$RUT October 2015 Butterfly (CIB) Trade Review

Overview:

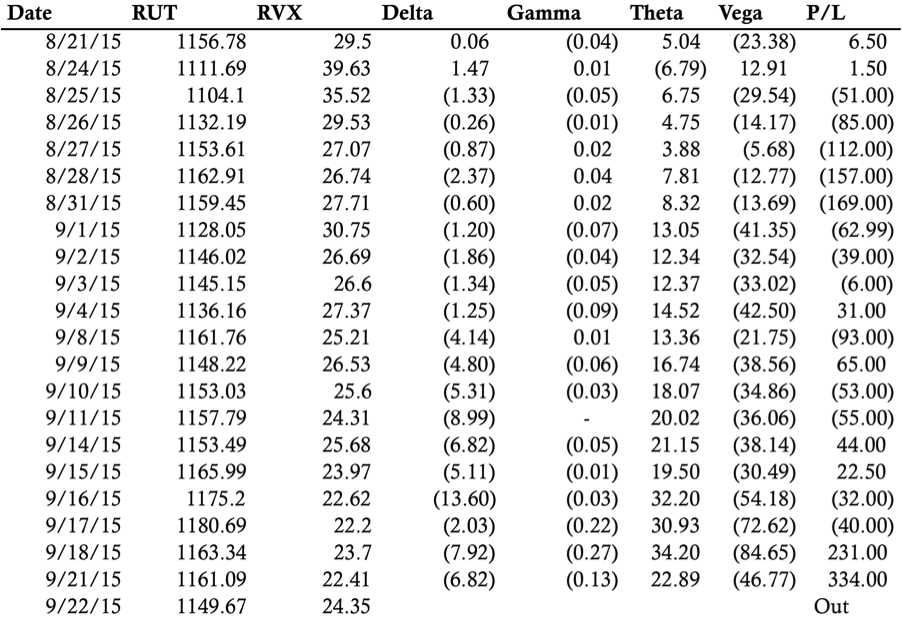

The October RUT Butterfly is now closed and I learned a few good lessons over the course of the trade. I opened the trade on Friday, August 21, 2015, which was fairly poor timing considering it was the Friday before the big push lower on Monday. At the time, I thought RUT was oversold and I was expecting a slight push lower followed by a high volatility consolidation. Instead, RUT pushed much lower.

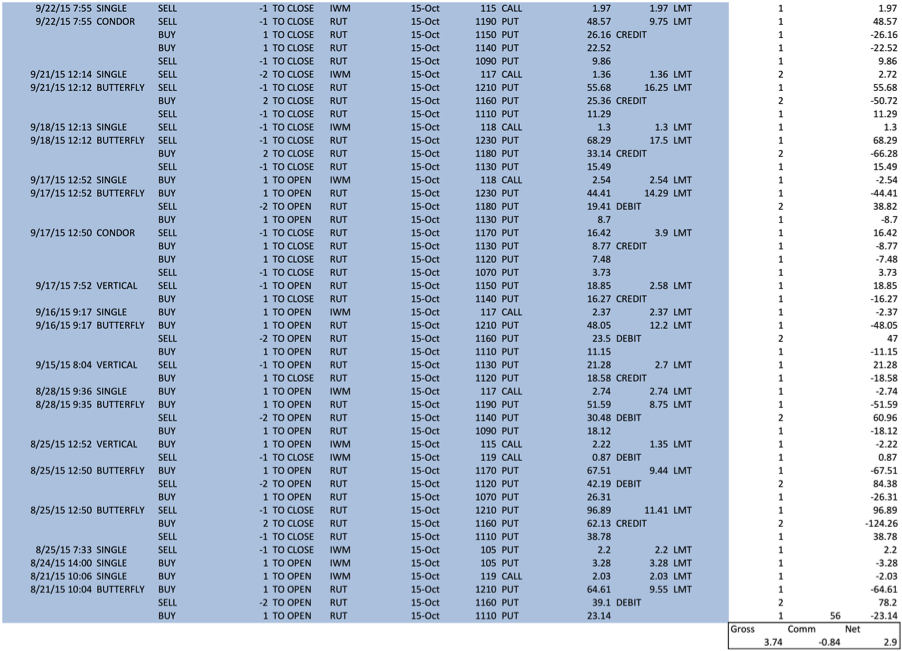

The chart below shows the entry and exits days for the October Butterfly trade. The market ended up essentially unchanged over the life of the trade, which might make the trade seem relatively easy. However, the price range of RUT over the course of the trade was somewhat large. Overall, the trade held up well in the high volatility environment with somewhat wide price swings.

Initiation:

Initiation:

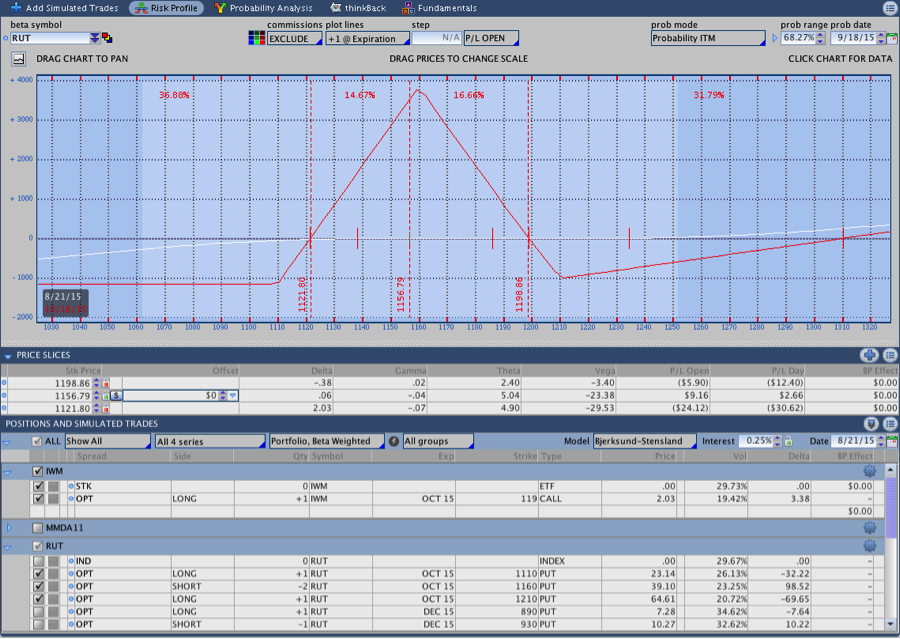

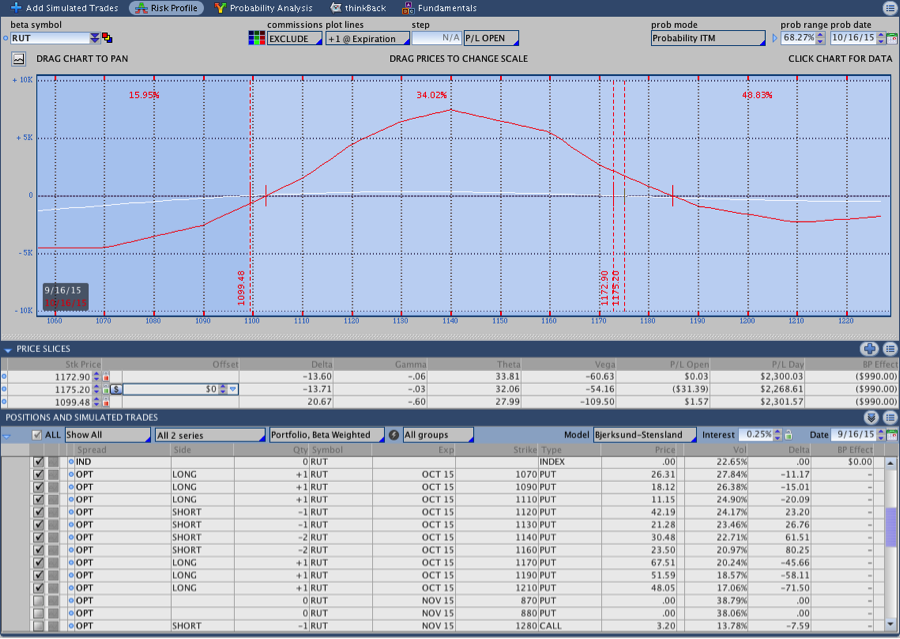

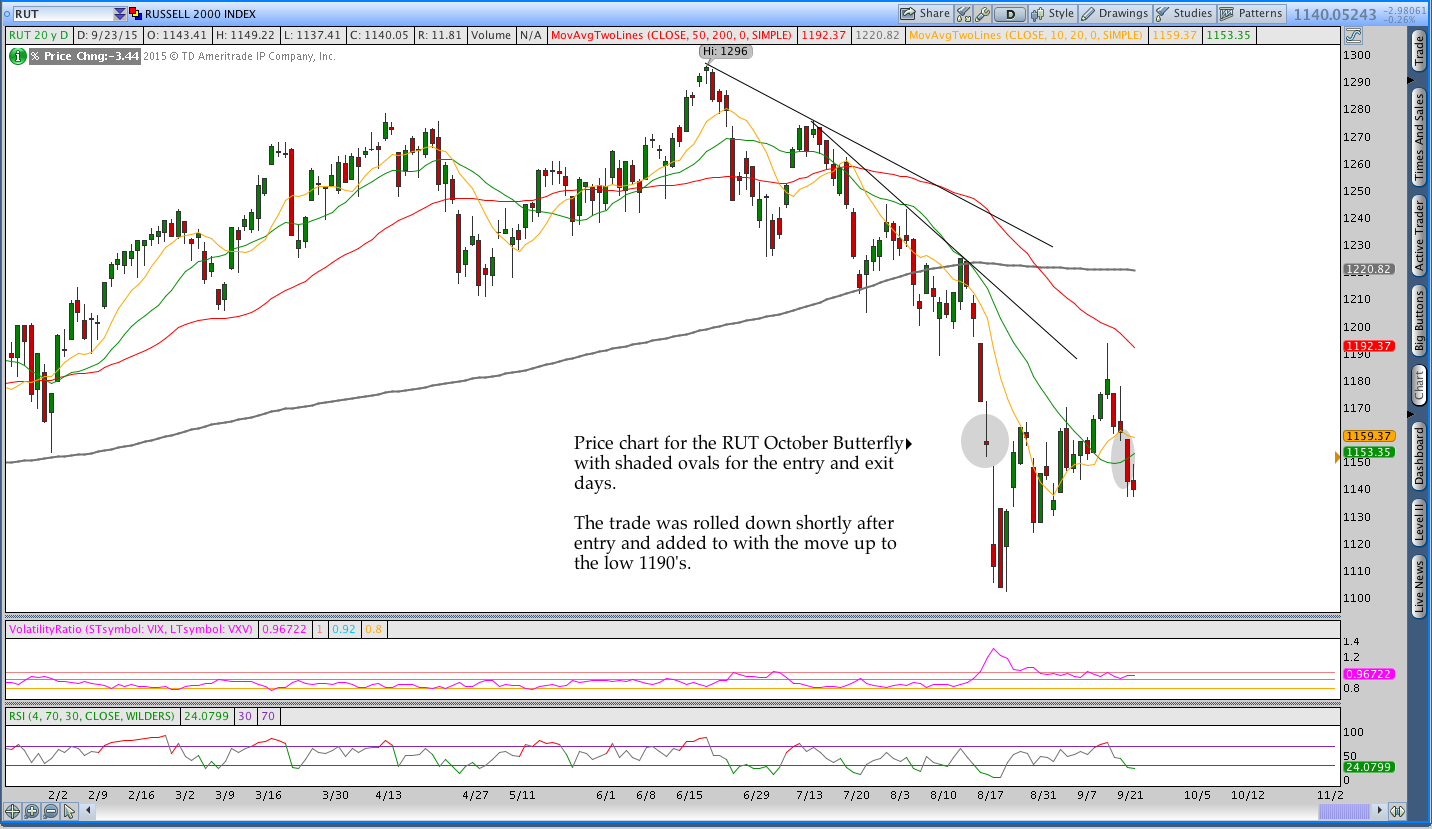

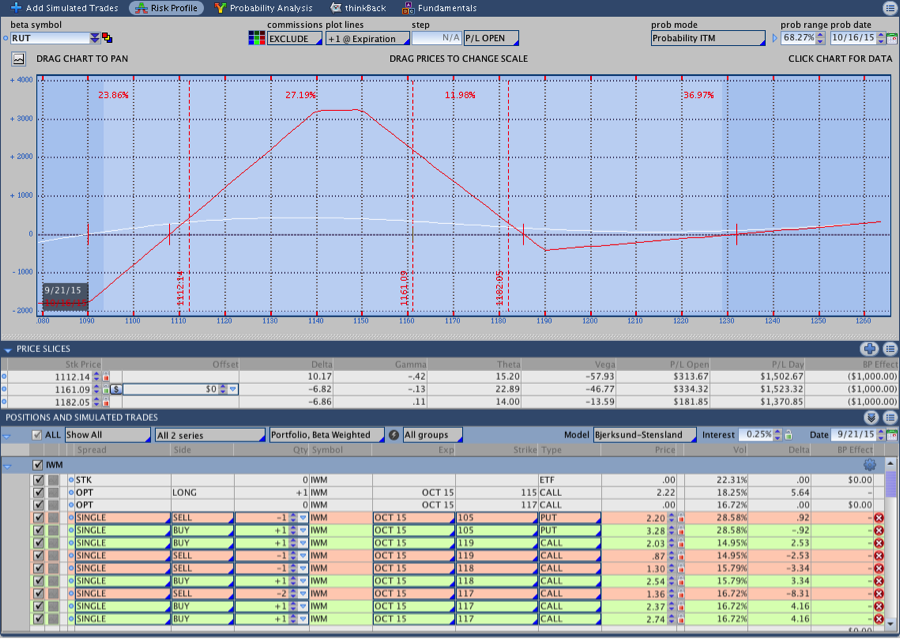

The image below shows the October Butterfly trade on the day of initiation. I entered the trade with 56 DTE on Friday, August 21st. Implied Volatility was high when I entered the trade so I chose to enter the initial position at the money rather than 10-20 points below the money. It turns out that I should not have done that, but you never those things in advance.

The trade began as a 50 point wide Put Butterfly in the Russell 2000 (RUT) with the short strike at 1160 (1110/1160/1210) and a long 119 IWM Call. I paid 9.55 for the Butterfly (cheap) and 2.03 for the call.

Adjustment #1 (aka mistake):

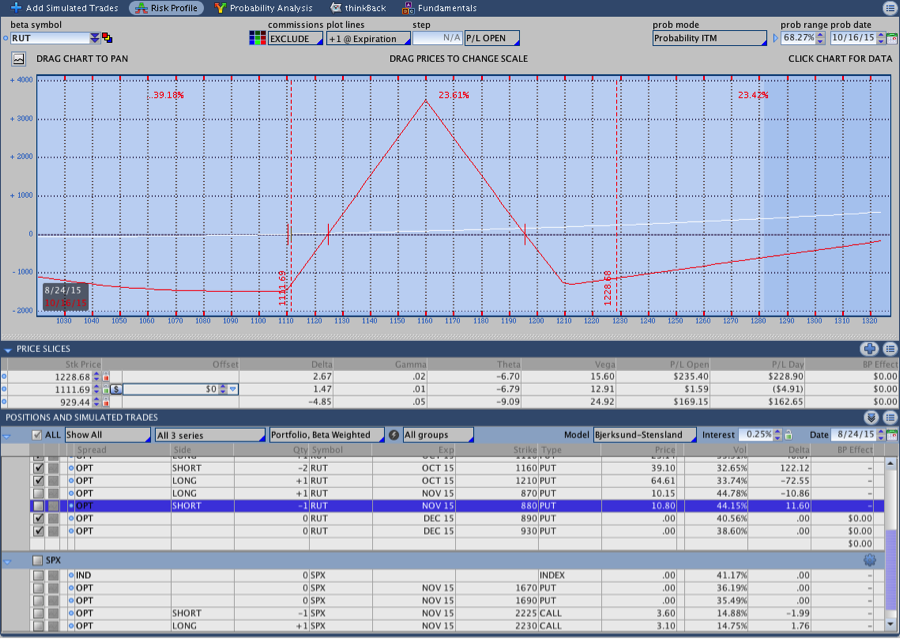

The first adjustment I made took place on Monday, August 24th when I purchased a long put near the end of the trading day. I say the adjustment was a mistake because I should have simply rolled down the Butterfly earlier in the day rather than buying a long put. I purchased the put late in the day because I became concerned that the market had the potential to crash further. My gut feeling was that the market would probably not crash further the next morning, but I didn’t want to wake up to a 10% down day.

As you can see, the market closed outside the expiration break even at the close, which is not consistent with my trading guidelines. I was slow to roll the trade lower because my concern was that the market could quickly reverse and take off higher. I wasn’t expecting a bullish trend to emerge, but the market does seem to rebound when it is severely short-term oversold (as it was on August 24th).

Adjustment #2:

The next morning I sold out the long put at a $100 loss and rolled the Butterfly down from 1160 to 1120. That roll re-centered the Butterfly ATM, which is my rule for rolling down the trade. Note that trade is only down $50 despite the loss on the put and the significant market movement after entry.

Adjustment #3:

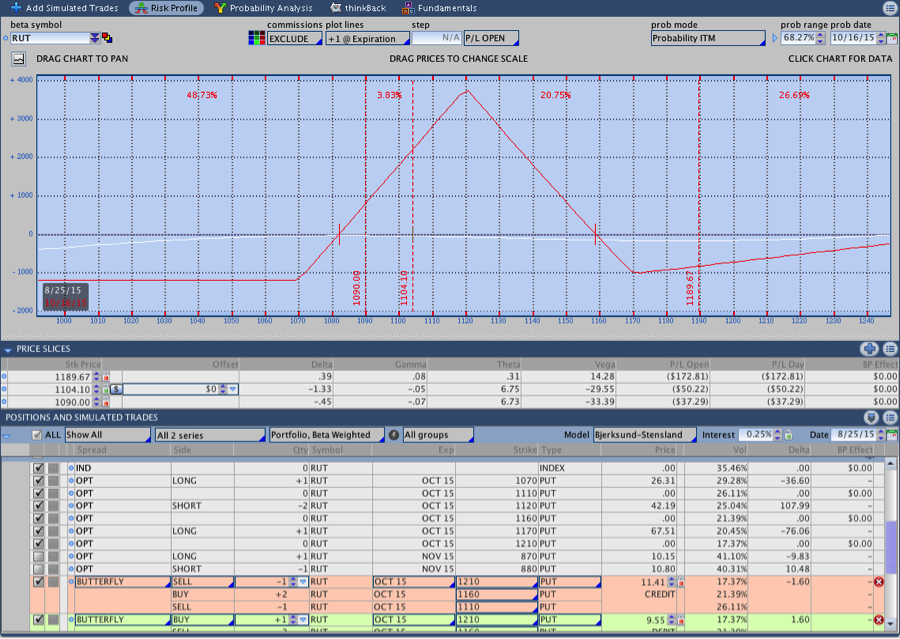

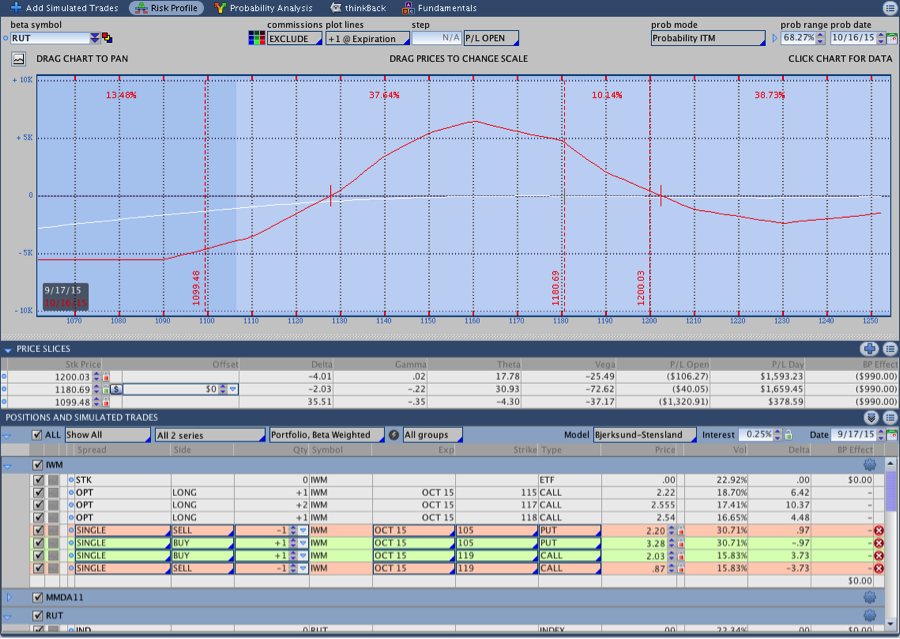

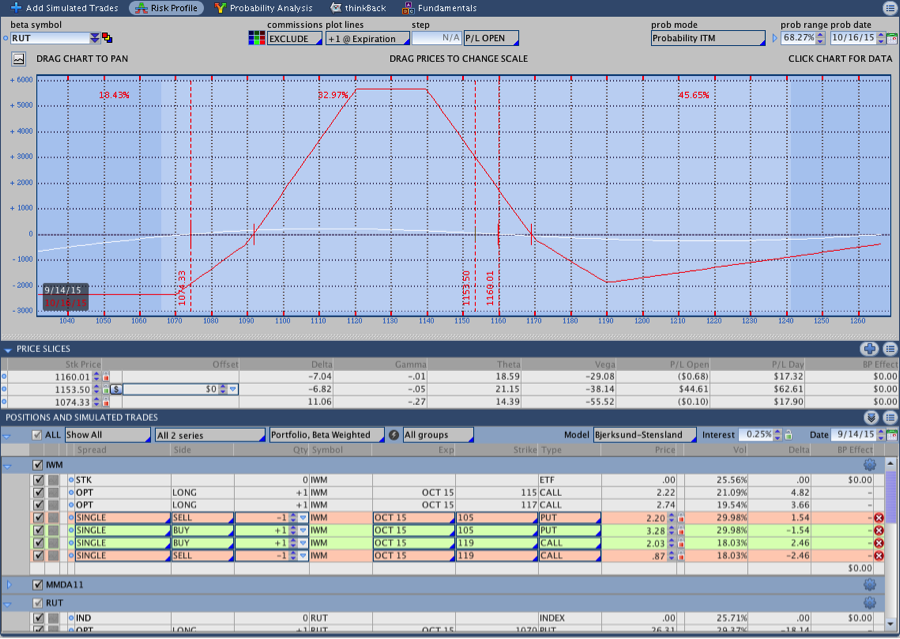

As most of you probably know, the market had a good bounce higher after the mini-crash on August 24th. After rolling the trade down to 1120, the market hit my upside adjustment point and I added the 1140 Put Butterfly and 117 IWM Call to the position. The image below shows the trade after the adjustment.

Adjustment #4:

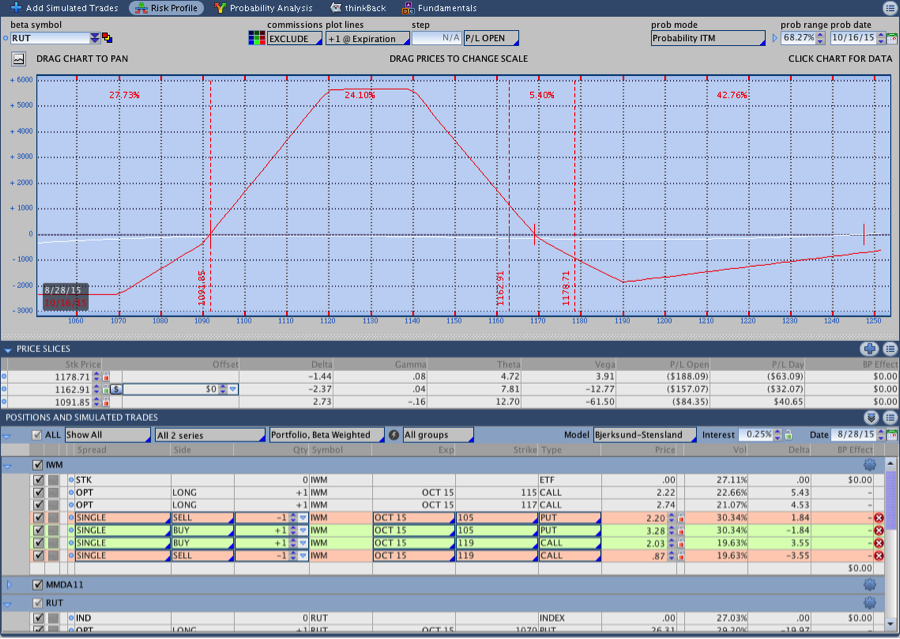

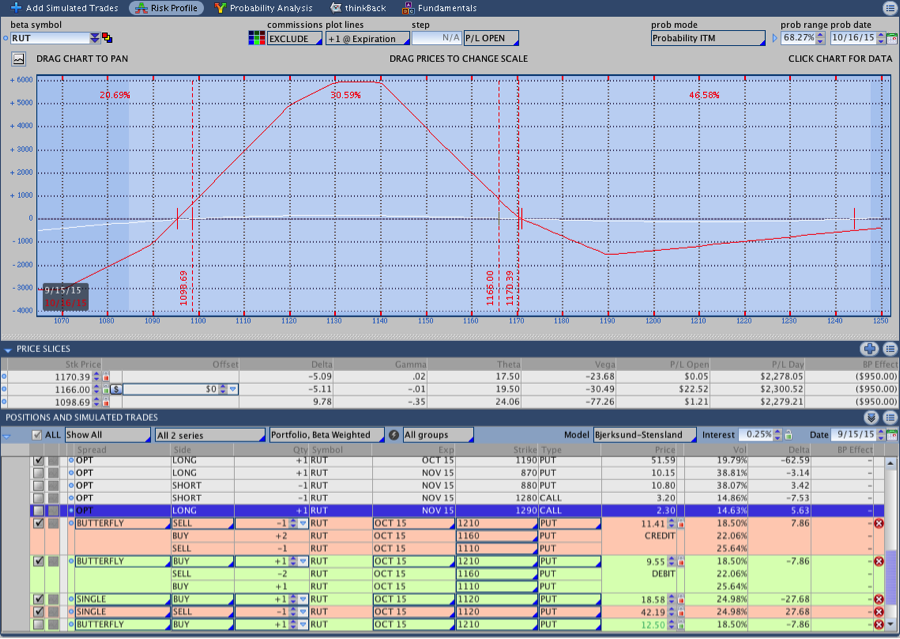

After adding the second Butterfly on August 28th, the trade had a little time to breathe. The market moved around, but the trade did not reach another adjustment point until September 14th. On the 14th, the market was sitting around the front of the Butterfly and the T+Zero line was beginning to dive within the body of the Butterfly.

I rolled up one of the short 1120 puts to 1130 in an effort to flatten the T+Zero line and soften the impact of a move higher. The position below shows the trade prior to the adjustment.

The next image shows the trade after rolling up the short put. At this point in the trade my adjustment point was around 1175 and the trade would only be down a small amount of money at that level. I had plenty of room to move on the downside and I wasn’t overly concerned about moving higher.

Adjustment #5:

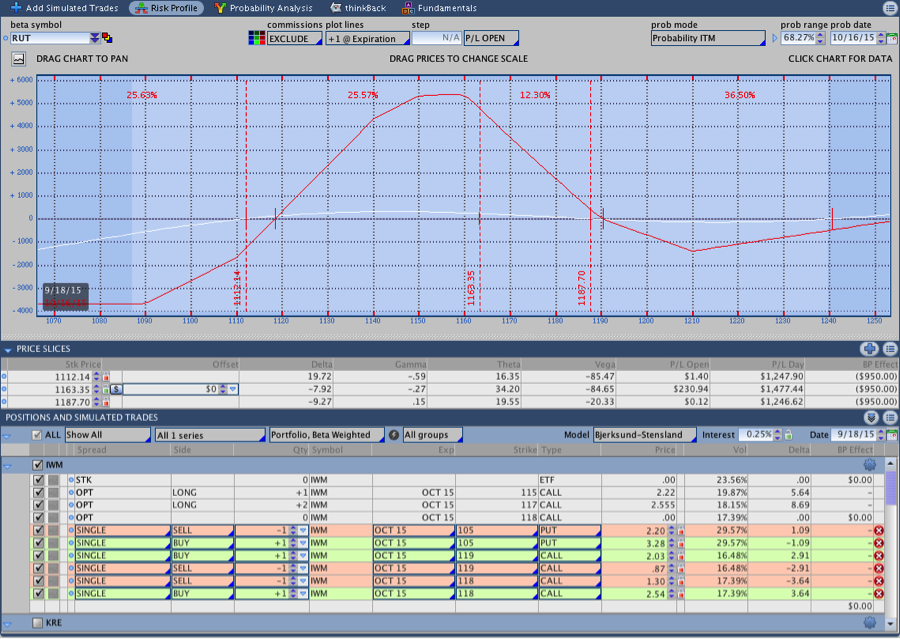

The next adjustment took place a few days later when RUT traded to 1175. The adjustment added the 1160 Butterfly with the 117 IWM Call and brought the position to full size.

Adjustment #6:

The week of September 14th was the Fed week. At the time, there was some sort of discussion and uncertainty about raising the Federal Funds rate by a whopping 0.25%. The market was well bid all week and ran higher to 1194 shortly after releasing the number. Going into the number, the market was near the front of my position and closing in on the next adjustment point. I knew that I wouldn’t hit max loss so I let the trade ride and planned to adjust if we hit the 1190 level . . . and adjust I did.

The image below shows my position after the Fed number. I rolled the 1120 Butterfly up to 1180 just in time for the market to trade lower. However, as we’ll discuss next, trading lower was a good thing for the position.

Peeling Exit #1:

After the Fed announcement on Thursday, September 18th, the market traded lower. On Friday the market traded even lower and the 1180 Butterfly and long call were able to be closed for a quick $180 profit. Note that Butterflies added later in the trade are shorter Delta than earlier in the trade. As a result, pull-backs can quickly put them in the money. I prefer to take a quick profit on the trade when possible and add the position back if necessary. Based on the price action after the Fed announcement, I wasn’t overly concerned about a big move higher.

On Friday morning, I closed out the 1180 Butterfly from the day before and was left with the risk graph shown below. The resulting position had reduced risk and was “safer” to carry through the weekend.

Peeling Exit #2:

Early this week, the trade made it beyond the intended profit target of $300. As a result, I peeled off another Butterfly and let the trade sit another day. After removing the 1160 Butterfly, the trade had very little directional risk as shown in the risk graph below.

Full Close:

The image above is the last picture I have of the trade prior to the full close on September 22nd. The trade could have gone slightly longer, but it had already reached the profit target. I let the trade run longer than usual to try to cover some of my commissions costs, which were very high this month. The trade was closed for a gross profit of $374, but $84 went to TOS for commissions and the trade net $290. Overall, the cycle was good and would have been even better without the $108 loss on the long put early in the trade.

Lesson Learned:

I think the biggest lesson I learned is that there are times to be patient making adjustments and other times where it doesn’t pay. I try to let the market work things out and I’m usually not extremely fast to adjust. This month that left me in a bind and I panicked to get downside protection because I didn’t roll lower early enough. Lesson learned.

Despite that challenge, the trade held up well through a relatively volatile period. The trade was relatively easy to control even though you might expect an ATM options strategy like the Butterfly to struggle when the market is moving fast. Obviously there were some increased costs due to the high number of adjustments, but the position held up well.