Weekend Market Commentary ($SPY, $IWM, $GLD) – 12/5/2014

Big Picture:

As US Stocks continue to grind higher, markets around the world seem to be moving in a big way. Specifically, I’m talking about Oil, Commodities, Gold, and the Dollar. The Dollar has been strong against the other majors (Euro, Yen, Swiss Franc) and is also beating up on Commodities. Remember that our commodity markets are measured in terms of Dollars so when the price of a Commodity falls it means that the Dollar is relatively stronger because it buys more of that Commodity with fewer Dollars.

I think the possible fundamental “reason” for the Dollar strength is that Central Banks outside of the US have begun to vocalize a move towards softer monetary policy. At the same time, there are rumors floating around that the US will be tightening monetary policy sometime soon, potentially in 2015. That expectation of tightening in the US combined with softer policy around the world could be driving some of the Dollar strength. Do you know how we’re going to trade all of that fundamental stuff? That’s right, through price alone.

Enough fundamental nonsense and back to the markets. Gold and the Russell 2000 were both strong this week. The strength in the Russell is putting a little pressure on the December $IWM Butterfly, but we’re within 2 weeks of expiration so I’m hoping to sneak out of that trade with some sort of gain. There is more information about that position below. Gold moved into neutral mode on the daily timeframe and also flipped the weekly Parabolic SAR, which is the signal for the pTheta system to sell puts.

Please not that despite the fact that Gold has firmed up a little bit, the market still looks like something of a hot mess and I wouldn’t take an outright long position in GLD at this point. I do, however, want to sell naked puts.

Implied Volatility:

Implied Volatility got smacked down again this week and the VIX went into the weekend below 12. When you look at the mediocre performance in SPY this Friday combined with the low VIX, it seems like the market is more likely to go higher or sideways than lower.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

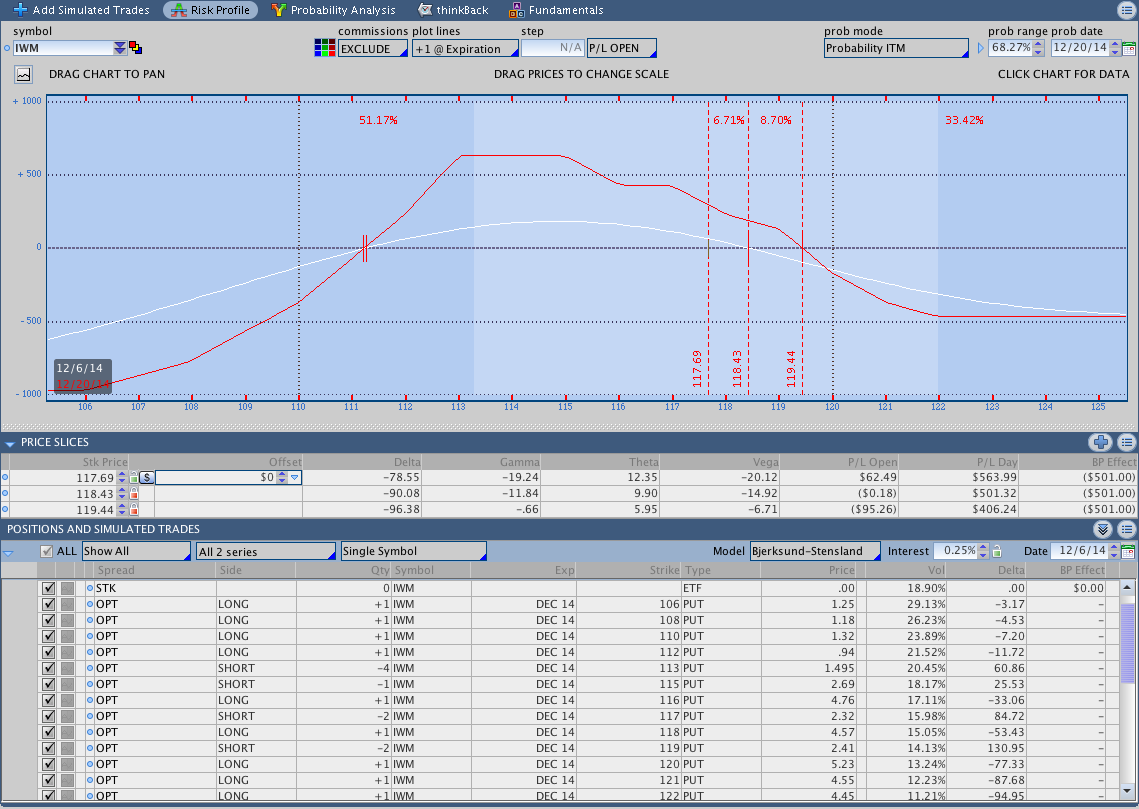

$IWM December 2014 Put Butterfly Update:

The December IWM Butterfly is still open and showing a profit despite IWM’s best efforts to take my money. I let the position ride this week despite the up move, but I do have a couple of adjustments in mind if we continue to move higher. At this point I’m just trying to stay in the trade and not get taken out by a fast move higher as we approach expiration. I think the Russell 2000 looks fairly neutral on the daily timeframe and that’s part of why I’m willing to sit in the trade.

This video from earlier in the week goes through the potential adjustments and the levels where they’ll become necessary. The image below shows the position at the close on Friday.

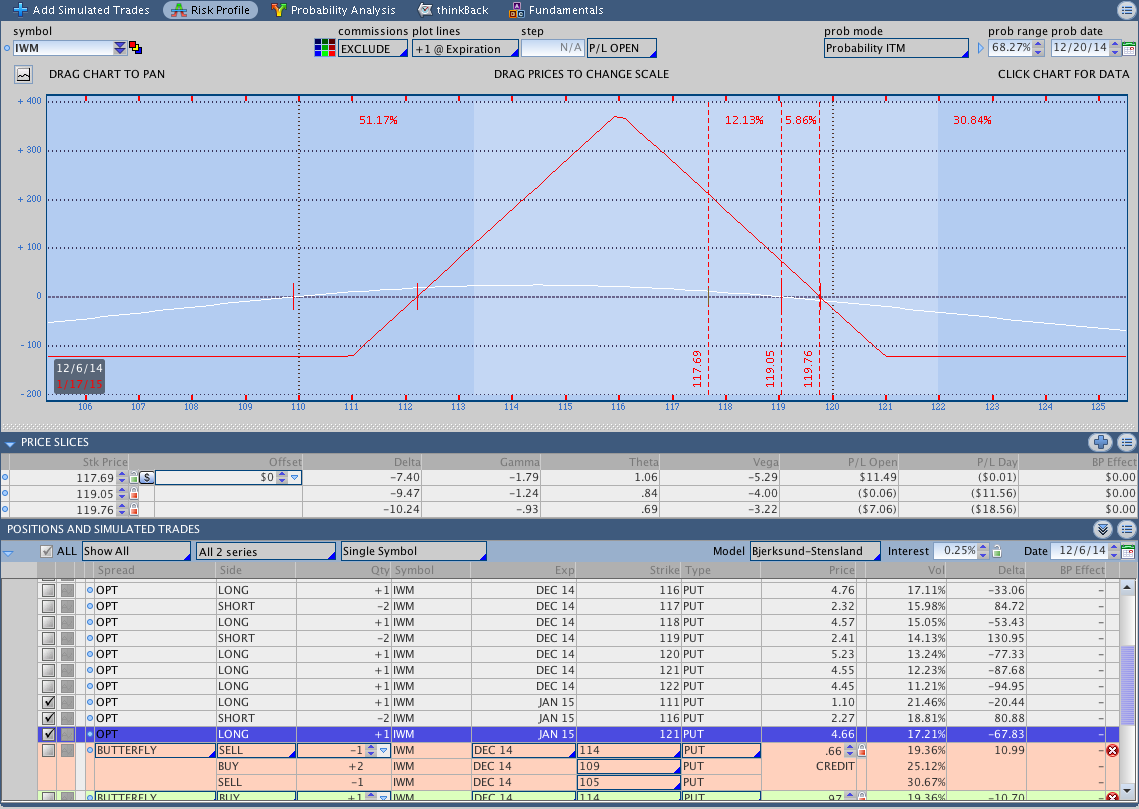

$IWM January 2015 Put Butterfly

It goes without saying that the January 2015 IWM Put Butterfly has been a much easier trade than the December IWM Butterfly. An image of the position is shown below. Right now there is nothing to do other than sit and wait.

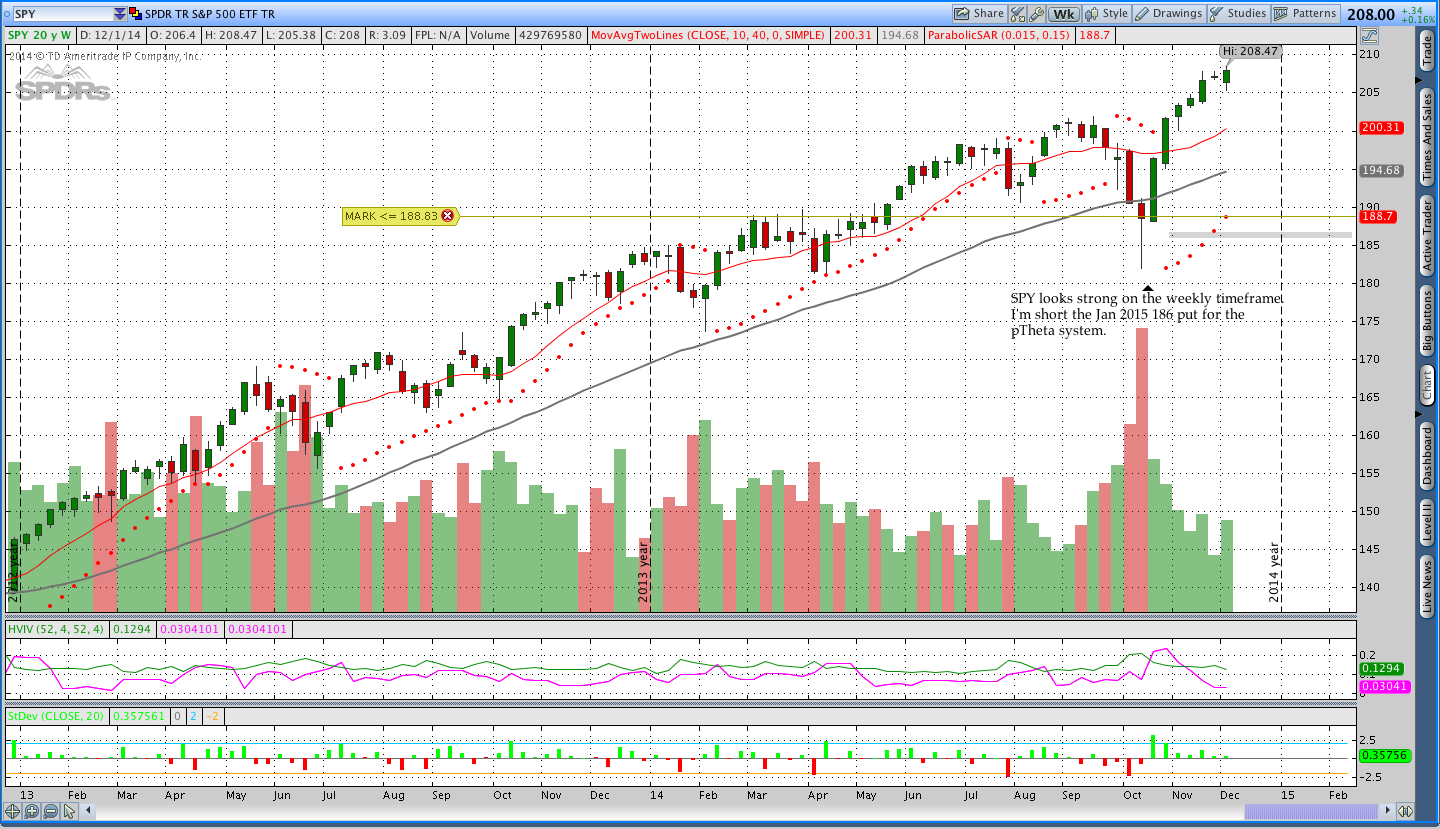

pTheta Open Position and Trade Watch:

I’m currently short the SPY January 2015 186 put for the pTheta system and that trade has been doing well. An image of the SPY weekly chart is shown below with a shaded box to indicate the short put level.

Gold made a move higher this week and flipped the Parabolic SAR signal from short to long. I’m looking for a February or Jan4 weekly Put to sell sometime this week. Specifically, I want to sell something in the 8-12 delta neighborhood for at least a .50 credit.

Schwab Commission Free ETF Rotation System:

In case you didn’t notice, I put up some new pages to track the ETF Rotation systems. We’re moving into 2015 soon and the ETF Rotation systems are going to move to the forefront in a big way. Check out the following pages if you haven’t already:

Backtesting an ETF Rotation System in Excel (Free Download)

Schwab Commission Free ETF Rotation System Results

Forex Breakout System:

As mentioned above, the Dollar is strong right now . . . really strong. An image of my open trade in USD/JPY is shown below as an example of the strength. The market looked extended after the previous Donchian Channel breakout in USD/JPY, but the current breakout is showing us that the market can do whatever the hell it wants.

Trades This Week:

None!

Option Inventory:

IWM – Jan 2014 111/116/121 Put Butterfly (bought for 1.22)

IWM – Dec 2014 106/111/116 Put Butterfly (bought for 1.03) (the 111’s were rolled to 113)

IWM – Dec 2014 104/113/114 Put Butterfly (bought for 1.05)

IWM – Dec 2014 109/115/119 Put Butterfly (bought for 1.17) (one of the 115’s is covered now)

IWM – Dec 2014 112/117/121 Put Butterfly (bought for .85)

IWM – Dec 2014 115/119/122 Put Butterfly (bought for .63)

SPY – Short Jan 2015 186 Put (sold for .65)

ETF & Forex Inventory:

SPY – Long 12 Shares from 207.38

IYR – Long 32 Shares from 76.7699

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

USD/JPY – Long 2,000 notional units from 110.084

NZD/JPY – Long 2,000 notional units from 89.036

Looking ahead:

This is going to be an important week for the December IWM Put Butterfly position because we’re getting very close to expiration. I’m hoping for a little bit of a pull back in the Russell 2000 so I can exit the position and free up some mental space that has been devoted to that trade.

Gold gave us a signal this week and I’m looking for a put to sell. I’m planning to get out a video sometime this weekend that goes through the IWM Butterfly and talks about entry considerations for Gold. Keep an eye on the blog tomorrow afternoon.

I’d like to thank all of you for the great feedback on the Market Momentum Newsletter. I will continue to publish that newsletter and we’re going to be talking about ETF Rotation Systems quite a bit in 2015. As always, thanks for reading and have a great weekend.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. Thanks for reading!

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.