Backtest Results From Short Options Trend Following and New Questions

Overview:

Finally. The manual backtest of the Theta Breakout system produced some pretty interesting results and the general take away is that the system “works.” That being said, this is by no means a recommendation to take a trade and the results are being presented for educational purposes. I will also note that the system is selling out of the money naked options, which is generally considered much riskier than selling credit spreads. If you have bad risk management skills and/or hold trades even though your stop has been hit, you can and eventually probably will lose your ass. Don’t do that. Trade with a plan and manage your risk appropriately.

Methodology:

The system sells out of the money options following a 50 day Donchian channel breakout. For example, a new 50 day high triggers the system to sell out of the money puts. A new 50 day low triggers the system to sell calls above the market.

The system sells out of the money options following a 50 day Donchian channel breakout. For example, a new 50 day high triggers the system to sell out of the money puts. A new 50 day low triggers the system to sell calls above the market.

The system trades with both a stop and a risk based exit point. The risk based exit point is simply 100% of the credit received for selling the naked option. In other words, if a naked Put is sold for a .50 credit, the risk exit point is at $50. The second exit point is an average true range trailing stop. If price closes below the 3.5 ATR trailing stop, any short options are covered at the close.

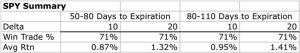

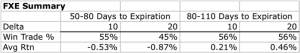

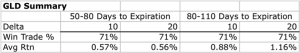

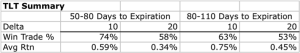

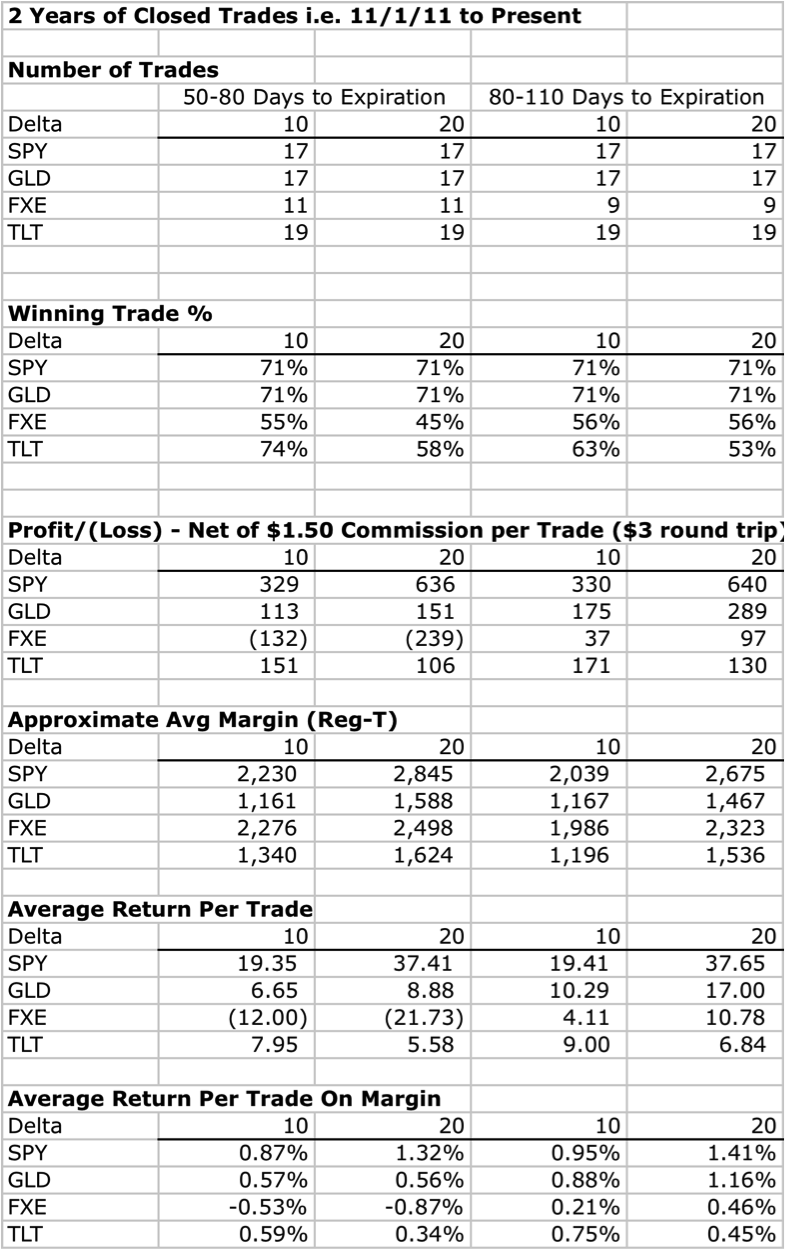

The backtest looked at 10 and 20 delta options that were roughly 60 and 90 days from expiration. Because breakouts don’t take place at exactly 60 or 90 days, the real time windows were really 50-80 days and 80-110 days. Essentially I wanted to consider options that had 2-3 expiration cycles to go. In months where the trend stretched across multiple expiration cycles (think Gold in 2013), I rolled positions when the longer dated options reached 65 days to expiration. In other words, if an option was sold with 90 days to expiration and the trade signal was still valid, I rolled the position when the option had 65 days to expiration.

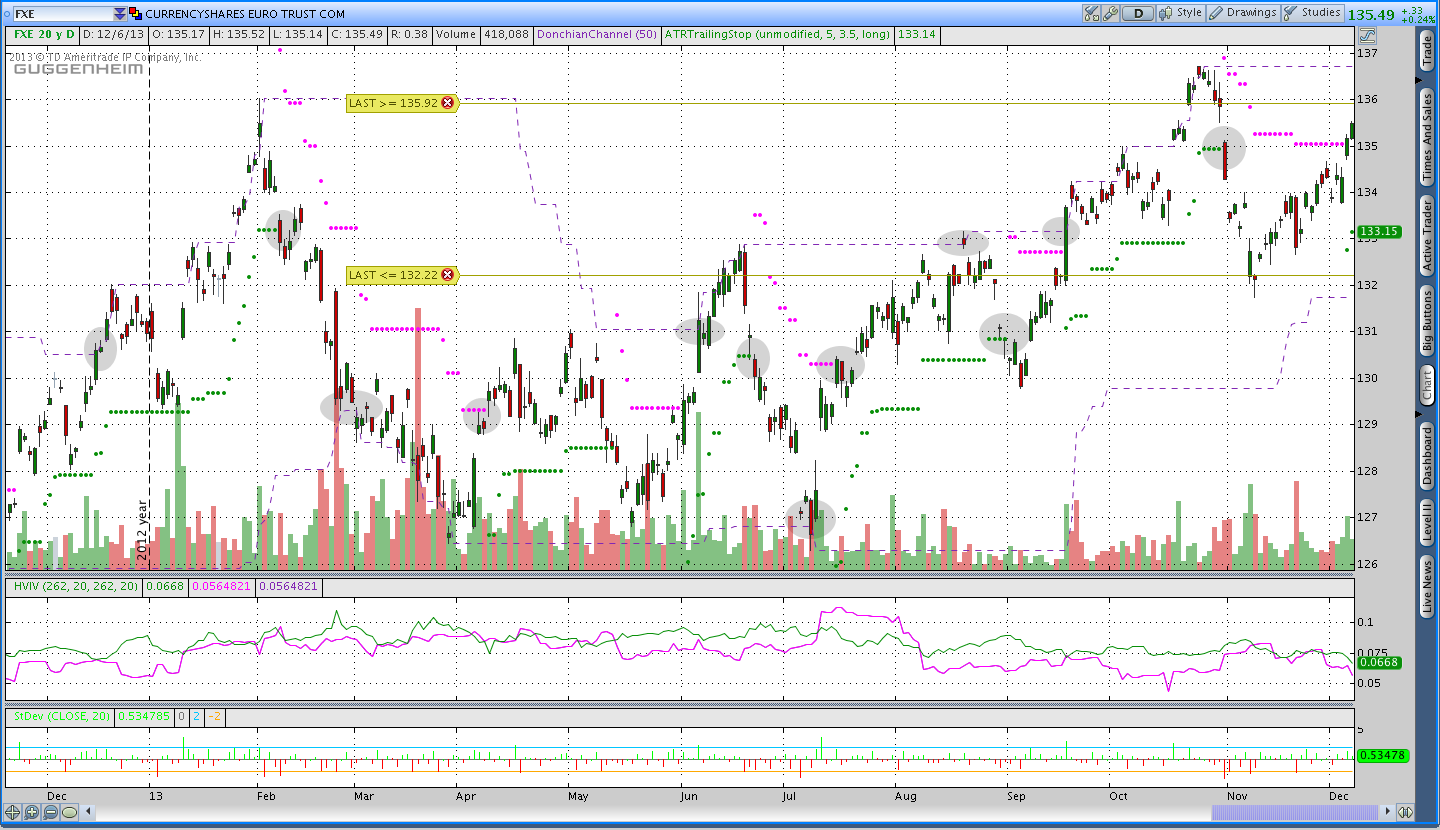

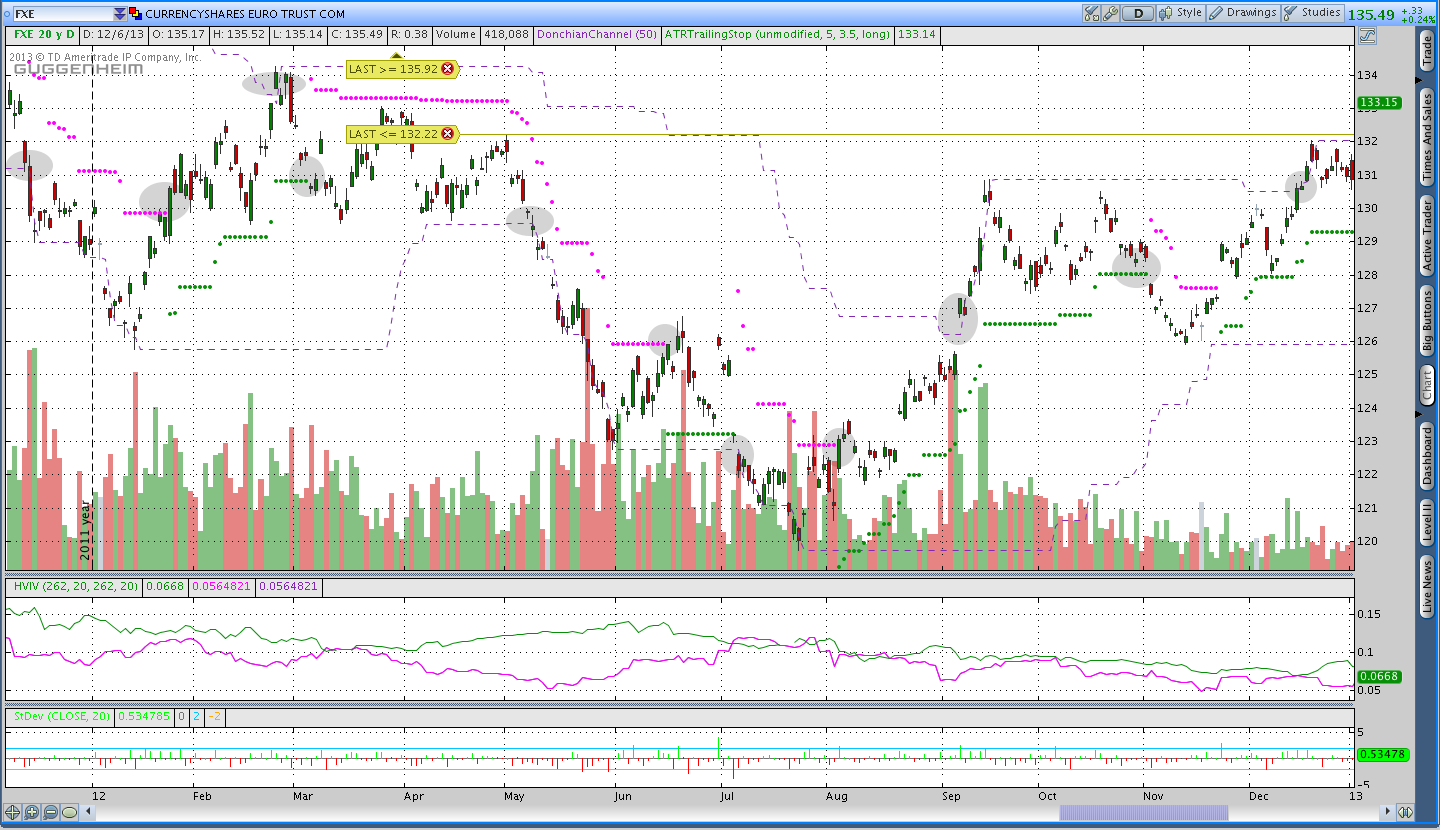

In general there were options to test both options cycles, however, the Euro (FXE) did not always have options that fit the parameters described above. As a result, I have less confidence in the Euro results, but decided to include them anyway.

Data:

All data for this test was gathered from the ThinkOrSwim ThinkBack tab and, yes, I manually gathered the data in excel (super tedious). If anyone knows of a good and reasonable priced options backtesting solution please let me know in the comments below. Bonus points if it runs on a Mac!

Period and Markets Covered:

As noted above, the backtest was performed manually so I used a relatively short look-back period. However, I chose four very different markets in an attempt to simulate different market environments. Specifically, I ran a 2 year test on the S&P 500 (SPY), Gold (GLD), the Euro (FXE), and Bonds (TLT). Images and commentary about each market are included below, but the test included both choppy and trending markets.

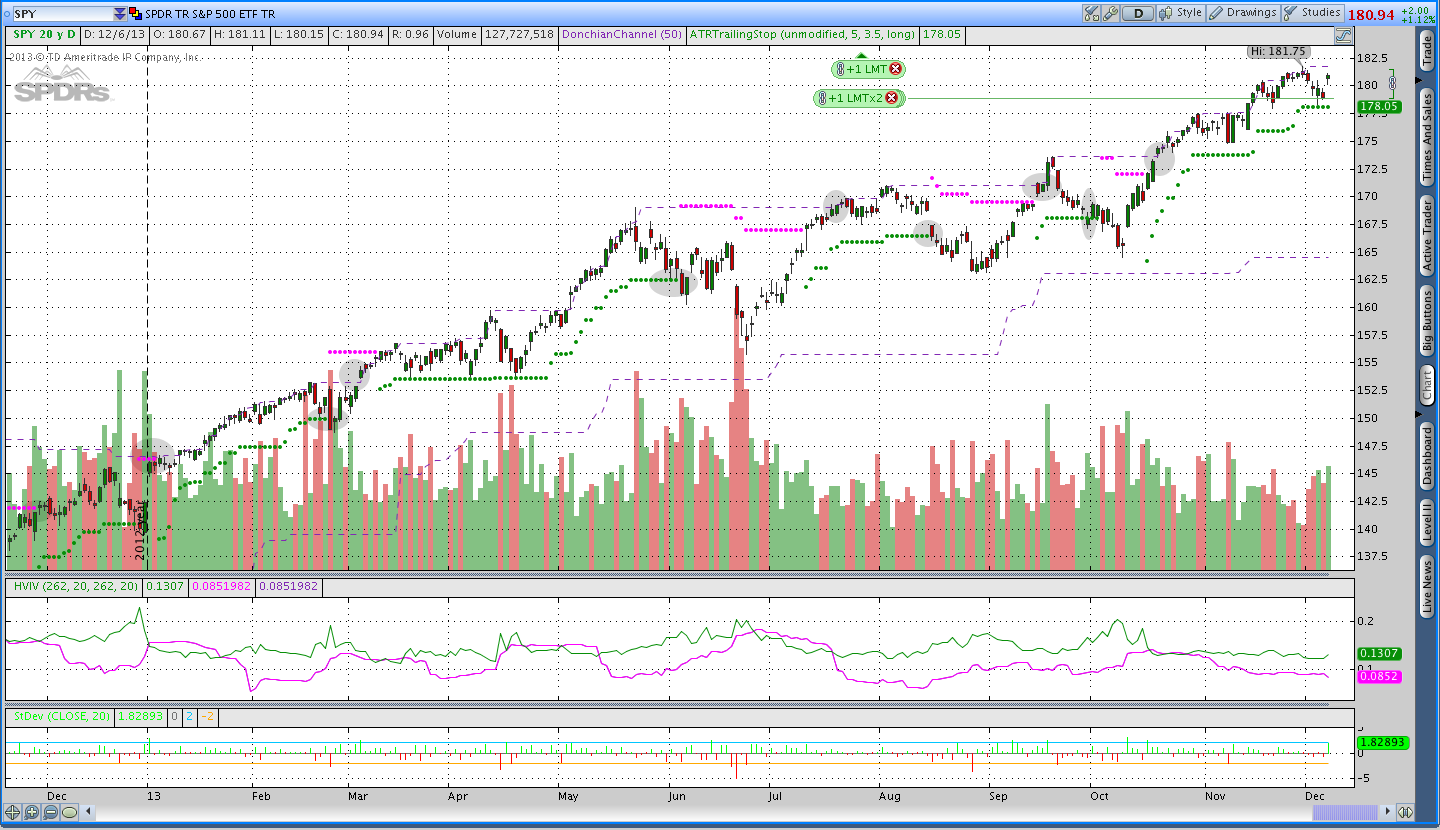

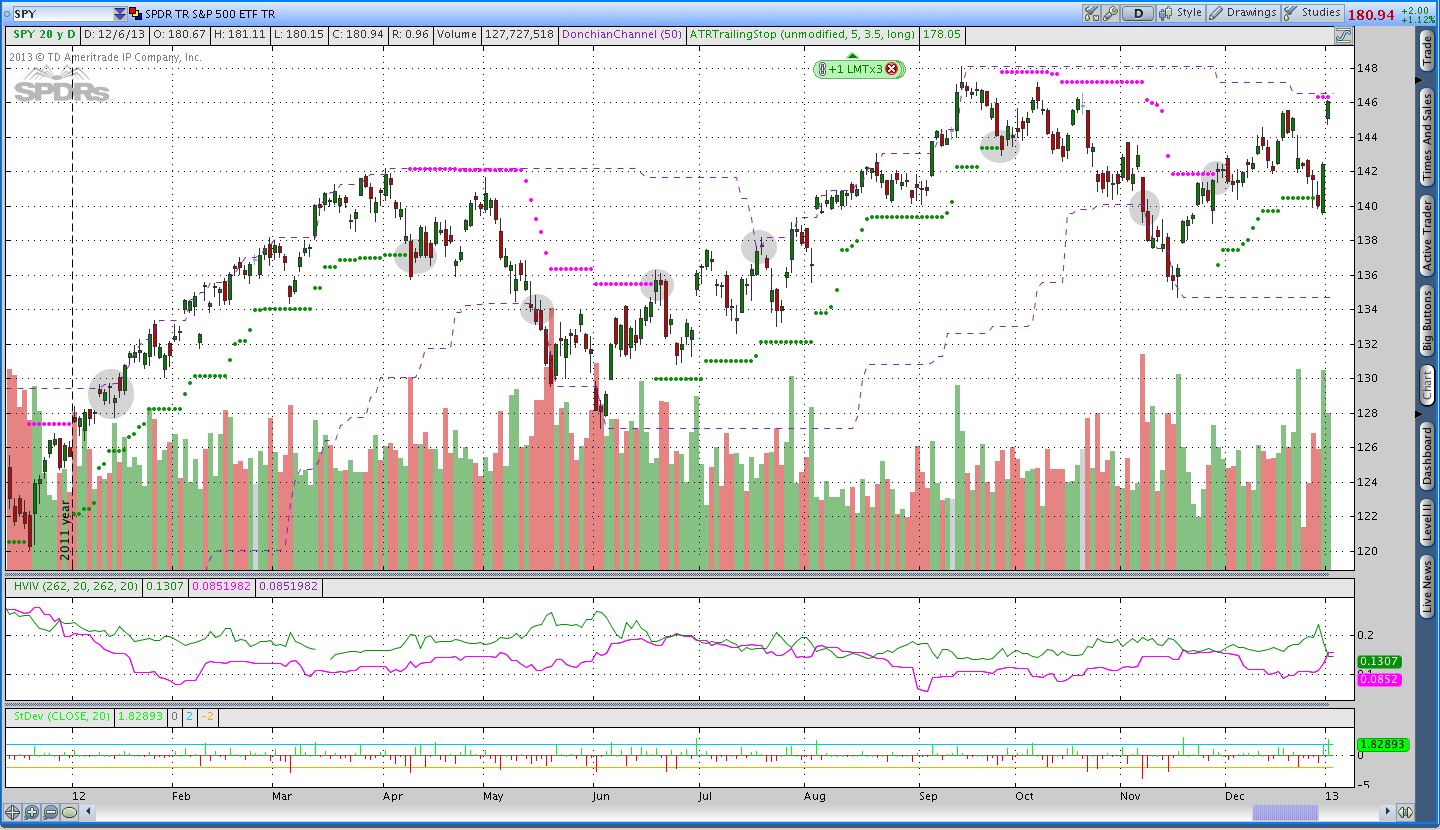

S&P 500 Market Environment and Results:

Euro Market Environment and Results:

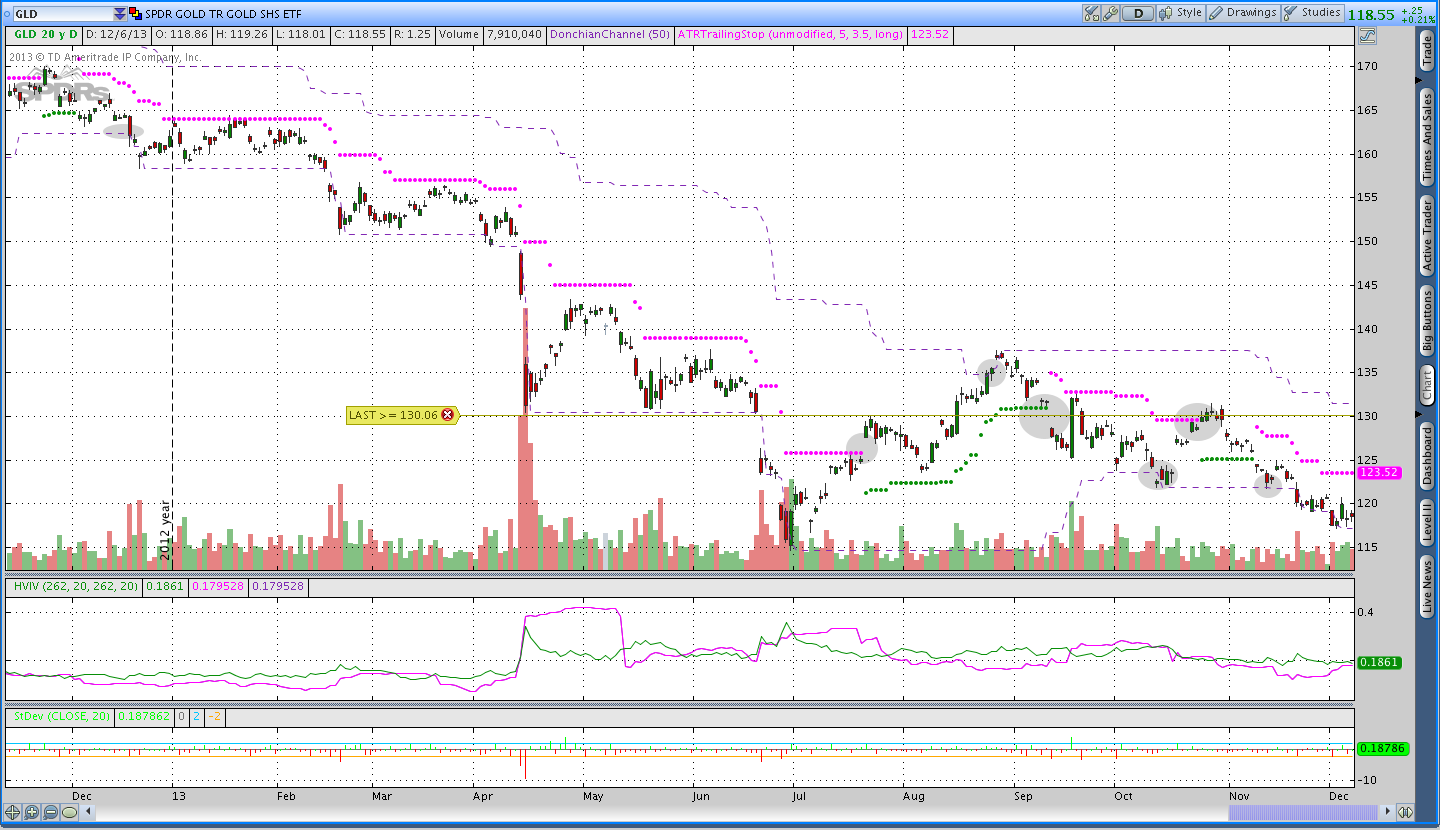

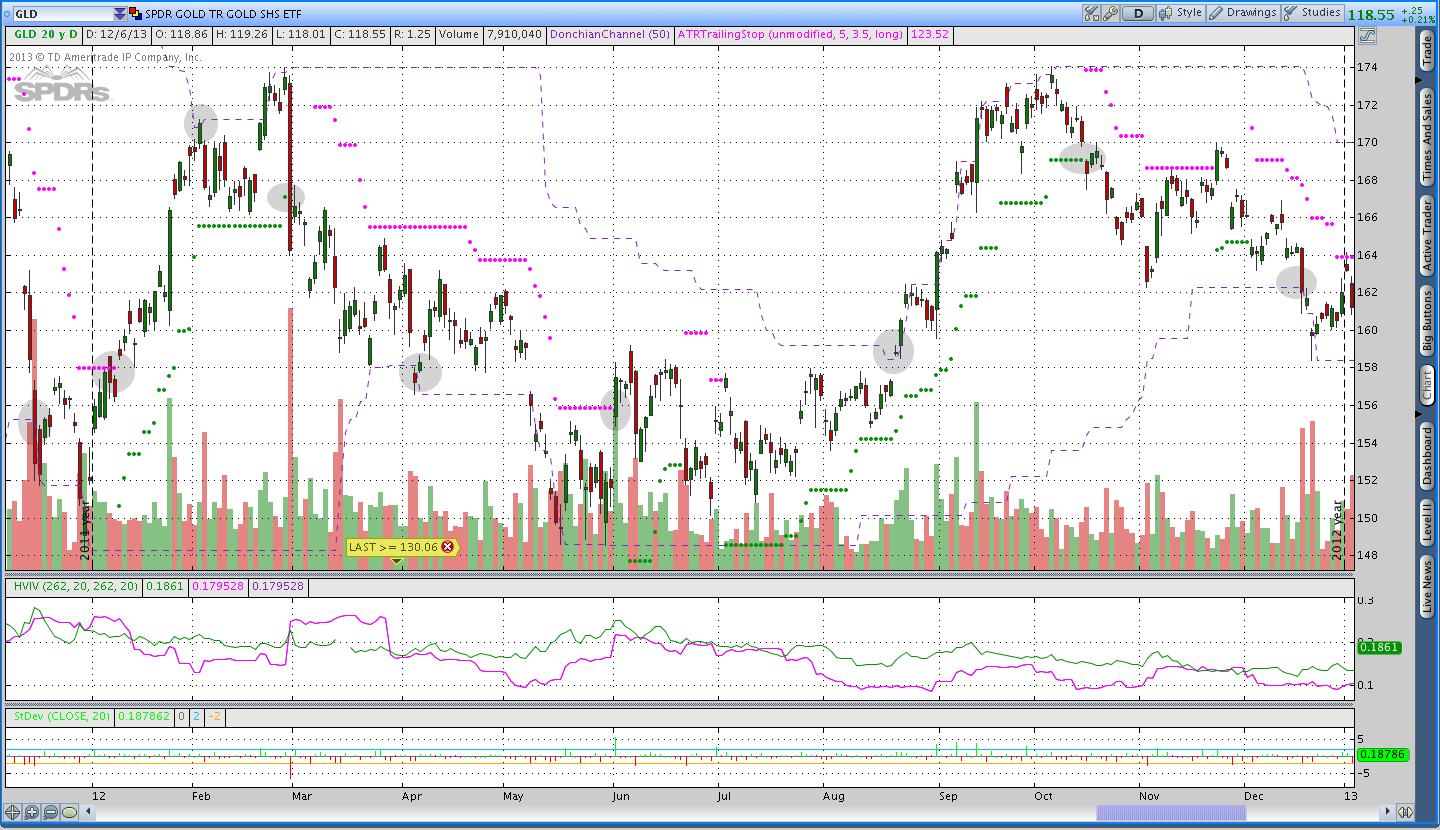

Gold Market Environment and Results:

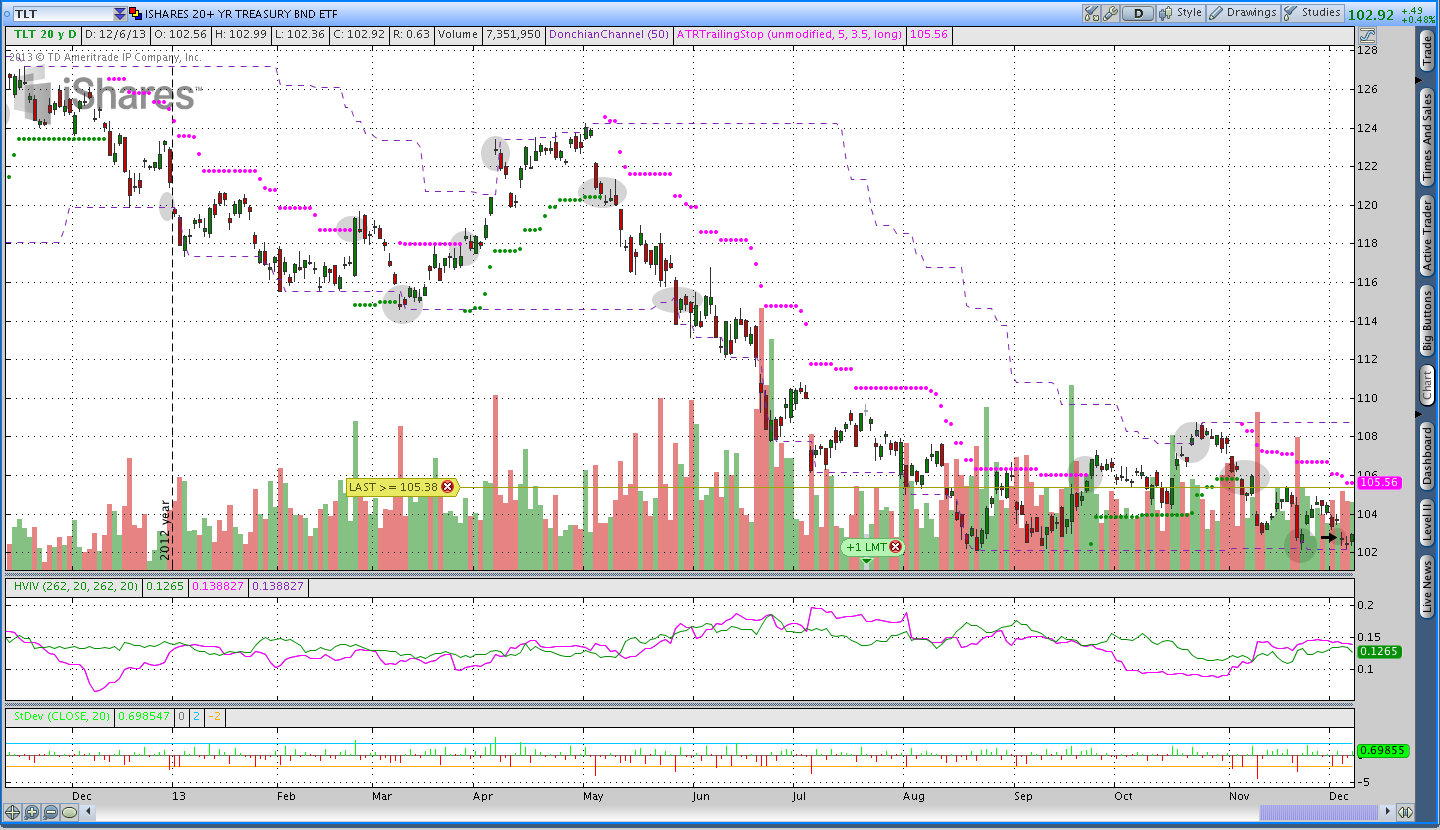

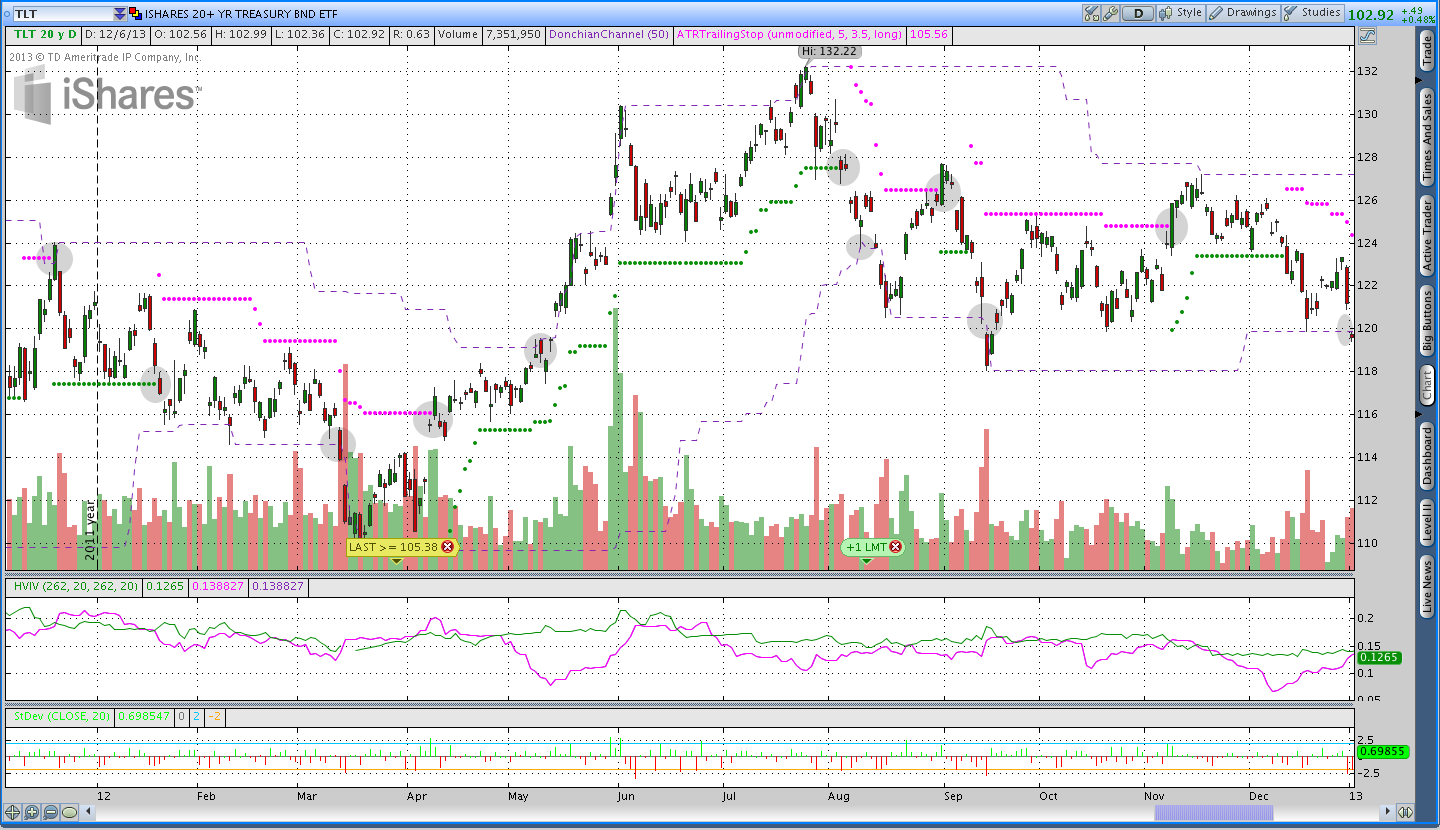

Treasury Bond Market Environment and Results:

The Full Results:

The Take Away:

After going through the results, I’d like to take a look at the returns in other equity indexes like the Russell 2000 (IWM) and the Nasdaq (QQQ). It might also be possible to add some diversification by trading individual stocks (AAPL anyone?). Based on the results, my personal preference would be to sell around a 10 delta option with 90 days to expiration. Overall the returns are fairly consistent with what you’d expect from a short options trading system with a relatively high winning % and a low return on margin.

Extensions:

I think the biggest question is what happens if you just sell options in every month regardless of the trend direction and manage those positions based on a change in Delta. Alternatively, what if we were to use a different trend filter, like a 50 day simple moving average, and sell puts when price is above the 50 day average and calls when price is below. The management rules would probably need to be slightly different and that’s a road I’ll explore in the future.

Want to know what’s going on at Theta Trend and see new systems as soon as they’re posted?

Sign up for my email list and stay up to date with the latest happenings.

Click here to get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and Theta Trend updates.

I use OptionNet Explorer for backtesting. It’s still a manual backtest process but light years easier that using ToS. http://www.optionnetexplorer.com

A year ago I tested selling 10-delta SPX weekly credit spreads every Thursday morning, then closing either at a 25% stop loss or allowing to expire worthless. The expectancy per trade was about 2% on margin including commission and slippage with a 90% win percentage.

Awesome, thanks Chris. I’ll definitely check out that software. I also came across http://www.oscreener.com, which might have some potential. Even though the manual backtesting is slow, I feel like you develop “a feel” for the system. Your weekly options trading sounds pretty interesting as well. Thanks for sharing.

Best,

Dan