Weekly Options Trade Watch 6/25/14 – Weekly Theta

Disclaimer: This is not a recommendation to take a trade and is being provided for educational and informational purposes only. See the full disclaimer.

Update on fills as of 6/26/2014:

I sold two spreads this morning. I was filled during the morning sell off on the SPX 1910/1900 Jul1 14 put spread at .45 and also a 1905/1900 Jul1 14 put spread at .35.

Video:

The video below gives a visual overview of the Weekly Theta trade I’ll be watching tomorrow. Next week is a short week with the July 4th holiday so this trade has one day less to expiration than usual. Trade specifics are listed below the video and in the chart at the bottom of the post. Earlier today I tweeted that I was trying to sell a 1900/1890 vertical for .50 and I chased to .40 as price traded higher. Unfortunately, the trade didn’t get filled.

The Trade:

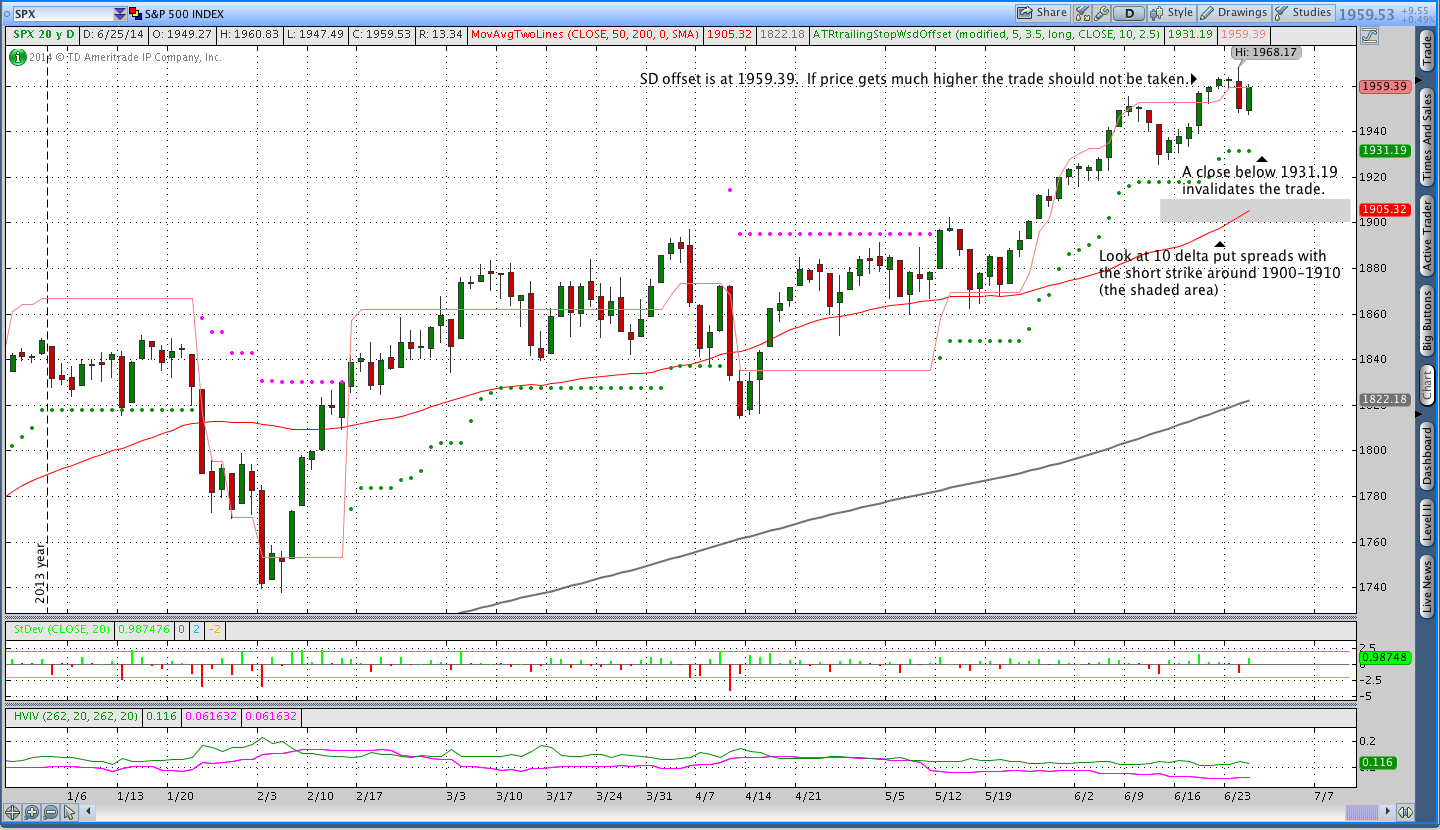

SPX closed at just under 1960 today and there is a valid signal for the Weekly Theta system. The ATRts is in a long state and price is below the SD offset so I’m looking at put spreads in the SPX Jul1 14 weekly options. On Thursday morning I’ll be looking for a roughly 10 delta vertical to sell in SPX for a minimum credit of .40 (although I will be trying for .45-.55). As of Wednesday night, and assuming the market doesn’t move significantly overnight, I’m expecting the short option of the 10 point vertical to be somewhere around the 1910 level. One thing to note is that price is currently right around the SD offset level and I’m not comfortable chasing much higher.

Daily Chart:

Potential Verticals:

- Situation 1 – SPX opens and trades flat – I’ll be looking to sell the 1910/1900 Jul1 2014 put spread for a .45 credit

- Situation 2 – SPX opens slightly lower – If price is around 1950-1955 in the morning, I will want to sell the 1905/1895 put vertical for around .45 credit

- Situation 3 – SPX opens higher than 1960 – Wait for a pullback below 1960 before taking a trade

- Situation 4 – SPX opens lower than 1950-1955 – Re-evaluate 10 delta spreads after the open

The ATRts is around 1930. If price opens below that level, there isn’t a valid long trade.

Risk and Targets:

At the time I place the trade, I will also put in a GTC order to buy back the vertical for 80% of the credit sold. For example, if the vertical is sold for .45 I will be putting in an order to buy it back for a .10 debit. Additionally, I’ll set an alert on the price of the vertical for 80% of the credit in heat (about $35 on a vertical that is sold for .45). If the trade taxes 100% of the credit in heat and/or price closes below the 1930 level, it should be closed for a loss.