Weekend Market Commentary 2/28/14 – Stocks, Bonds, Gold ($SPY, $TLT, $GLD)

Big Picture:

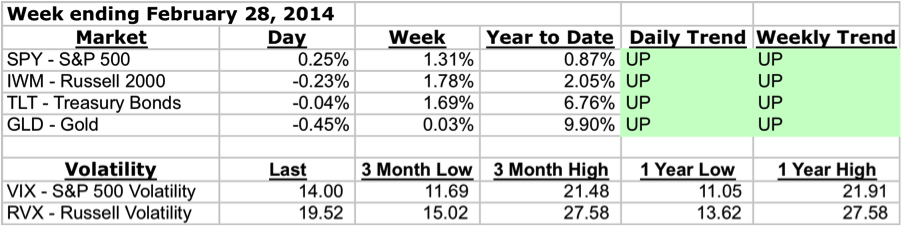

This week was smooth for most of my open positions with the exception of the $IWM short call that was closed early in the week. The trend in the Russell took a while longer than the S&P to flip long, but that happened this week. If you look at the market stats below, all markets are currently in uptrends on both the daily and weekly timeframes.

This was a very busy week for me at work and honestly I hardly watched the markets. Everything I do is totally mechanical and I only trade when there are alerts that trigger a trade. Essentially, I set alerts in my trading system and go about doing other things during the day. When an alert is triggered, I receive an email that hits my phone and I login to the trading platform to see what’s going on and/or place orders.

Side-note: For those of you who don’t already know, I’m a CPA and work as a tax accountant by day. What that means is that from now through April 15th my life becomes something of challenge. I’ll do my best to tweet out new trades, etc, but my work has really picked up and at times that might not be possible. For some reason, tax clients don’t appreciate you pausing your time with them to tweet trades. Oh well.

Implied Volatility:

Implied volatility remained essentially unchanged this week. The $VIX was slightly lower and $RVX was slightly higher.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

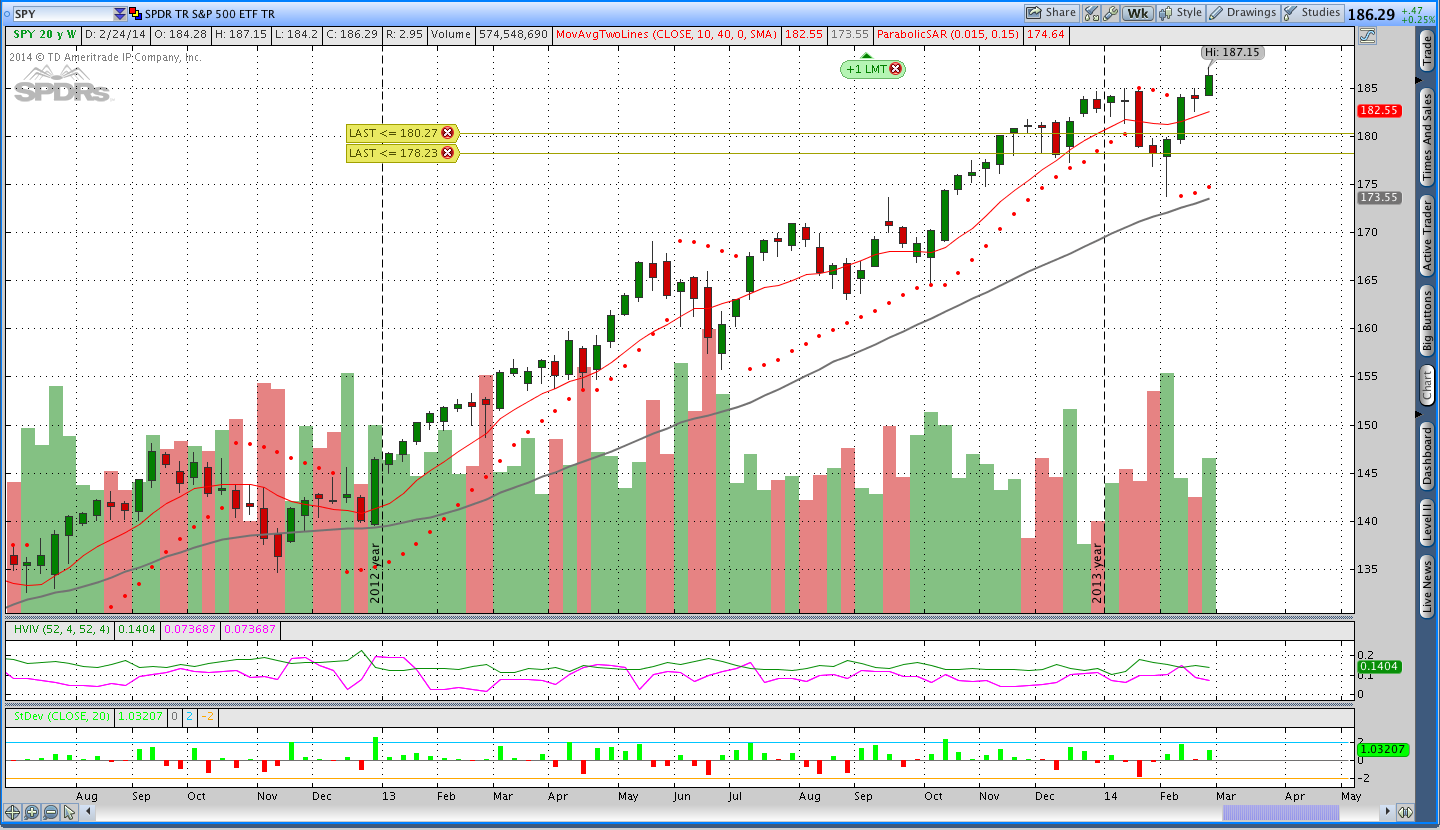

Stocks ($SPY – SPDR S&P 500):

The S&P 500 finished the week with a gain and turned positive on the year. Despite the big run last year, there isn’t any indication that the market is going down. I don’t like to predict prices, but it does seem like this year we might end up seeing positive prices even if the returns are lower than last year.

Until something changes, the pTheta system is long and pretty soon I’ll be looking for June Puts to sell. In the meantime, there was a new 50 day high on the daily timeframe and I bought shares of $SPY. I now have a short $SPY put and a few shares of the ETF.

Gold ($GLD – SPDR Gold Shares ETF):

Gold stalled a little bit this week, but is still up over 9% on the year. After the big run it isn’t surprising to see the market pause and digest some gains. Commodities in general remain strong and this week I also sold USD/CHF which means I sold dollars to buy Swiss Francs. It seems like the dollar is weakening a little bit.

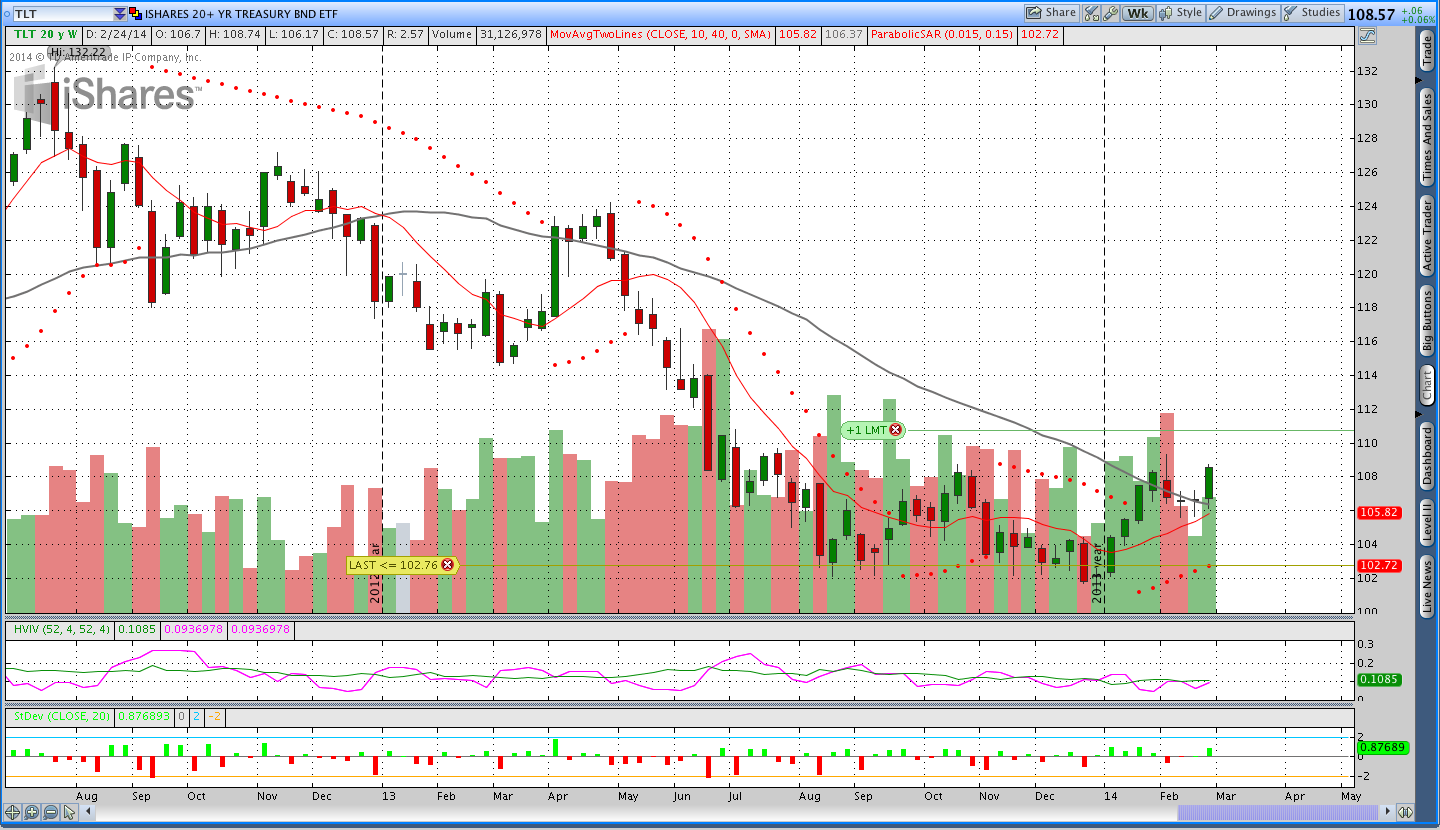

Bonds ($TLT):

Nice. After a couple of quiet weeks, Bonds went the right way for the pTheta system. I’m going to be looking for June puts to sell soon. Due to the low implied volatility in Bonds, I prefer to sell options with a slightly longer time to expiration.

Donchian Channel Breakout Trades:

The Donchian Channel trades are going along fairly smoothly. Coffee ($JO) continues to be the big winner and new trades were triggered in International Real Estate ($RWX), the S&P 500 ($SPY), and Swiss Francs (USD/CHF).

Trades This Week:

USD/CHF – Short 4,000 notional units at .87997

RWX – Bough to open 63 shares at 41.50

SPY – Bought to open 15 shares at 185.05

IWM – Covered the Short May 122 Call

Option Inventory:

GLD – Short May 2014 108 Put (sold for .60)

SPY – Short April 168 Put (sold for .72)

TLT – Short May 2014 99 Put (sold for .55)

IYR – Short June 2014 57 Put (sold for .58)

ETF & Forex Inventory:

BAL (Cotton) – Long 50 shares from 53.19

JO (Coffee) – Long 31 shares from 23.38 (started with 58 shares)

IYR (Real Estate) – Long 39 shares from 65.63

SGG (Sugar) – Long 25 shares from 56.555

USD/JPY – Short 3,000 Notional Units from 100.765

USD/CHF – Short 4,000 Notional Units from .87997

SPY – Long 15 shares from 185.05

RWX – Long 63 shares from 41.50

Looking ahead:

Right now I’m focusing on keeping my head above water at work, but I’m also trying to trade through it (don’t worry, I’ve done it before). Next week I’ll start looking for June puts to sell in $TLT and I may look at $GLD as well. If we get a continued pull back in Gold, the time could be right to sell some puts. We’ll see what happens.

Have a great weekend and please share this post with anyone you think would enjoy it. Thanks for reading.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.