Weekend Market Commentary 2/1/14 – Stocks, Gold, Cotton, Coffee ($SPY, $GLD, $BAL, $JO)

Big Picture:

And it happened. This week the trend in stocks finally reversed for the weekly pTheta system. As a result, all of my short puts are closed and it was a little bit of a painful close because it happened so soon after selling the puts. That being said, I’ll push on and this week I’m looking for a bounce in stocks to sell naked calls.

And it happened. This week the trend in stocks finally reversed for the weekly pTheta system. As a result, all of my short puts are closed and it was a little bit of a painful close because it happened so soon after selling the puts. That being said, I’ll push on and this week I’m looking for a bounce in stocks to sell naked calls.

As a result of the trend reversals, I only have open options trades in $GLD. I took several small losses and that’s totally fine with me. One of the big lessons I’ve learned from trading the Donchian channel breakout system is that it’s ok to take numerous small losses, especially if the longer term expectancy is positive. As long as I never take the big loss, everything should work out over time.

Side-note: For those of you who don’t already know, I’m a CPA and work as a tax accountant by day. What that means is that from now through April 15th my life becomes something of challenge. I’ll do my best to tweet out new trades, etc, but my work has really picked up and at times that might not be possible. For some reason, tax clients don’t appreciate you pausing your time with them to tweet trades. Oh well.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

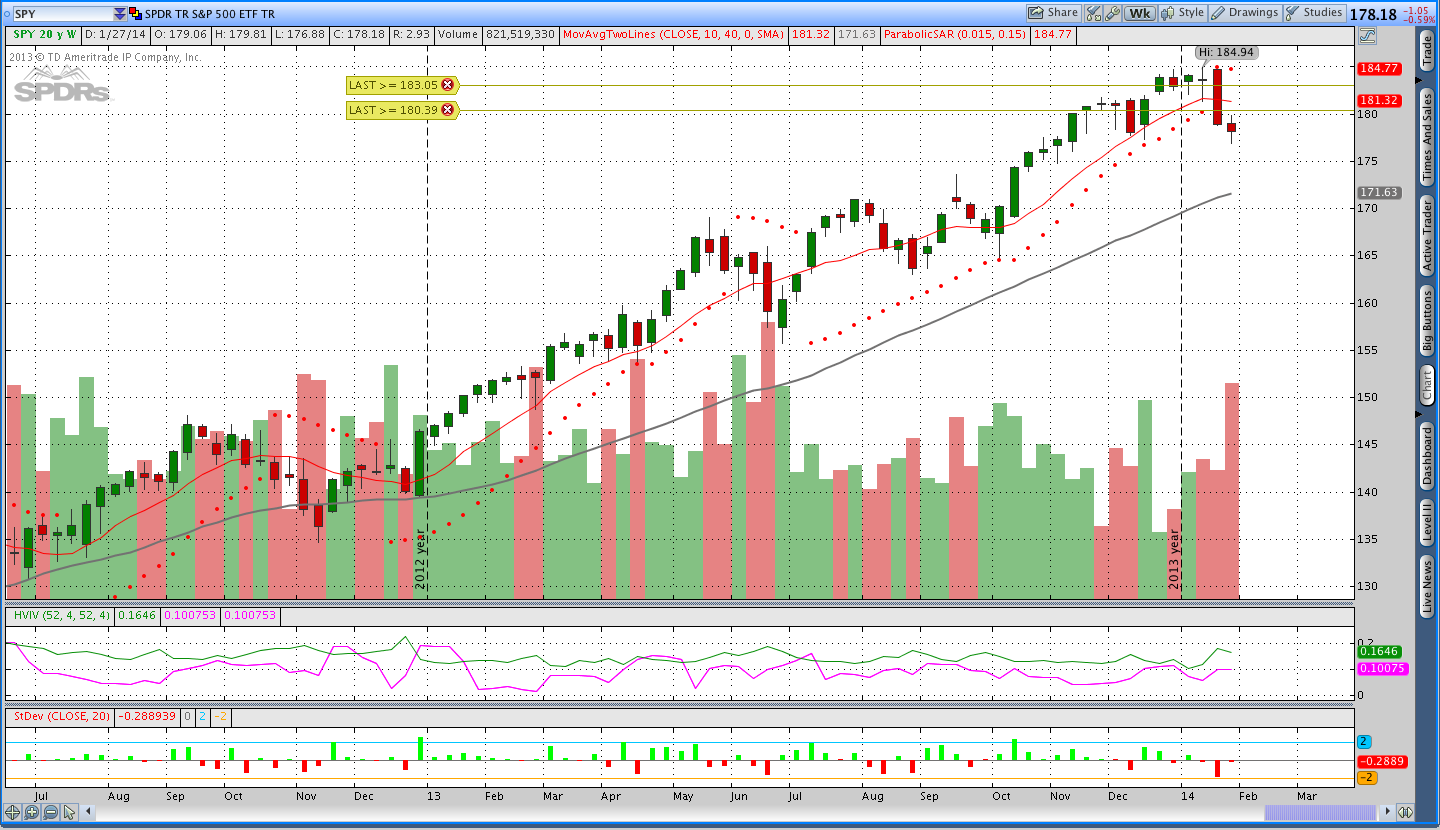

Stocks ($SPY – SPDR S&P 500 ETF):

Stocks ended the week down again, but the rate of decline slowed. In the weekly chart of the S&P 500 below, it’s interesting to note that we have a spinning top with high volume. I’m not sure what that means for the direction of the market, but right now the weekly trend says we should be short. I’m looking for opportunities to sell calls in $SPY.

The decline in stocks has pushed volatility up to the high end of the 3 month range. Selling premium looks very attractive unless prices continue to decline and volatility goes higher. I may take an Iron Condor trade in the next week or two depending on both price action and volatility. Specifically, I’m watching a 20 or so delta Iron Condor with 40ish days to expiration.

Gold ($GLD – SPDR Gold Shares ETF):

Gold pulled back a little bit this week and that helped my short calls. Right now Gold is very close to hitting the pTheta trailing stop and that would take me out of the short calls. If I’m taken out of the short calls, I’ll be looking for opportunities to sell naked puts.

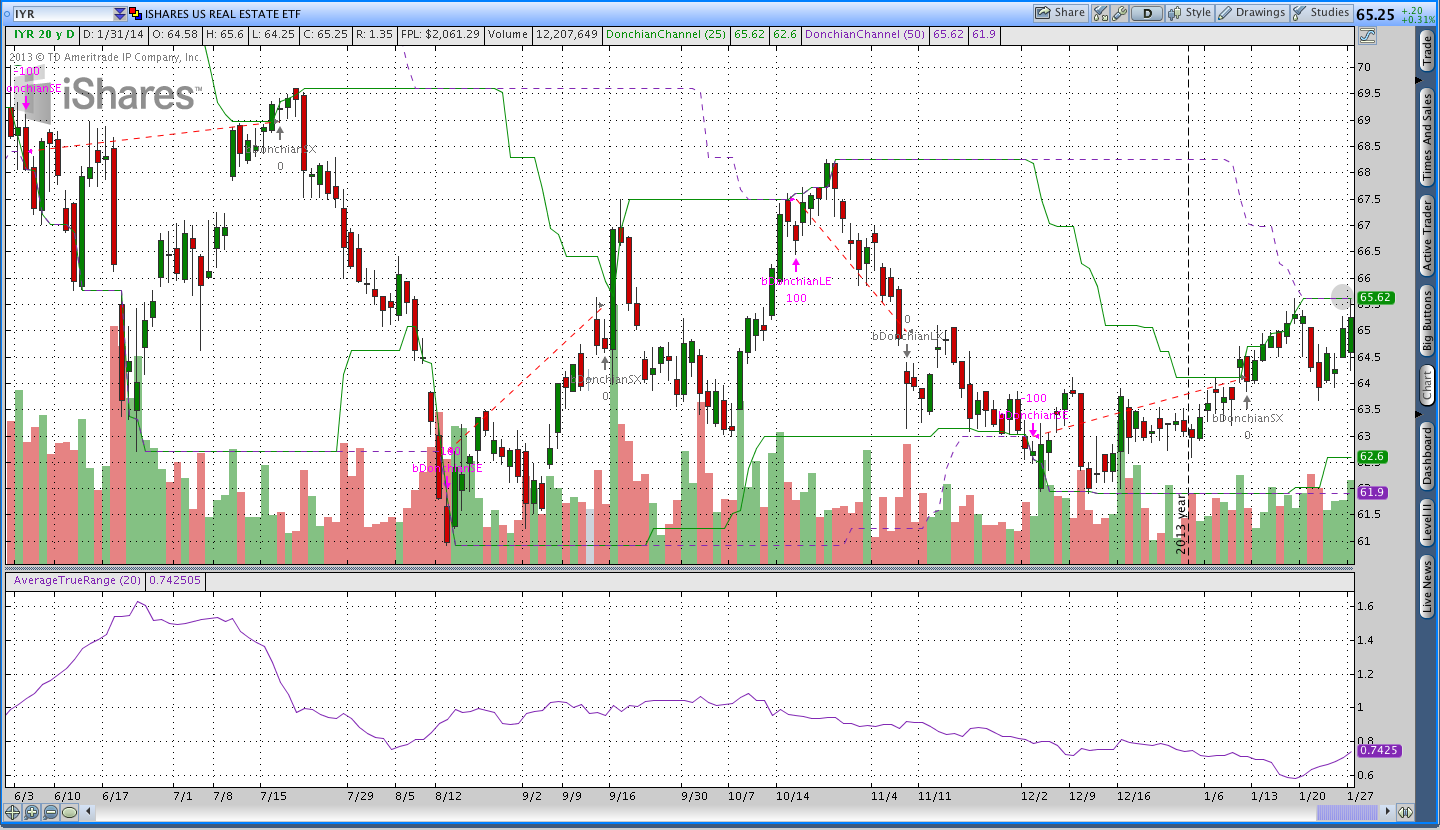

Donchian Channel Breakout Trades:

I decided to switch things up a little bit for the weekly commentary and today I’m going to show a couple of my Donchian Channel Breakout trades. Right now I have positions in Cotton ($BAL) and Coffee ($JO), but it looks like a trade in Real Estate ($IYR) might be triggered soon. The Donchian Channel system buys new 50 day highs and sells on 25 day or 3 x average true range breakdowns.

Trades This Week:

GDXJ – Closed the naked put

QQQ – Closed the naked put

IWM – Closed the naked puts and short strangle

Option Inventory:

GLD – Short March 2014 139 Call (sold for .53)

GLD – Short April 2014 133 Call (sold for .50)

ETF & Forex Inventory:

BAL (Cotton) – Long 50 shares from 53.19

JO (Coffee) – Long 58 shares from 23.38

Looking ahead:

Right now my option inventory is pretty lean and I’m looking for calls to sell in $SPY. That being said, I’d like to see a bounce in stocks so I can get a little better trade location. The rise in implied volatility has made premium more attractive to sell and I’m watching a 20 delta, 45 day RUT Iron Condor. The Donchian Channel system also looks like it may be buying Real Estate $IYR sometime soon. Have a good Sunday.