Understanding Fear. Weekend Market Commentary 1/16/2015 – $IYR, $IWM, $RWO, $USDCHF, $GLD, $SLV

Big Picture:

I’ve always been practical to a fault and externally that seems to have served me well, but internally it hasn’t. Earlier this week I received some lab results from the doctor and it appears as though I have some sort of autoimmune condition. I’m being referred to a specialist and I don’t know much about what’s going on just yet. It doesn’t sound like it’s exceedingly serious right now, but it isn’t good either.

My guess is that the winter climate in the Idaho mountains is triggering bad things in my body (it always has) and, as a result, I’m planning to move South. The funny thing about that realization is that I’ve wanted to make a geographic change for a long time. In fact, I’ve wanted to do that ever since I moved to Idaho from Hawaii. The lesson . . . don’t do that. I sincerely hate winter and live somewhere where there is more winter than summer. Something about that isn’t right. However, fear can be debilitating at times, which can make changing hard. Combining my fear with practicality has led me down the wrong path for a long time.

My guess is that the winter climate in the Idaho mountains is triggering bad things in my body (it always has) and, as a result, I’m planning to move South. The funny thing about that realization is that I’ve wanted to make a geographic change for a long time. In fact, I’ve wanted to do that ever since I moved to Idaho from Hawaii. The lesson . . . don’t do that. I sincerely hate winter and live somewhere where there is more winter than summer. Something about that isn’t right. However, fear can be debilitating at times, which can make changing hard. Combining my fear with practicality has led me down the wrong path for a long time.

The problem is that when fear drives behavior and leads us down the wrong path, it ultimately results in outcomes that we don’t want. If I ever feel fearful when I’m trading or investing, I know that I’m either trading too big or it’s time to get out. I never want to feel fearful in a position because I know that can lead me to making the wrong choices. If I feel that way or if I feel uncomfortable, I take it as a sign to get out or scale back the position.

This week I woke up to an email saying my short Swiss Franc position was closed overnight. I wake up around 4 a.m. (sometimes earlier) and can be a little foggy when I first get out of bed so I didn’t think much about it. A few hours later I looked more closely at my trading account to see what happened and realized that I had been closed out at a horrible fill and that something big happened overnight. I went to bed long USD/CHF with price trading around 1.02 and woke up to a fill down at 0.89 even though I had a stop in around 0.955. Ouch.

By now we’ve all read the news and know that the Swiss Central Bank decided to stop defending an exchange rate level and that caused the Swiss Franc to strengthen. However, since Forex trading uses big leverage, the move has the potential to inflict enormous losses in excess of traders ability to pay. In the end, I lost all of my open profit on the trade and took a small hit (long from .9037 and closed at .89). After taking that loss, I closed my Euro and Yen Forex positions (NZD/JPY was stopped out earlier in the week). I did that because the move made me feel uncomfortable and I didn’t know if there would be reverberations throughout the currency markets. However, I didn’t have a strong sense of fear about the event and while I’m bummed to give back around 1,000 pips of open profit, it happens and I really didn’t lose much on the trade.

After taking some time to reflect on the trades and closing the other positions early, I think the better move would have been to cut the other positions in half. Unfortunately, at the time I didn’t have the foresight and I just went flat. We can learn an incredible amount about ourselves through financial markets and the move in the Swiss Franc was a learning experience.

U.S. Equities had a volatile week that ultimately ended lower ($SPY -1.28% and $IWM -0.74%). However, it looks like there is some willingness to take risk in international markets. Specifically, International Equities were higher on the week ($EEM +0.56% and $VUE +1.47%). Some of that strength can probably be attributed to weakness in the Dollar, but the relative performance of $IWM vs $SPY this week makes me think there’s a little risk taking as well.

The Forex markets are something of a mess after the move in the Swiss Franc and the Euro is still very weak, but we did see the Yen firm up against the Dollar. Looking beyond currencies, the biggest move this week took place in precious metals with Gold and Silver ($GLD +4.49%) making big moves higher. Last week I mentioned that Gold looked like it was firming up and this week we saw a new 50 day. I never predict market direction, but objective performance numbers can help us get a sense for what’s happening. I bought the breakout in both Gold and Silver.

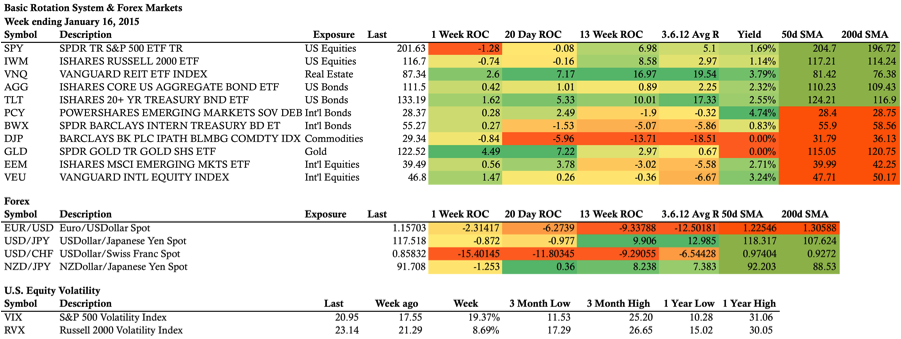

The Weekly Stats:

ETF Rotation System Positions:

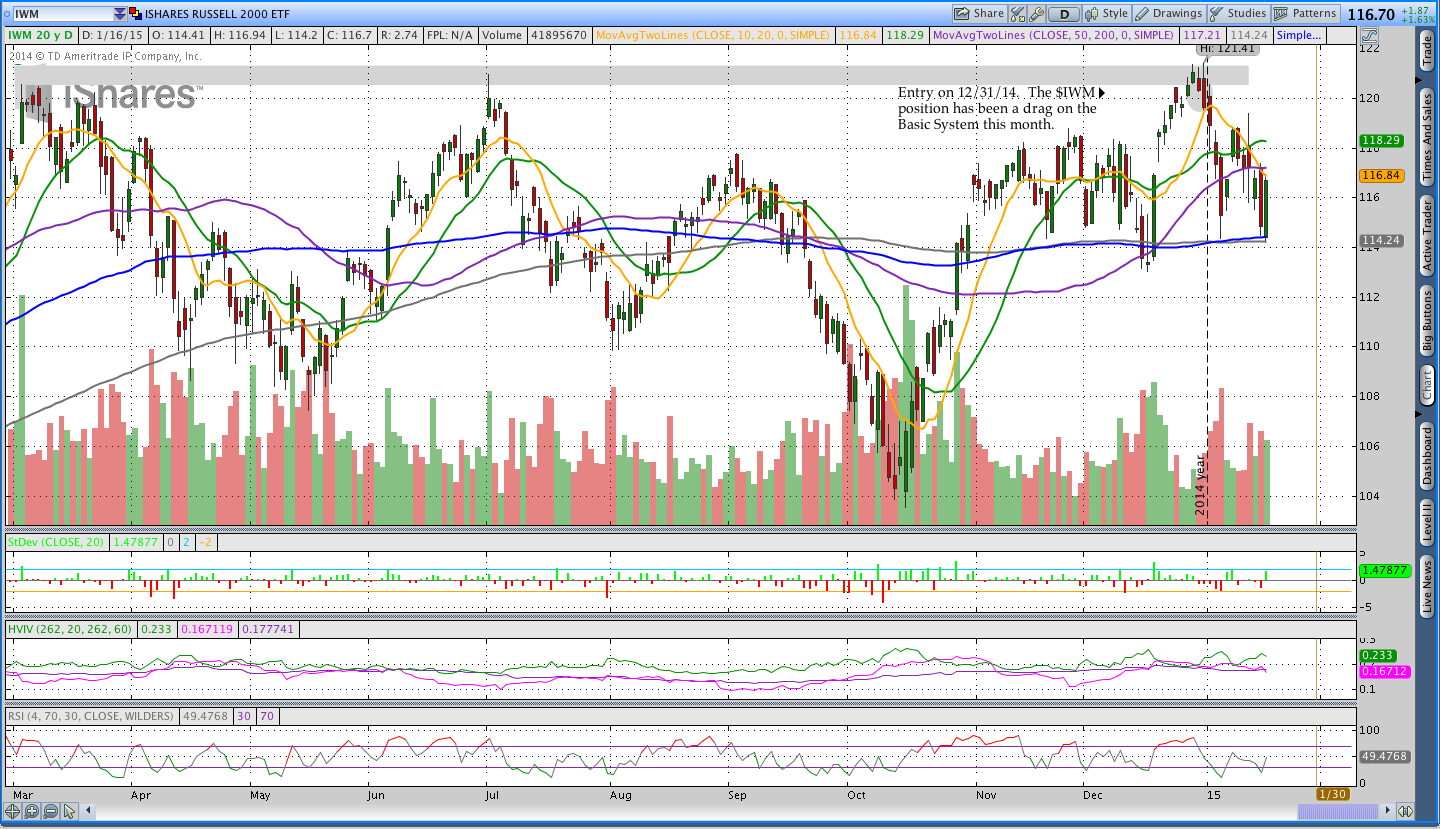

The Basic ETF Rotation System had another mixed week. The Russell 2000 ($IWM) was down while Real Estate ($IYR) continues to tear higher. The Schwab Commission Free ETF Rotation System is long Real Estate and International Real Estate ($SCHH and $RWO). Both of those positions did well this week.

Click here to see a copy of the December 2014 Market Momentum Newsletter that covers the systems in more detail.

Schwab Commission Free ETF Rotation System Positions:

Basic ETF Rotation System Positions:

Forex Breakout System:

The Forex trades were all closed this week. Read the discussion above for the reasoning and my thoughts about the trades. Three of the four open positions were exited profitably.

$SPX Weekly Options Trade:

Early in the week I covered the $SPX Weekly Vertical trade for a .10 debit. The vertical was originally sold for .50.

Note that I tweeted this position before getting filled and after it was closed. If you aren’t already, you should follow me on Twitter. Click here and then Follow.

Donchian Breakout Trades:

Trades This Week:

GLD – Bought to open 18 shares at 118.99

SLV – Bought to open 60 shares at 16.49

SPX – Bought to close Jan 15 2090/2095 call vertical for .10

EUR/USD – Bought to close 5,000 notional units at 1.16141 (Short from 1.35028)

USD/CHF – Sold to close 6,000 notional units at .89 (Long from .9037)

USD/JPY – Sold to close 2,000 notional units at 116.441 (Long from 110.084)

NZD/JPY – Sold to close 2,000 notional units at 89.97 (Long from 89.036)

ETF, Options, & Forex Inventory:

IYR – Long 32 Shares from 76.7699

IWM – Long 20 Shares from 120.67

SCHH – Long 41 Shares from 34.009 (previously 58 shares)

SCHH – Long 72 Shares from 38.73

RWO – Long 92 Shares from 48.49

GLD – Long 18 Shares from 118.99

SLV – Long 60 Shares from 16.49

Looking ahead:

Next week is a short week for the markets and I have no idea what to expect. There were some big shifts this week with the Swiss Franc and the breakout in Gold. It’s unlikely that either of those moves has been digested by the markets and I wouldn’t be surprised to see continuation. U.S. Equities were very strong into the close on Friday after a rocky week. My hunch is that we could see some continued upside in equities, but I’m not exceedingly bullish. A little upside would be good for the $IWM position and is what I’m hoping to see.

Late this week I funded a new account at Interactive Brokers that is going to be monitored by Covestor for a year. I’m going to be trading an ETF Rotation System in that account and will probably begin tracking that on the blog as well. Thanks for reading and have a good weekend.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. Thanks for reading!

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.