Fashionably late to the S&P party with a trade in hand

Let’s face it, the S&P has had a pretty decent run in recent weeks and anyone long is keeping a close eye on the downticks while anyone who missed the run is wishing they could still get long. So what do you do if you want to show up a little late to the party and still have a good time? Sell a vertical spread of course.

There are three directions price can go when it gets a little overextended: price can go higher (seriously, it can happen), lower, or it can chop around. A vertical spread is a defined risk option position that can benefit in two of those three scenarios. Suppose we want to be really rational about things and say that price hasn’t given us any indication that it wants to go down right now, which is essentially true. As a result, it makes sense to look at a put vertical below the market. The put vertical will make money as long as price goes higher or chops around. The position will only lose if price sharply reverses on the position soon after the trade is put on. The reason we can benefit if price chops around without advancing is that over time the short option in the vertical spread loses value. Since we know we can still crash the party, it’s time to look at a specific trade example . . .

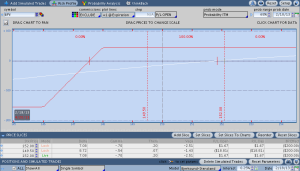

On Friday the S&P 500 ETF SPY closed at 152.11 and there is recent short-term support around 149.50. A Vertical spread strategy that looks good is to sell the 148/146 April Put vertical spread with about 61 days to expiration for roughly a .45 credit. The short 148 Put has a Delta of .32 meaning there is an approximately 68% chance that it will expire worthless. Our goal in the trade should be to take 80% of the credit and run.

While it’s great to focus on the profit target, it’s essential to know when a trade is wrong and when it’s time to get out. Since there was recent short-term support around 149.50, a close below that level would indicate weakness and suggest that it’s time to exit. If price was to hit 149.50 immediately after entering the trade and without a major spike in volatility, the position could probably be exited for a loss of around $20 per spread. If price chops around for a while before getting to that level, it might be possible to exit the position for a slight gain.

The takeaway from the trade is that you can use options in creative ways that an outright position (purchasing shares of SPY) doesn’t allow. That being said, always know your exit in advance both on the upside and the downside.