Upside Butterfly Adjustments to Control Directional Risk $RUT

I’m generally somewhat poor at predicting market direction on a daily timeframe. As a result, I frequently have the opportunity to learn from market moves and adjust options trades. In the past few days the Russell 2000 has rallied a few percent and that move has put my October $RUT Butterfly under pressure. As a result, I’ve been adjusting the trade on the upside and trying to stay out of the way of the market.

This post looks at two different adjustments to the October $RUT Butterfly.

Adjustment #1 – Rolling up a Short Put

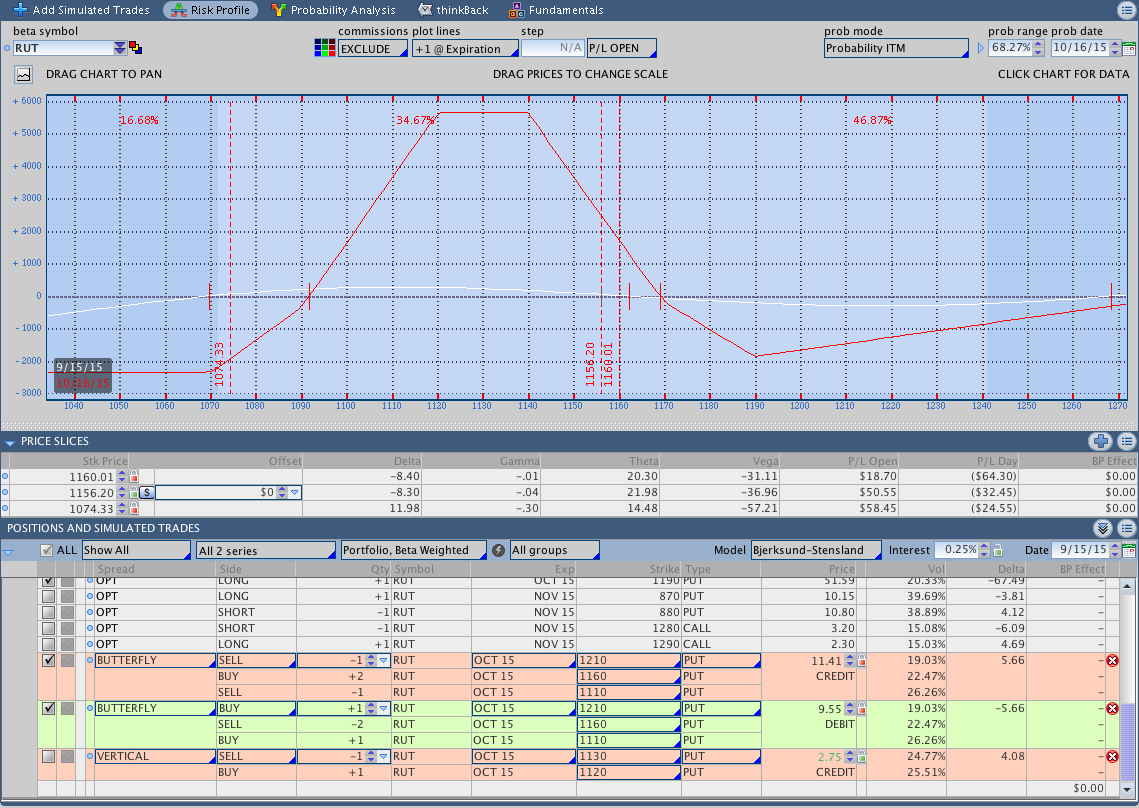

On September 15th (Tuesday) the market had not yet reached the point where I would add another Butterfly, but my T+Zero line was starting to dive within the body of the Butterfly and short Delta was becoming uncomfortable. The image below shows the Butterfly before making the adjustment.

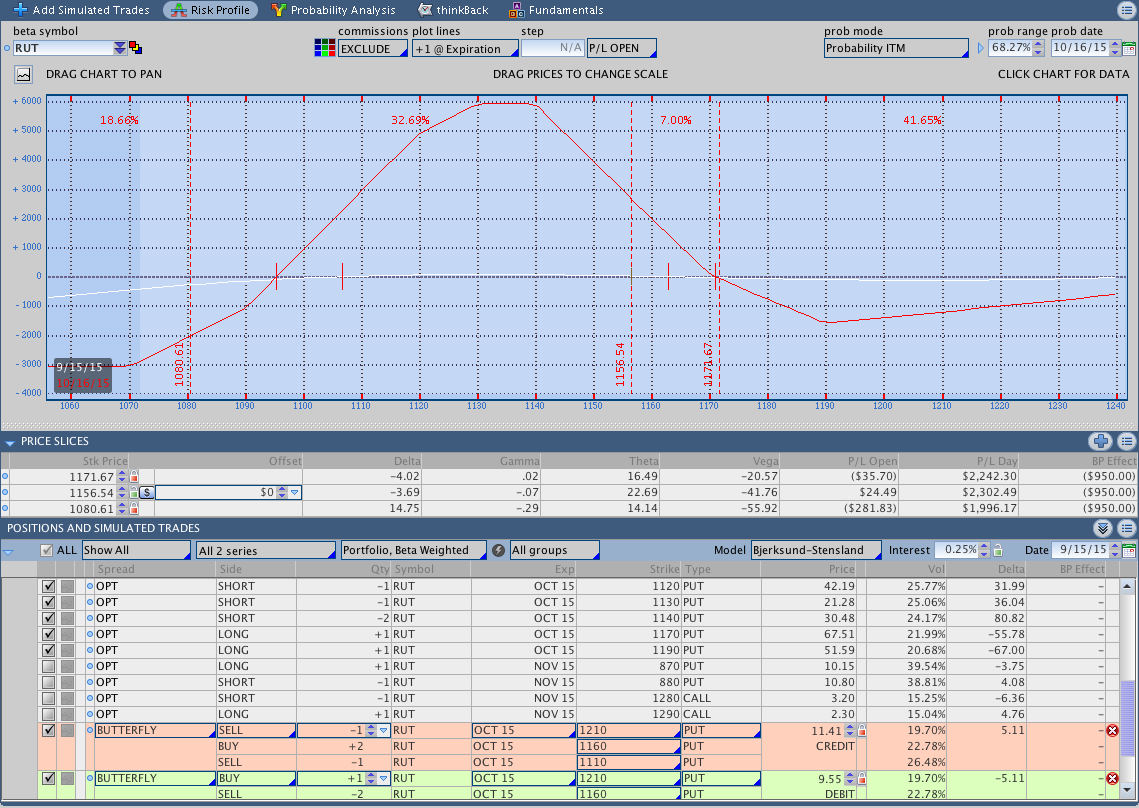

In an effort to avoid getting into trouble on the upside if/when price traded up to 1170, I decided to roll one of the short 1120 puts up to 1130 by selling the 1120/1130 Put spread for a 2.70 credit. Rolling up a short put does not stretch out the expiration break even significantly, but I does flatten the T+Zero line and bring the short Delta back to a more manageable level. The image below shows the trade after making the adjustment.

Adjustment #2 – Adding The 3rd Butterfly and Long Call

After rolling up the short Put on Tuesday, the Russell decided to continue the march higher. Late in the day Tuesday the position was close to the point for adding another Butterfly, but hadn’t quite reached it yet. On Wednesday morning, the Russell hit that level.

The next adjustment was to add another 50 point Butterfly centered at 1160 when the Russell reached the low 1170’s. At the same time, I added another long IWM call at 117. It’s worth pointing out that, as the trade progresses, it becomes more difficult to mitigate short Delta with long calls.

After adding the third Butterfly and long call, the position is at the maximum size for the trade. If price trades higher after this, the lowest Butterfly does not help and instead begins to hurt the position.

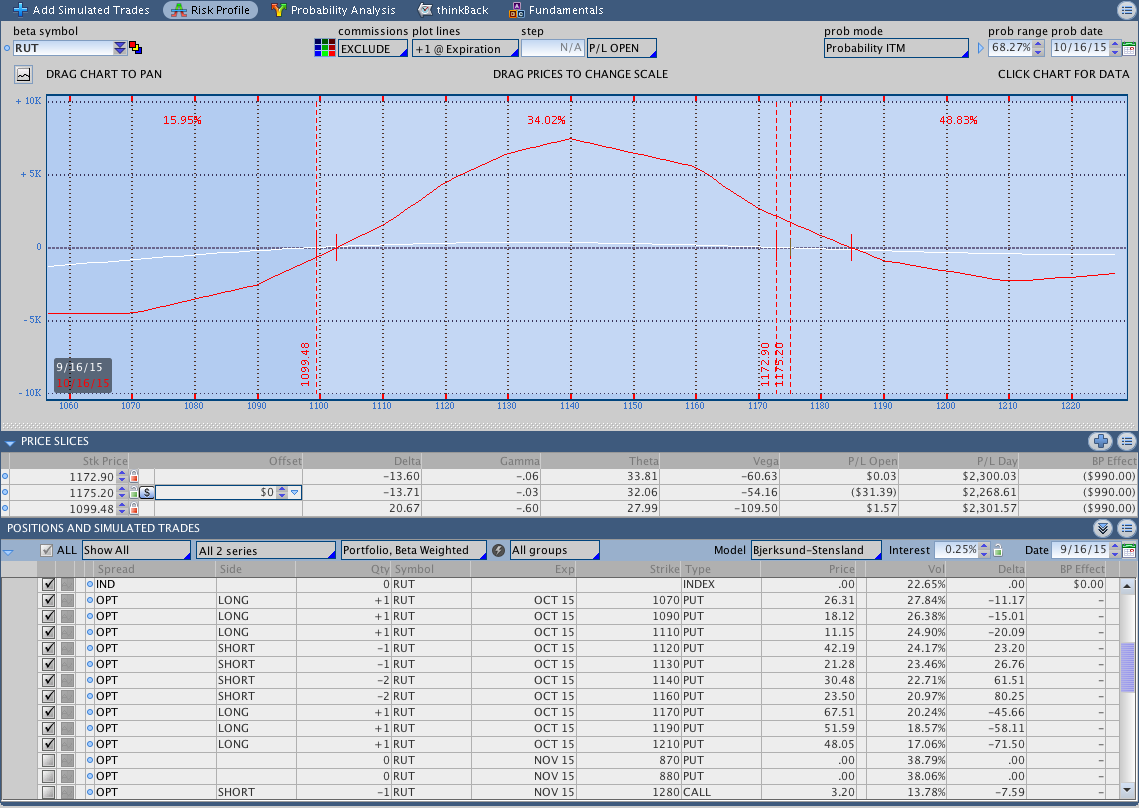

Adjustment #3 – Active Waiting

With the big move up over the past couple of days, I’m hoping the Russell slows down and gives Theta a little time to work. The trade is inside of 30 days to expiration and that’s when things really start to get interesting.

In the case that the market continues to move higher (always possible), I’ve been looking at the next adjustment and waiting. The next adjustment point for the trade will be in around 1185 when I’ll be rolling up the 50 point Butterfly centered at 1120 up to 1180.

More information:

The Butterfly above is a somewhat complex (but very dynamic) options strategy. You can find more information about the trade in this post and see updates in the Weekend Market Commentary.