Weekend Market Commentary 2/20/15 – $RUT, $SPX, $RVX, $VEU, $IWM, $TLT, $VNQ

Big Picture:

That just happened. A couple of weeks ago, U.S. Equity Markets were stuck in a trading range. Price was beginning to look bearish and they appeared to be testing and thinking about falling through the bottom of that range. Instead of falling down, the markets rejected the lower band of the range, raced higher, and broke out to new all time highs. There’s a lot of noise in the media about Greece and what’s happening overseas, but, to be honest, I haven’t been following it and I don’t really care.

What I know is that it’s bullish when a market makes a new all time high. Whether or not equities can continue to move higher immediately is up for debate, but for now stocks are still strong. One of the things I always think about with equities is that, in general, people are net long stocks. In other words, the marginal money in the stock market wants to buy, rather than sell short, stocks. My belief is that the marginal buying creates a general buy side pressure in the stock market that, combined with inflation, tends to make stocks go up in price over time. They might be relatively expensive on a P/E basis or based on other fundamental measures, but, at least for now, the trend continues higher.

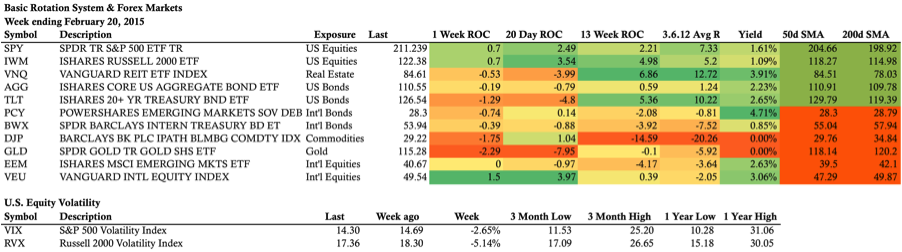

Volatility dropped again this week with the $RVX making a new 3 month low. Volatility in the Russell 2000 is at the lowest level since November. Volatility in the S&P 500 via the $VIX closed the week below 15 and both markets went into the weekend at new highs.

The big winners on the week were International Equities ($VEU) and US Equities ($SPY and $IWM). Bonds and Real Estate ($TLT and $VNQ) continued to head lower this week, but the rate of selling appears to be slowing. At this point, the rotation systems look like they’ll post negative returns for the month. Gold and Commodities were hit hard this week, which is consistent with the more “risk on” theme we’re seeing across equity markets.

The Weekly Stats:

ETF Rotation System Positions:

Even though the ETF Rotation systems are down on the month, the rankings haven’t changed just yet. It’s possible that next month the system will drop one of the assets below, but there are still a few days left in the month. The charts below show the Schwab Commission Free ETF positions in Real Estate ($SCHH), International Real Estate ($RWO), and Long Term Treasury Bonds ($TLO).

Click here to visit the Market Momentum Newsletter page that covers the systems in more detail.

Options . . .

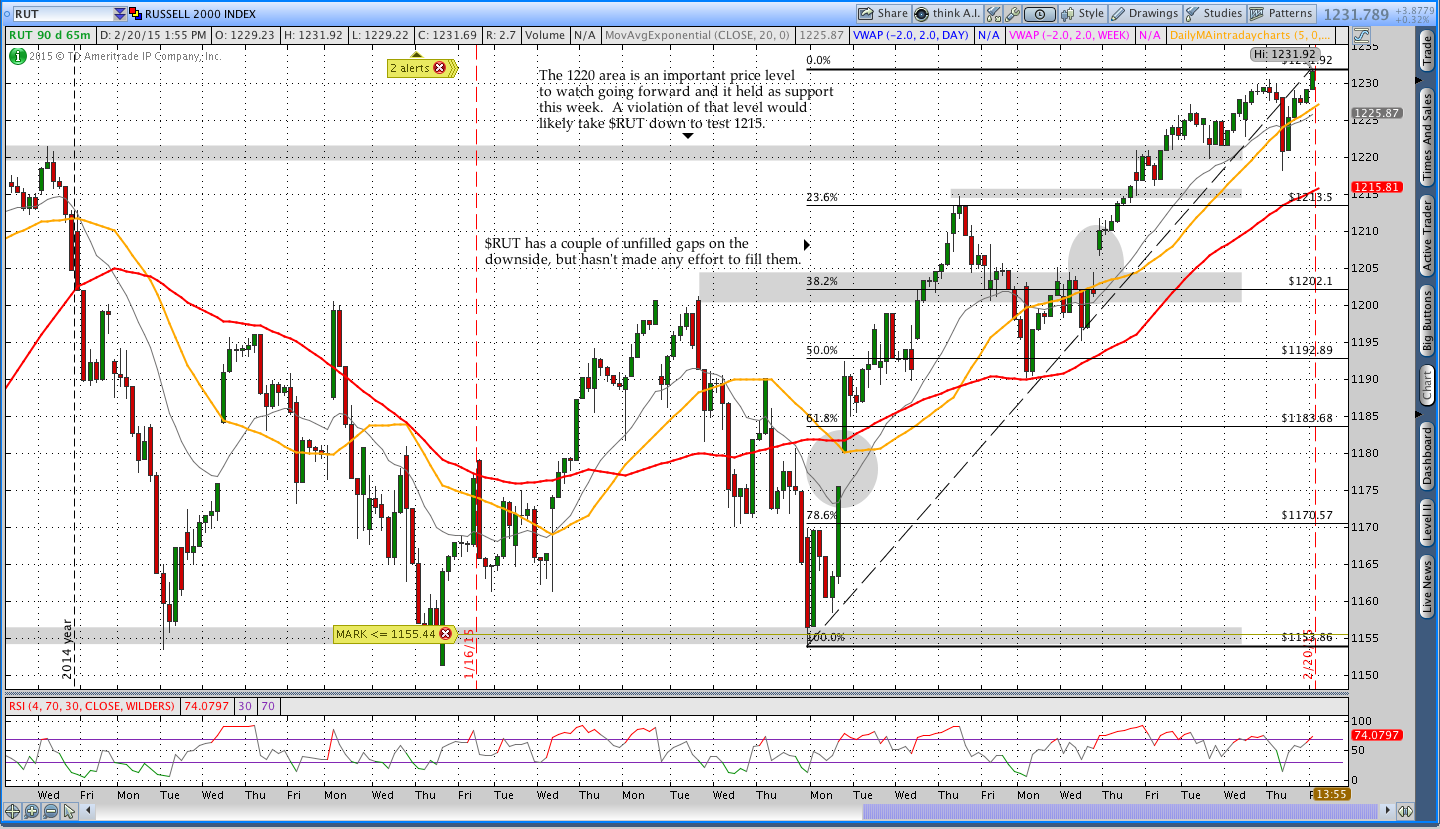

The charts below are the daily and intraday charts for the Russell 2000 ($RUT). This week the Russell pushed higher and the March Put Butterfly was adjusted. The next adjustment point (as shown below on the daily chart) is up around 1240. If we’re lucky, $RUT will take a little time to pause or, god forbid, pull back next week and I might be able to sneak out of the position. I’d love to see $RUT trade down to 1200, but I’m not holding my breath.

$RUT Iron Condor:

The $RUT Iron Condor was closed this week in an effort to free up some margin. The position was originally sold for 1.60 and was covered at 1.30. The position was doing what all good Iron Condors do . . . not much. I took the small profit and moved the capital into the Butterfly.

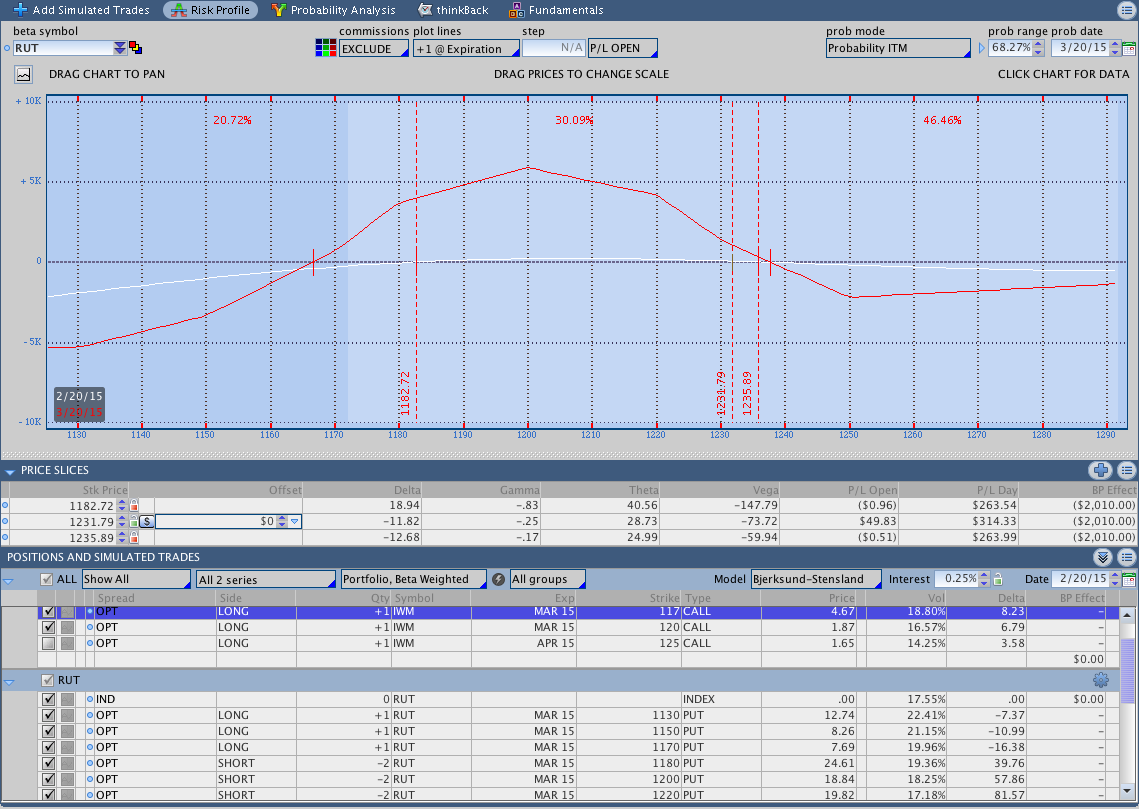

$RUT March 2015 Options Put Butterfly:

This was a good week for the $RUT March Put Butterfly. I adjusted the Butterfly again on Thursday slightly before hitting the 1230 adjustment point. I was heading to work and knew that it would be difficult to adjust the position later in the day so I decided it was safer to make the adjustment. That adjustment pushed out the expiration break even line again and added to the position.

After making the adjustment on Thursday, $RUT decided to sell off on Friday morning. That selling brought the market down into the neighborhood of prior resistance and the upward sloping 10 day moving average. Because I was short delta, the move lower brought the position into the money; however, I expected the market to bounce back rather than continue lower.

I used the down move as an opportunity to roll one of the long upside puts down 10 points and pulled some money out of the trade. That adjustment also had the effect of making me less short delta and protected the open profit on a market bounce. It was the right move. Shortly after rolling down the put, the market bounced, but the bounce didn’t hurt as much because of that adjustment. I’m planning to put together a post that goes through the second adjustment so keep an eye on the blog tomorrow.

I try to tweet out my trades whenever possible so you should click here and follow me on Twitter.

The video in this post goes through some technical analysis and talks about the first adjustment on Thursday. The risk graph below shows the position as of the close on Friday including all adjustments.

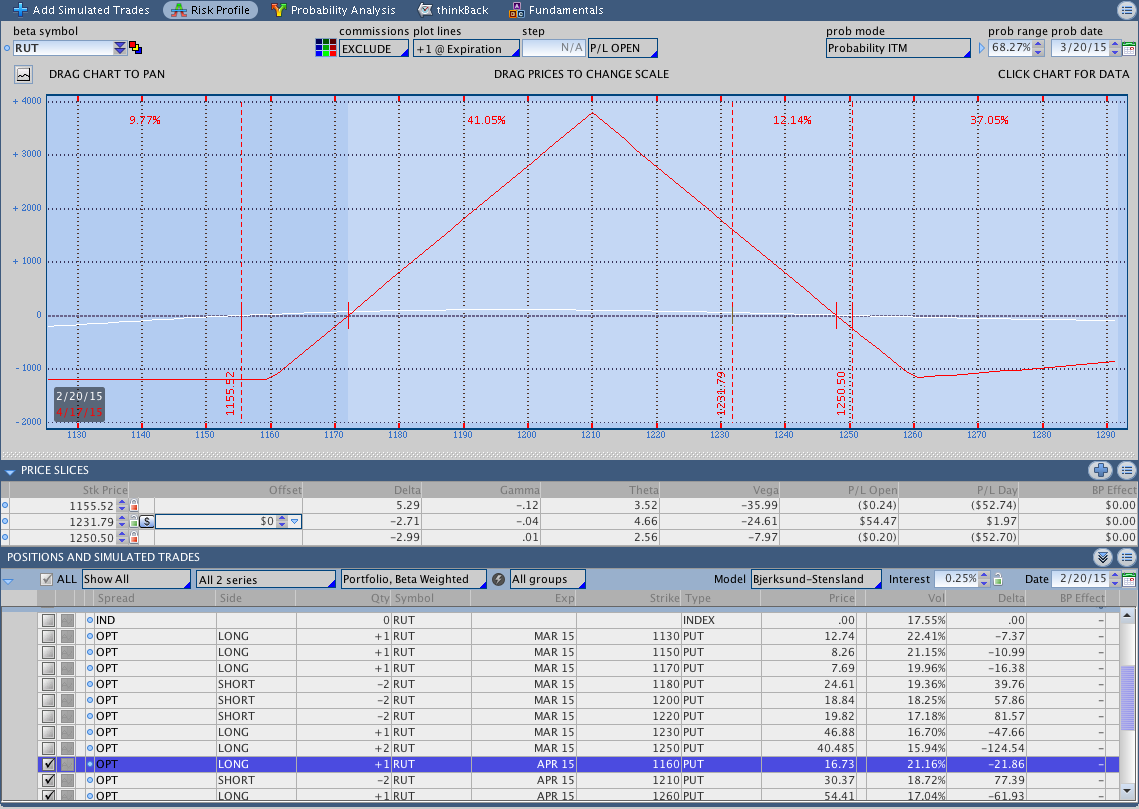

$RUT April 2015 Options Put Butterfly:

I like to initiate new Butterflies slightly below the money because it gives the positions a flatter T+Zero line with a better risk/reward ratio than an At The Money Butterfly. At the same time, I add a long call to hedge the short delta on the upside. That combination gives me a relatively flat T+Zero line and room to run on the downside. However, placing the butterflies slightly below the money makes an upside adjustment more likely so it’s ideal to put on a Butterfly when price is extended and unlikely to move significantly higher immediately.

With the Russell 2000 at new highs this week and looking a little extended, I decided to enter an April 2015 Put Butterfly. It’s a little early to say the timing was good, but I’m sure we’ll find out. An image of the position is shown below and this video goes over the March and April positions.

Trades This Week:

RUT – Bought to open 1160/1210/1260 Apr 15 Put Butterfly for a 10.40 debit

RUT – Bought to open 1170/1220/1260 Mar 15 BWB for 8.85

RUT – Rolled down 1260 Put (from BWB above) – Sold 1250/1260 Put Vertical for a 7.15 credit

RUT – Bought to close 1030/1040/1290/1300 Mar5 2015 Iron Condor for a 1.30 debit (to free up margin)

IWM – Bought to open April 2015 125 Call for 1.65

TLT – Sold to close 5 shares at 126.7201 (to free up margin)

TLT – Sold to close 13 shares at 126.75 (to free up margin)

IYR – Sold to close 10 shares at 79.89 (to free up margin)

IYR – Sold to close 22 shares at 80.10 (to free up margin)

ETF, Options, & Forex Inventory:

SCHH – Long 41 Shares from 34.009

SCHH – Long 72 Shares from 38.73

SCHH – Long 4 Shares from 42.28

RWO – Long 92 Shares from 48.49

RWO – Long 5 Shares from 50.92

TLO – Long 63 Shares from 78.94

RUT – 1150/1200/1250 March 2015 Put Butterfly bought for a 12.20 debit

RUT – 1130/1180/1230 March 2015 Put Butterfly bought for a 10.40 debit

RUT – March 2015 1170/1220/1260 Broken Wing Put Butterfly for 8.85. Rolled down the 1260 put by selling a 1250/1260 Put Vertical for a 7.15 credit

RUT – April 2015 1160/1210/1260 Put Butterfly bought for a 10.40 debit

IWM – March 2015 120 Call bought for a 1.87 debit (Butterfly Hedge)

IWM – March 2015 117 Call bought for a 4.67 debit (Butterfly Hedge)

IWM – April 2015 125 Call bought for a 1.65 debit (April Butterfly Hedge)

Looking ahead, etc.:

This week one of my posts was featured on the System Trader Success blog. The site is run by Jeff Swanson with some additional authors. He has a ton of great information over there on systematic trading and I highly recommend checking them out.

In other news, a blogger named Henri Wilkinson who writes a newer blog called Quant Head reached out to share some of his work on ETF Rotation Systems. He’s doing some interesting things with excel on his site so head over here and check him out as well.

Last weekend I was hoping for a little bit of a pullback in stocks to help the options trades. Instead we saw new all time highs and the markets are strong. I’d still like a little bit of a pullback, but there’s nothing I can do to make that happen. All we can do is look at the market we have and trade it accordingly. As of the close on Friday, that looks like a bullish market with lower volatility. We’ll need to see what next week holds.

Have a good rest of the weekend and thanks for reading.

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.