$RUT Butterfly Adjustment Video and New April Positiond

Overview:

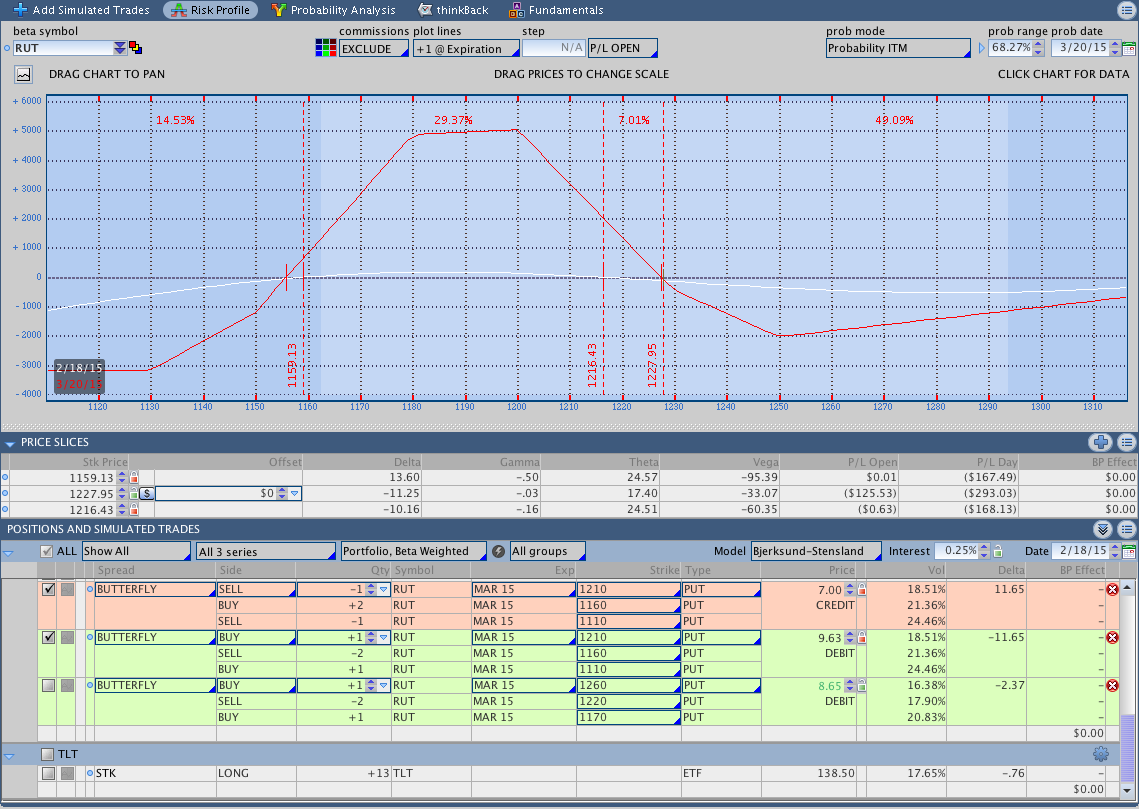

The Russell 2000 pushed up to close at a new all time high yesterday, which is just a few points shy of the next adjustment point. In the video below I take a look at the next adjustment for the position if the market continues higher this morning. At this point, I’m planning to add a broken wing butterfly centered around 1210. $RUT has moved up fairly significantly over the past week or so and looks like it could pause, but there is nothing to suggest that the market is pausing just yet. The March trade has an open loss of around $125 (including adjustments) and the target is a gain of around 10% of capital or $300.

Risk graph for the March 2015 Options Put Butterfly (28 dte):

Risk graph for the April 2015 Options Put Butterfly (56 dte):

The video also goes through the new position for the April expiration cycle. The position was initiated a day or two ago when $RUT broke out to new all time highs. If you have any questions about the positions or the adjustments, shoot me an email or post them in the comments below. Enjoy: