Schwab Commission Free ETF Rotation System Backtest $SPY, $TLO, $PCY, $RWO, $SHY

I’ve been doing a lot of writing about Momentum Based ETF Rotation Systems lately and for good reason. The systems are low maintenance and have historically provided a good return in a variety of market conditions. In this post we’re going to look at backtest results for the Schwab Commission Free ETF Rotation System. We’ll explore the Basic Rotation System backtest in a future post.

Why Charles Schwab?

An increasing number of brokers have started offering commission free ETF trading, however, the terms of “free” vary by broker. In some cases, the brokers have a minimum holding period of up to 30 days and require you to enroll in a commission free program. My idea of free is where you don’t do anything and it’s free. Fortunately, Schwab has the same idea and they offer access to around 175 commission free ETF’s. In addition to offering a large number of commission free ETF’s, Schwab doesn’t require you to enroll in the program and there is no minimum holding period. Other brokers aren’t quite as generous. On top of that, I already have some retirement accounts with Schwab so I didn’t need to open a new account. Easy is good.

An increasing number of brokers have started offering commission free ETF trading, however, the terms of “free” vary by broker. In some cases, the brokers have a minimum holding period of up to 30 days and require you to enroll in a commission free program. My idea of free is where you don’t do anything and it’s free. Fortunately, Schwab has the same idea and they offer access to around 175 commission free ETF’s. In addition to offering a large number of commission free ETF’s, Schwab doesn’t require you to enroll in the program and there is no minimum holding period. Other brokers aren’t quite as generous. On top of that, I already have some retirement accounts with Schwab so I didn’t need to open a new account. Easy is good.

Note that I don’t have any vested interest in promoting Schwab and I don’t receive any benefits. I just think their Commission Free ETF program is that good and they’ve always been great to work with from a customer service standpoint.

System Rules:

The rules for the ETF Rotation Systems are simple and can also be found in this post.

- Identify a basket of markets to trade (see the list below). In this case, we want a broad range of markets that gives us access to theoretically uncorrelated asset classes.

- On a monthly basis, rank the markets based on the 3 month total returns. This is generally done a couple of days prior to the end of the month.

- Allocate 50% of desired equity to each of the top two markets as long as the ETF’s are trading above their 6 month moving average. For example, if the second ranked market is below the 6 month moving average we don’t buy that market.

- If one of the top two positions is trading below the 6 month moving average, hold that portion of equity in cash or a Short Term Treasury ETF. In the backtest below, I used the iShares 1-3 Year Treasury Bond ($SHY).

- Ignore price fluctuations during the month and re-rank at the end of the month.

Charles Schwab Commission Free ETF Rotation System Markets:

Note that the markets presented in this table have been updated since the backtest and include a couple of additional ETF’s that were not present in the backtest below. The list of ETF’s in the backtest follows.

| Schwab Commission Free ETF Rotation System | Description | Exposure |

|---|---|---|

| SCHB | Schwab US Broad Market ETF | US Equities |

| SCHA | Schwab US Small Cap | US Equities |

| PGX | Powershares Preferred Portfolio | US Preferred Stock |

| SCHF | Schwab International Equity ETF | International Equities |

| SCHE | Schwab Emerging Markets Equity | International Equities |

| SCHC | Schwab International Small Cap Equity | International Equities |

| SCHH | Schwab US REIT ETF | Real Estate (US) |

| RWO | SPDR Global Real Estate ETF | Real Estate (International) |

| SCHZ | Schwab Aggregate Bond ETF | US Bonds |

| SCHR | Schwab Intermediate Term Treasury ETF | US Government Bonds |

| TLO | SPDR Barclays Long Term Treasury ETF | US Government Bonds |

| HYMB | SPDR S&P High Yield Municipal Bond | US Municipal Bonds |

| SCHP | Schwab US TIPS ETF | US Government Bonds |

| PCY | Powershares Emerging Markets Sovereign Debt Portfolio | International Bonds |

| BWX | SPDR Barclays International Treasury Bond ETF | International Bonds |

| USCI | United States Commodity Index | Commodity |

| SGOL | ETFS Physical Swiss Gold Shares | Commodity |

Backtest Results:

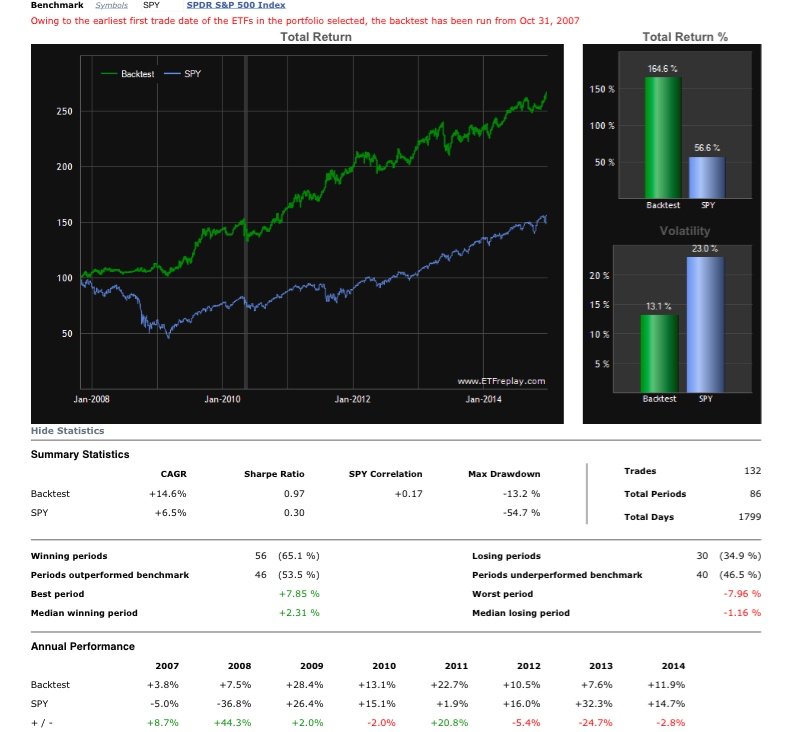

The equity curve for the rotation system backtest is shown below. It’s worth noting that some of the ETF’s lack a significant amount of historical data and the test was run for the longest period possible based on that data.

We all like an upward sloping equity curve when we backtest something and the system performed well over the test period. Most people will gravitate to the CAGR, which was around 14.6% and the Sharpe Ratio of 0.97. However, I’m significantly more impressed with the -13.2% maximum draw down that took place during 2008. Moving out of underperforming assets and into outperforming assets is the purpose of trading an ETF Rotation System and, in this test, the system did just that.

The system was up money in about 65% of the periods, which potentially makes it easier to trade than most Trend Following systems that tend to have a higher percentage of losing trades. It’s interesting to note that the system has been underperforming since 2011 while the S&P 500 ($SPY) has been racing higher. That being said, the S&P 500 is something of an arbitrary benchmark and is used more as a measure of buy and hold for our purposes.

Follow me on Twitter . . . Click here

ETF Holding Periods:

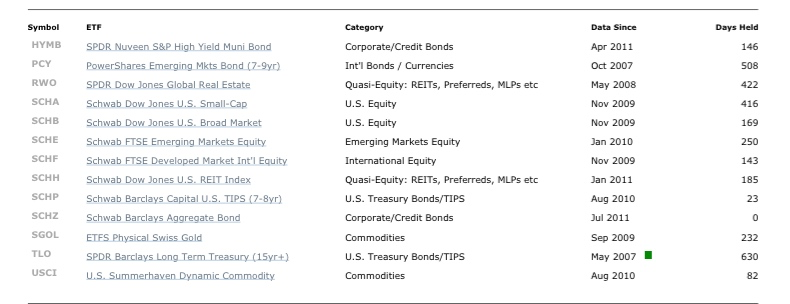

In the table below, we’re looking at the number of days each ETF was held. Over the test period the system held the Long Term U.S. Treasury ($TLO), Emerging Markets Bonds ($PCY), and Global Real Estate the longest ($RWO).

Where does that leave us?

What I take away from the ETF Rotation System test is that momentum investing appears to be a relatively low maintenance way to achieve good risk adjusted returns. My biggest criticism of the test is that we’re covering a short period of time and the returns could potentially be skewed by favorable market conditions. That being said, I’m willing to devote a portion of my personal accounts to trading the systems as a way to forward test them for everyone to see. In other words, I believe in the merits of the systems.

More Information:

If you want more information on ETF Rotation Systems, make sure to check out the Market Momentum Newsletter and the Schwab Commission Free ETF Rotation System Results.

Please share this post using the social media toolbar above and thanks for reading.

Want to receive updates on ETF Rotation System rankings, positions, and results?

Sign up for my email list and I’ll keep you posted on Trend Following systems and actual results.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.