positions and moving stops, but I do want to use a rules based approach for investing.

The markets in the following table are intended to mirror the asset classes found in the Ivy Portfolio with a couple of extra markets thrown in. It’s worth noting that most broad asset class categories are represented.

| Schwab Commission Free ETF Rotation System | Description | Exposure |

|---|---|---|

| SCHB | Schwab US Broad Market ETF | US Equities |

| SCHA | Schwab US Small Cap | US Equities |

| PGX | Powershares Preferred Portfolio | US Preferred Stock |

| SCHF | Schwab International Equity ETF | International Equities |

| SCHE | Schwab Emerging Markets Equity | International Equities |

| SCHC | Schwab International Small Cap Equity | International Equities |

| SCHH | Schwab US REIT ETF | Real Estate (US) |

| RWO | SPDR Global Real Estate ETF | Real Estate (International) |

| SCHZ | Schwab Aggregate Bond ETF | US Bonds |

| SCHR | Schwab Intermediate Term Treasury ETF | US Government Bonds |

| TLO | SPDR Barclays Long Term Treasury ETF | US Government Bonds |

| HYMB | SPDR S&P High Yield Municipal Bond | US Municipal Bonds |

| SCHP | Schwab US TIPS ETF | US Government Bonds |

| PCY | Powershares Emerging Markets Sovereign Debt Portfolio | International Bonds |

| BWX | SPDR Barclays International Treasury Bond ETF | International Bonds |

| USCI | United States Commodity Index | Commodity |

| SGOL | ETFS Physical Swiss Gold Shares | Commodity |

Great, where do we go from here?

Now that we have a general idea of the markets we want to be involved in, it comes down to ranking the markets and taking new positions. This post is intended to be a starting point for a discussion of ETF investing. The huge increase in the number of ETF’s has made it possible for all investors to have easy access to a wide range of markets, but access to the tools won’t make you a successful investor. In order to become better investors, we need a plan that fits with our personalities and the discipline to stick with that plan.

Thanks for reading. Please share this post using your favorite social media above if you enjoyed it.