Weekend Market Commentary 2/13/15 – $RUT, $SPX, $TLT, $SCHH, $RWO

Big Picture:

Have you ever had a conversation with a cat about trading? Yesterday I was walking around the house thinking about the things I need to do in preparation for my move and I realized that I was discussing the $RUT Butterfly trade with one of my cats. Yes, I just admitted to having more than one cat. I view the conversation as a great moment in my trading . . . A dog would have looked at me like he doesn’t understand the trade. The cat looks at me like I’m the one who doesn’t understand.

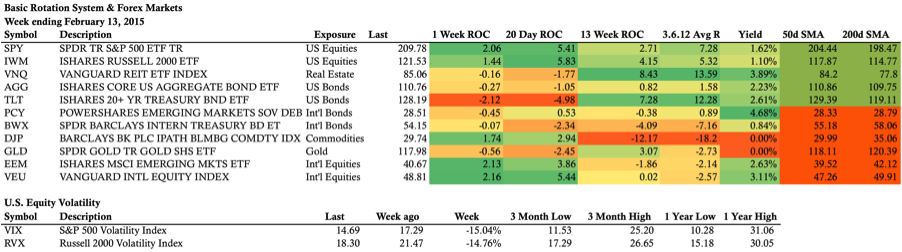

Last week the ETF Rotation systems were beat up by the down move in Bonds and Real Estate. This week Bonds continued a little bit lower, but the rate slowed and Real Estate gave the systems a little break by not getting clobbered again. The reality of trading an ETF rotation system (or any system for that matter) is that there will be periods of pain and underperformance. Part of trading and investing is watching equity go up and down with a longer term tendency to go up. Right now the ETF Rotation systems are on a down swing and that’s just part of the game. I do, however, wish I was still holding the long Russell 2000 position ($IWM) from January. Oh well.

The Russell 2000 and the S&P 500 both closed the week at new all time highs and volatility dropped going into the long weekend. The strong price action with volatility confirmation makes me suspect that the possibility of moving higher is greater than the possibility of heading lower. I think a little pull-back is possible, but absent any catastrophic news over the weekend, a crash lower seems unlikely.

The Weekly Stats:

ETF Rotation System Positions:

The ETF Rotation systems are having a rough month primarily due to the Long Term U.S. Treasury holdings ($TLO and $TLT). The charts below show the Schwab Commission Free ETF positions in Real Estate ($SCHH), International Real Estate ($RWO), and Long Term Treasury Bonds ($TLO).

Click here to visit the Market Momentum Newsletter page that covers the systems in more detail.

Options . . .

The charts below show the Russell 2000 ($RUT). The first chart is a daily chart showing the breakout to new all time highs this week and the second chart is an intraday 65 minute chart with areas of potential support.

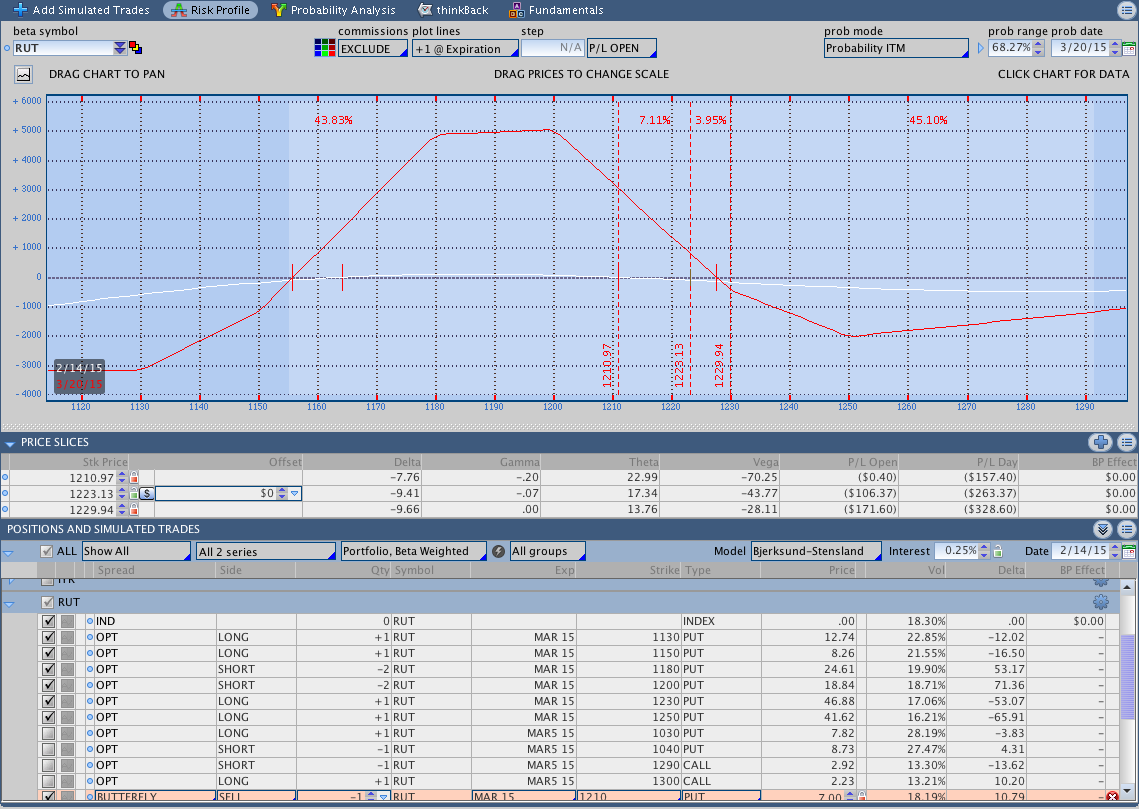

$RUT Iron Condor:

The $RUT Iron Condor is still down a little bit of money on the call side, but the collapse in IV helped the trade significantly this week. The short call delta has decreased from around -.10 to -.136 with the move up. It’s worth noting that last week $RUT was about 18 points lower and the short call delta was essentially the same. Time and falling IV have helped the position, which has 45 days to expiration.

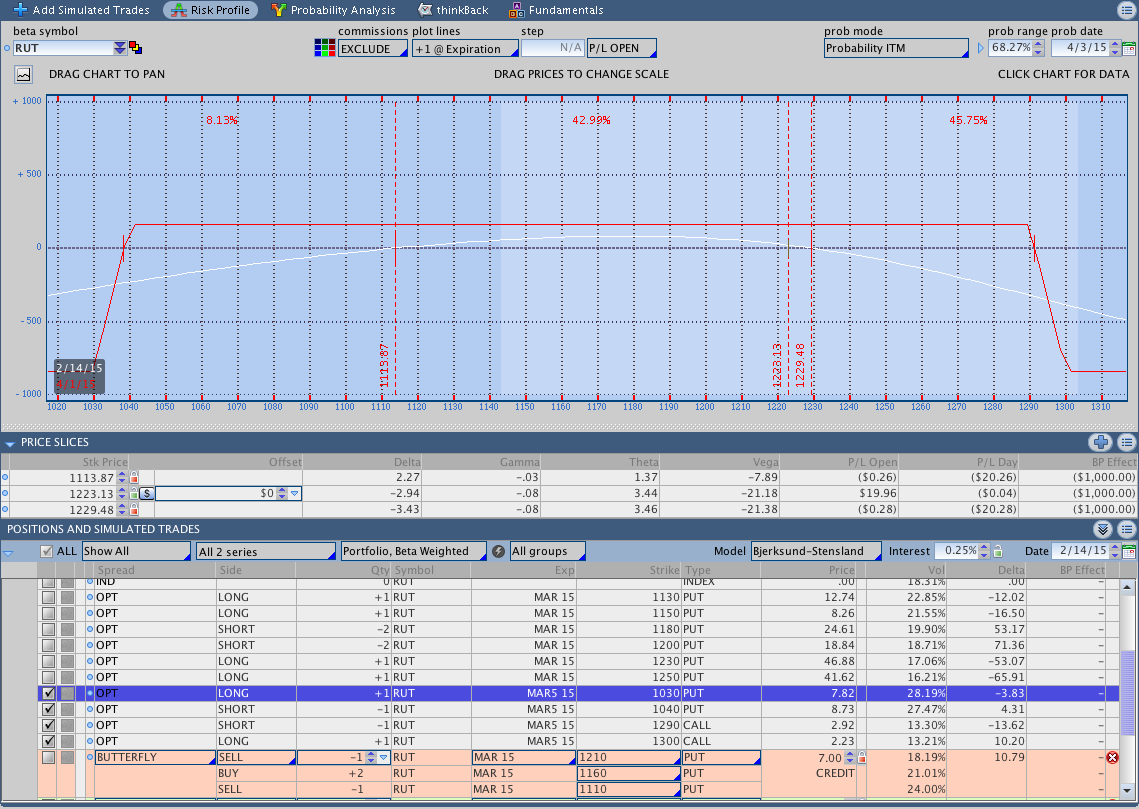

$RUT Butterfly:

The $RUT Butterfly was adjusted again this week when $RUT hit the 1220 level. I adjusted the position by rolling the 1600 Put Butterfly to 1200 and the next adjustment point is around 1230. Right now the trade is down a little bit of money, but is generally healthy. The trade was initiated when $RUT was trading around 1170.

The trade has around $3,000 of capital allocated to it and I’m targeting around a 10% return on capital at risk. The open loss is around $100 or roughly 3.5% of capital at risk so from a risk/reward standpoint everything still looks good. The trade has 33 days to expiration as of today.

I discussed the $RUT Butterfly Adjustment choices in this post prior to making the adjustment. Be sure to check it out.

$SPX Weekly Verticals:

Last Thursday I sold a couple of $SPX weekly call verticals and I Tweeted out one of trades after getting filled. Both trades were covered early this week for small debits and they both hit their profit targets. This Thursday I watched $SPX gap higher, and move higher throughout the day without filling the gap. I did NOT sell a call spread this Thursday because of the strong price action in $SPX. On Friday $SPX traded higher and validated the decision to remain flat.

The previous stop level for selling weekly call spreads was around 2092 and $SPX closed at 2096 on Friday. The Friday close flipped the weekly system from short to long and I’ll be selling put spreads next week if the conditions are favorable. The chart below shows $SPX closing above the stop level.

Trades This Week:

RUT – Bought to open 11500/1200/1250 Mar 15 Put Butterfly for 12.20 (rolled up)

RUT – Sold to close 1110/1160/1210 Mar 15 Put Butterfly for a 7.00 credit (rolled up)

SPX – Bought to close Feb2 2015 2100/2105 call vertical for a .10 debit

SPX – Bought to close Feb2 2015 2105/2110 call vertical for a .10 debit

GLD – Sold to close 18 shares at 117.375 (to free up margin)

ETF, Options, & Forex Inventory:

IYR – Long 32 Shares from 76.7699

TLT – Long 18 Shares from 138.50

SCHH – Long 41 Shares from 34.009

SCHH – Long 72 Shares from 38.73

SCHH – Long 4 Shares from 42.28

RWO – Long 92 Shares from 48.49

RWO – Long 5 Shares from 50.92

TLO – Long 63 Shares from 78.94

RUT – 1150/1200/1250 March 2015 Put Butterfly bought for a 12.20 debit

RUT – 1130/1180/1230 March 2015 Put Butterfly bought for a 10.40 debit

IWM – March 2015 120 Call bought for a 1.87 debit (Butterfly Hedge)

IWM – March 2015 117 Call bought for a 4.67 debit (Butterfly Hedge)

RUT – 1030/1040/1290/1300 Mar5 2015 Iron Condor sold for 1.60 credit

Looking ahead:

U.S. Equities finished the week strong and right now I’m hoping that we get a little bit of a pullback rather than continuation on the upside. That being said, I’m expecting more upside and I’ll be watching the options trades closely.

We’re already about half way through February and the ETF Rotation systems have taken a beating this month. Hopefully the second half of the month will be better, but we’ll need to wait and see how it plays out. The systems have had a few good months so they were probably due for a little pain.

Have a good rest of the weekend and Happy Valentine’s Day.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.