Weekend Market Commentary 1/2/2015 – $IWM, $IYR, $SCHH, $RWO, $EURUSD

Big Picture:

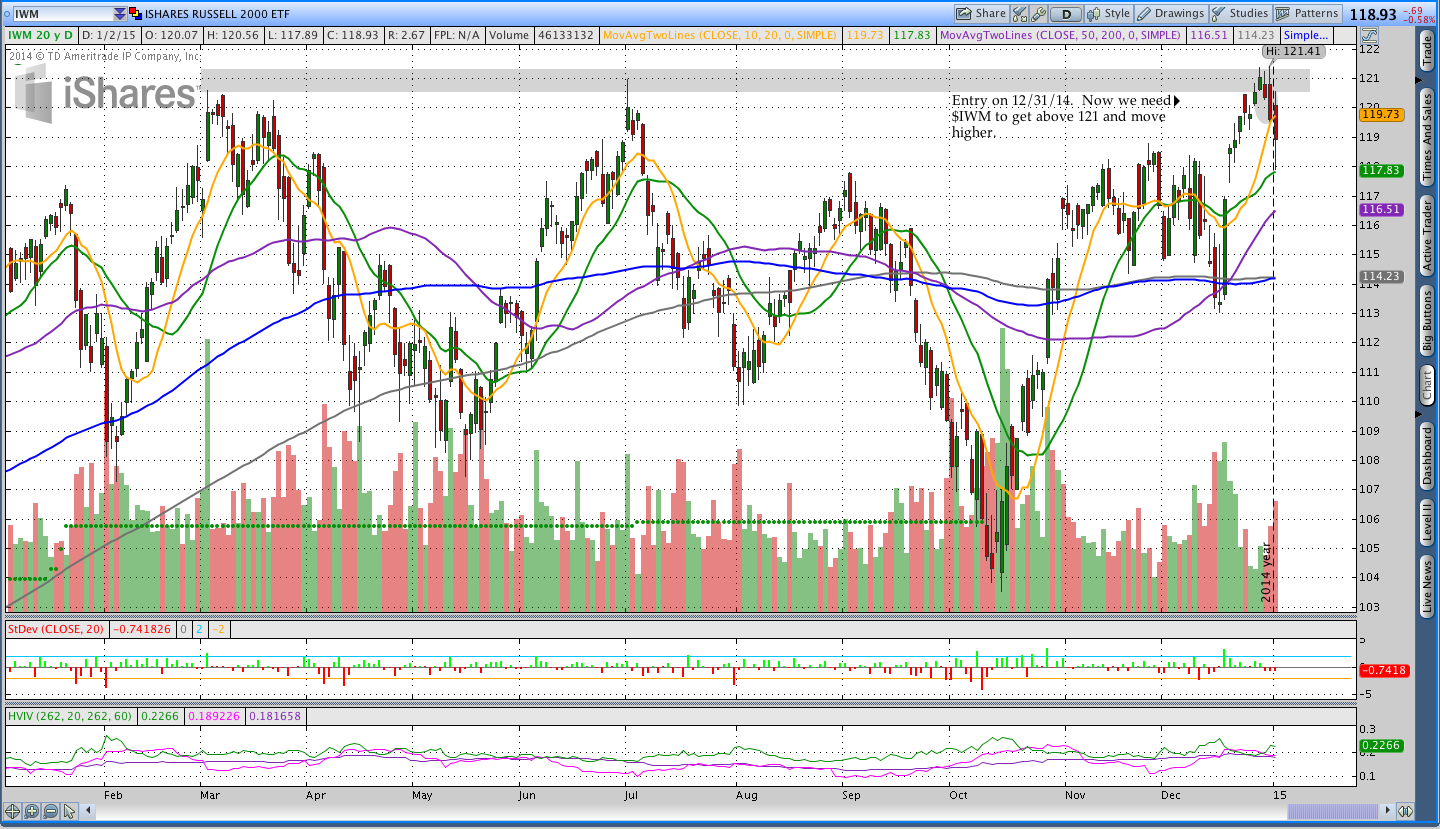

Happy New Year. U.S. Equity Markets sold off a little bit as they wrapped up 2014 and headed into 2015, but they’re still close to All Time Highs. This is the third time in the past year that the Russell 2000 ($IWM) has run up to the 121 level. My hope, since I’m long $IWM, is that it’s successful in getting above the 121 level and moving higher. We’ll need to see what happens next week after the holidays.

Happy New Year. U.S. Equity Markets sold off a little bit as they wrapped up 2014 and headed into 2015, but they’re still close to All Time Highs. This is the third time in the past year that the Russell 2000 ($IWM) has run up to the 121 level. My hope, since I’m long $IWM, is that it’s successful in getting above the 121 level and moving higher. We’ll need to see what happens next week after the holidays.

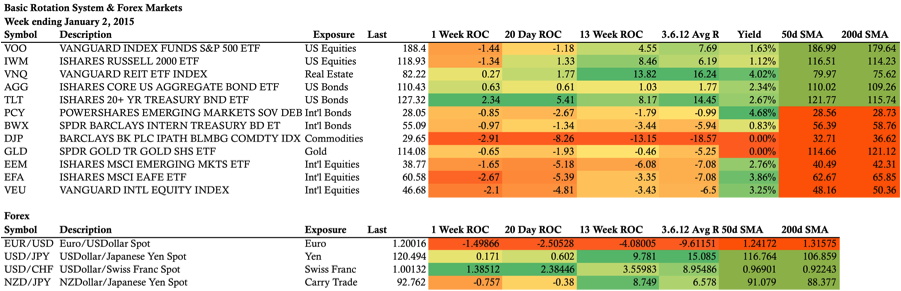

When we look at the numbers for the week, most things are pretty red. In fact, only Real Estate ($VNQ) and U.S. Bonds ($TLT & $AGG) were higher this week. Commodities are still getting destroyed as evidenced by the decline in $DJP and the Dollar strength in the Forex markets. The longer term theme from the number below is that there has been a demand for Dollars and U.S. Assets (Stocks and Bonds) with more demand for Bonds. Assets in other parts of the world are being sold. At this point, I’ve seen some news coverage of the strong Dollar and the Bonds, but I haven’t seen many headlines about Real Estate. I always feel better about positions when the media doesn’t know about them.

The Weekly Stats:

ETF Rotation System Positions:

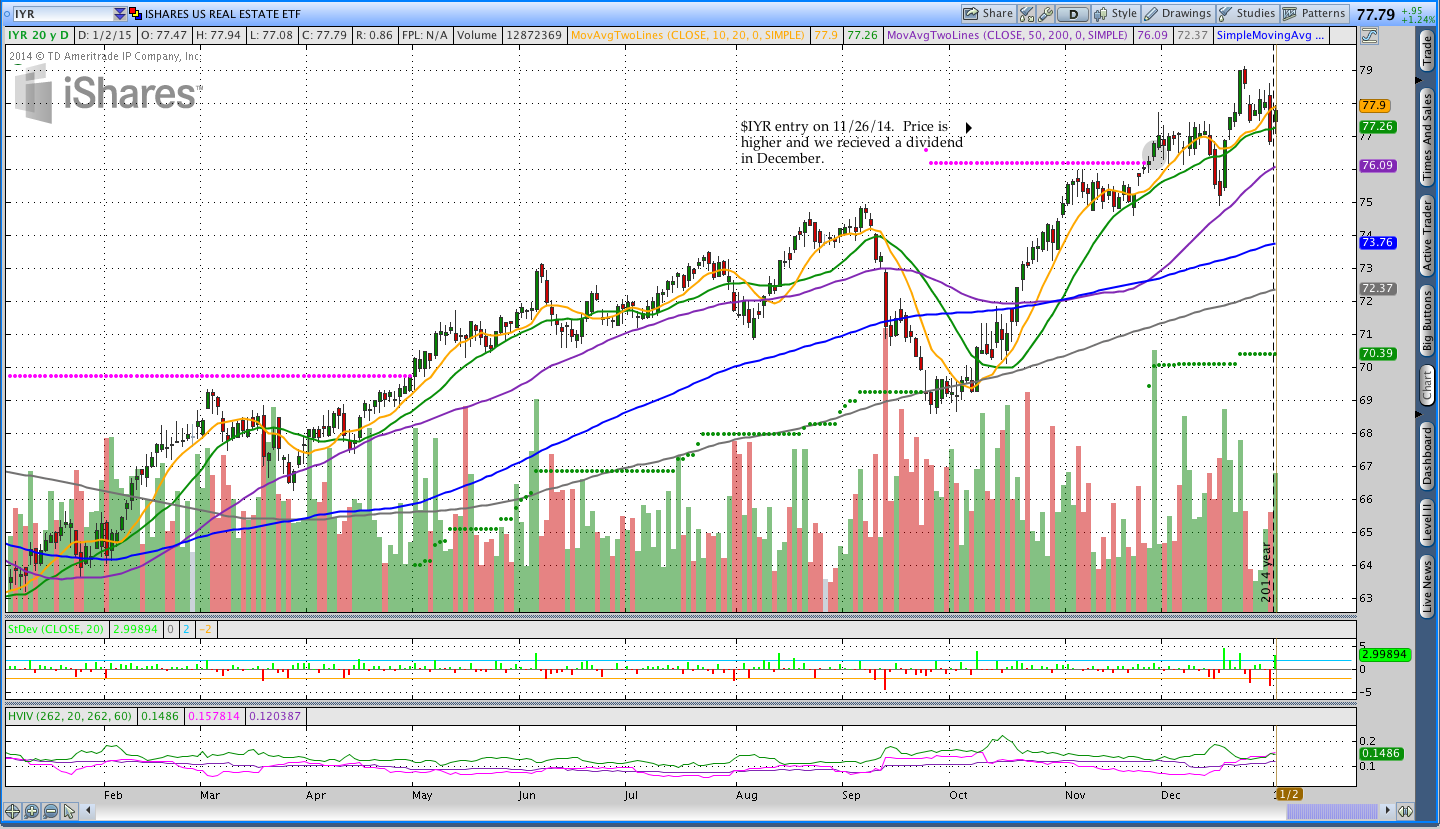

The ETF Rotation Systems ended 2014 in positive territory and we’re rolling into 2015. The Basic ETF Rotation System has positions in Real Estate and Small Cap Stocks ($IYR and $IWM) while the Schwab Commission Free System has positions in Real Estate and Global Real Estate ($SCHH and $RWO). The actual and hypothetical performance numbers will be updated sometime this week.

Click here to see a copy of the December 2014 Market Momentum Newsletter that covers the systems in more detail.

Schwab Commission Free ETF Rotation System Positions:

Basic ETF Rotation System Positions:

Forex Breakout System:

The Forex trades continue to move along with any real pressure. The Dollar is still strong and pushed back against other currencies and commodities this week. The Dollar strength sent the Euro (EUR/USD) to it’s lowest level since 2012.

Trades This Week:

IWM – Bought to open 20 Shares at 120.67

SPY – Sold to close 12 Shares at 207.86

RWO – Bought to open 92 Shares at 48.49

TLO – Sold to close 70 Shares at 72.62

SCHH – Sold to close 17 Shares at 39.861 (To rebalance and adjust account equity)

ETF & Forex Inventory:

IYR – Long 32 Shares from 76.7699

IWM – Long 20 Shares from 120.67

SCHH – Long 41 Shares from 34.009 (previously 58 shares)

SCHH – Long 72 Shares from 38.73

RWO – Long 92 Shares from 48.49

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

USD/JPY – Long 2,000 notional units from 110.084

NZD/JPY – Long 2,000 notional units from 89.036

Looking ahead:

We’re into 2015 and now it’s time to start moving forward. The January rotation system positions are in place and I’ll be updating the system numbers for December. I really like the low turnover of the systems and receiving dividend payments.

In the next few months, I’m going to be looking at ways to increase yield (using ETF’s) and I may be delving into individual stocks with strong performance numbers. Let me know if there’s something you’re interested in seeing on the blog and have a good weekend.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. Thanks for reading!

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.