Ali Pashaei On Weekly Put Selling And Beyond

Article & Course Content Update 6/3/2016:

I recently heard form Ali and he mentioned that there have been some concerns about selling naked options and/or people are hoping to have a credit spread variation of his strategy. He said that in Class Number 2 there will be a rule based credit spread system (to be used as a guide) for trading pure credit spreads.

Overview:

As many of you know, I recommend keeping an eye on the Capital Discussions community. A while back I ran across a presentation by Ali Pashaei on directional options trading and I added Ali to my list of people to follow. The reason I like his approach is that it’s statistically based, but not blind. In other words, he starts with an objective view of market activity and looks for opportunities rather than just taking a DTE trade. Ali has been actively trading options since 2001, considers Charles Cottle a mentor, and successfully manges his own and family money.

Ali recently presented a trade that uses a weekly short put in SPY as the foundation. However, the adjustments to the trade go beyond the typical rolling and hoping things rebound. Ali will be teaching a course that takes place over three Saturdays (beginning June 4th) to cover the trade, adjustments, position sizing, and more.

The Strategy:

As we talked about here, selling puts on the S&P 500 beats buying and holding the index. The CBOE has several papers on put selling strategies and there are now multiple indexes to track various strategies. If you’re reading Theta Trend I probably don’t need to convince you that selling premium is a viable strategy, but it is.

The strategy Ali is teaching is built around selling weekly puts in SPY. However, rather than simply roll or close positions, Ali is defending the puts using various adjustments including rolling, vertical spreads, and butterflies. Effectively he’s taking a know edge, selling puts, and managing the short put positions based on market movement and opportunities.

Ali will be the first to tell you that he isn’t teaching a strategy in the typical sense. He’s capitalizing on a known edge (selling puts) and then focusing on managing his position. What he’s really doing is teaching concepts and a thinking process that can be applied to other strategies as well. If you’re looking for a set of rules to blindly follow, this isn’t it. The goal is more to recognize opportunities and how those opportunities change as the market moves.

There is a PDF document linked below where you can see a sample trade. The trade takes place earlier this year where SPY traded down from around 208 to 204 as shown in the image below.

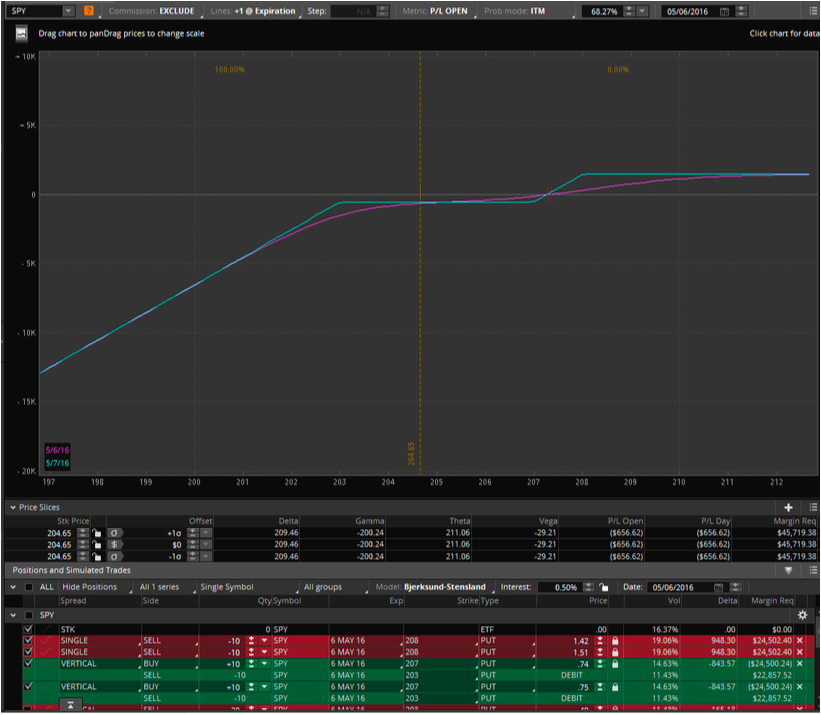

The trade began as a short weekly put paired with a vertical spread as shown in the risk graph below.

As the market moved lower, the trade was adjusted with other vertical spreads and rolling to result in a position like the one shown below. Effectively the trade was converted to more of a broken wing condor/butterfly structure.

To see the strategy in action you can download a sample trade PDF here: SPY-Weekly-Income-Strategy-v2.pdf

If you’d like to watch a video discussing the background on the trade and the edge, check out the Capital Discussion Round Table from earlier this week.

Note:

This post exists primarily to make you aware of the upcoming course that Ali will be teaching. I receive no compensation for telling you about his course. My motivation for telling you about the course is that I believe the information that Ali will be presenting is high level with a different approach to options trading than we typically see. One of the things I really like about Ali’s approach is that he’s focusing on opportunities that arise in the market rather than following a rigid set of trading rules.

Sign up:

There are several different pricing structures for the course. The links below take you to the payment pages. More information on the payment options and the course content is shown towards the end of the Capital Discussions video. Again, I receive no compensation from telling you about this, it’s just something I found interesting that I thought you might like to know about.

For a full description of what’s covered in each course, check out this PDF and go to page 34: SPY-Weekly-Strategy-Slides.pdf

Course 1 Only ($95) – June 4th 1 p.m. EST and the course will be recorded

Add on Courses 2 & 3 ($250) – June 11th and June 18th 1 p.m. EST and both courses will be recorded

All 3 Courses ($315) – June 4th, June 11th, and June 18th at 1 p.m. EST