Monthly ETF Rotation System Rules & Results – $SCHH, $IYR, $TLO, $SPY

As some of you know, I recently began trading two monthly ETF Rotation Systems. One is a Basic ETF Rotation system that trades a diverse group of markets and the other covers similar markets using Schwab Commission Free ETF’s. The Basic System is intended to take the place of the ETF Portion of the Donchian Channel System while the Schwab System is being traded in one of my retirement accounts. The Donchian system is still being traded on a few Forex pairs.

This post covers the December results for both systems and provides a little more information on the rules and markets traded.

Results:

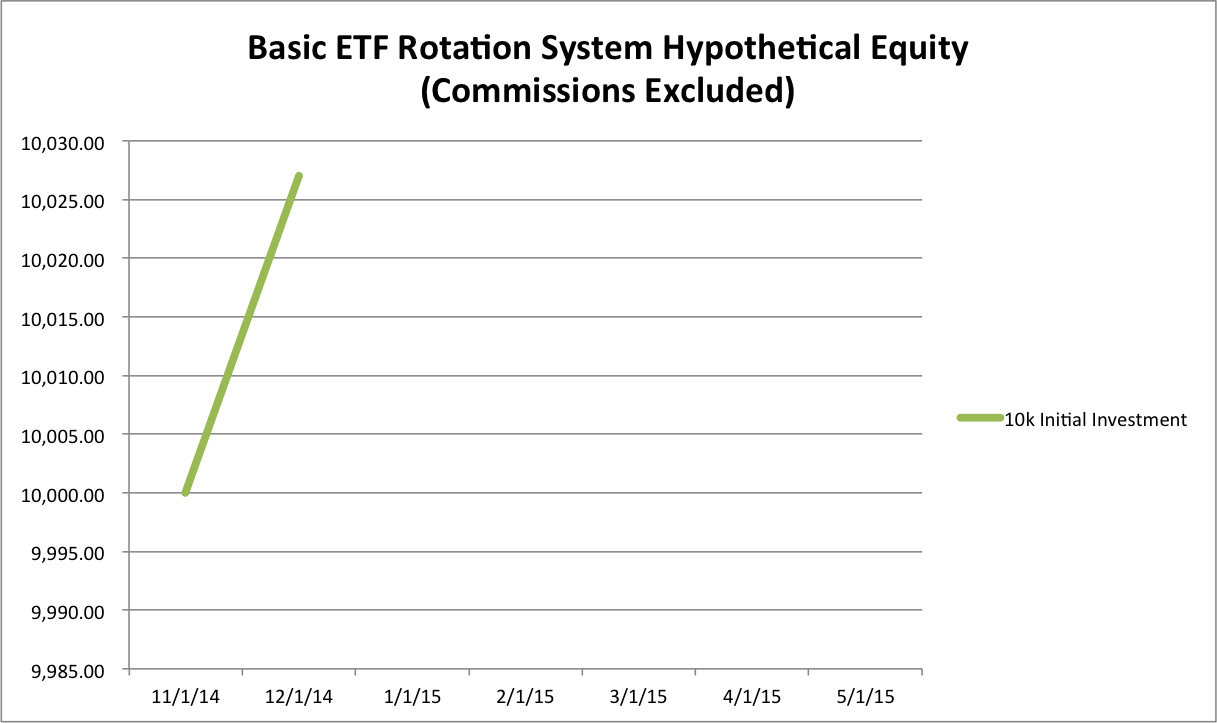

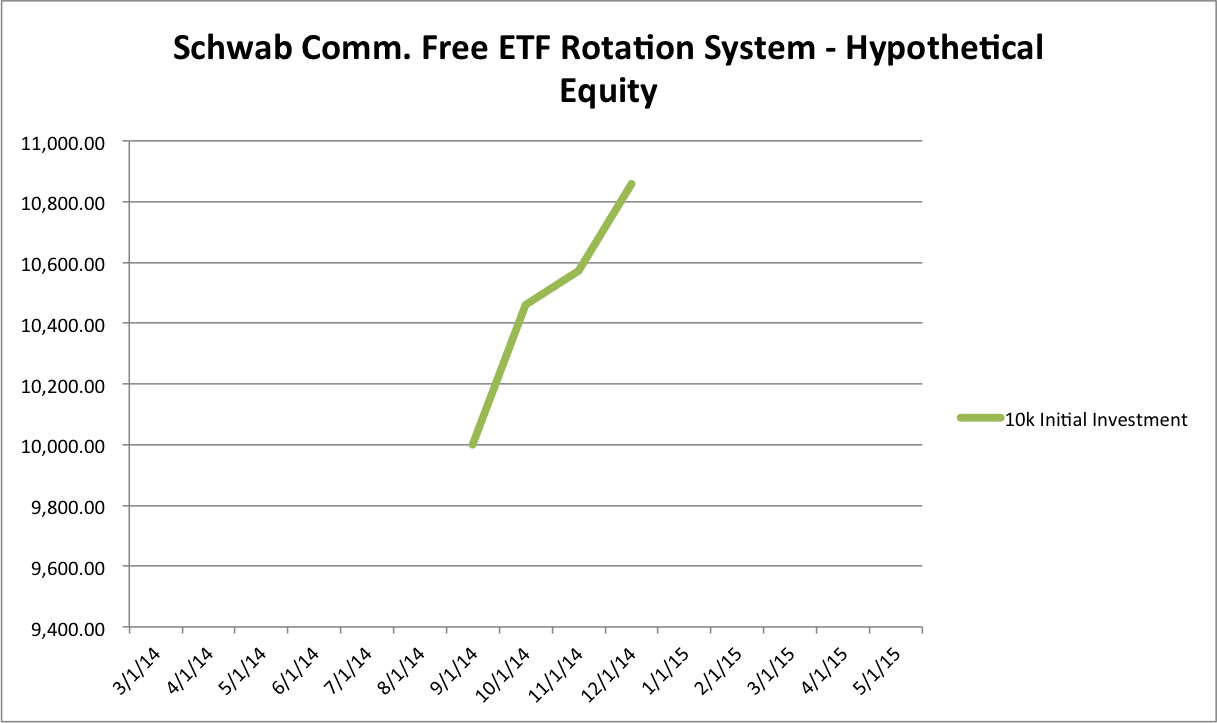

December was a good month for the Schwab Commission Free Rotation system, which held positions in Long Term U.S. Treasuries and Real Estate ($TLO and $SCHH). The Basic Rotation System was invested in Real Estate and the S&P 500 ($IYR and $SPY) and didn’t perform quite as well.

The hypothetical monthly return for the Schwab system was 2.73% while the Basic System had a hypothetical return of 0.27%. Hypothetical returns are calculated using adjusted close data from Yahoo Finance and applied to a $10,000 initial account balance. The Schwab ETF Rotation system has been traded a month longer the basic system and, as a result, has an additional data point in the equity curves below.

For the month of January 2015, the Schwab system is holding Real Estate and Global Real Estate ($SCHH and $RWO). The Basic system is holding Real Estate and U.S. Small Cap Equities ($IYR and $IWM). The full January rankings for both systems are shown in the Market Momentum Newsletter.

Information regarding actual positions, historical rankings, and hypothetical equity for both systems is being maintained on the following two pages:

Basic ETF Rotation System Results

Schwab Commission Free ETF Rotation System Results

ETF Rotation System Trading Rules:

I haven’t dug too deeply into the specific rules for the ETF Rotation Systems so they’re being presented here for your reference. I backtested the systems using ETFReplay and designed them to fit with my comfort level. If you plan trade an ETF Rotation System, I highly recommend using a tool to backtest and design a system to fit with your comfort level. In order to be successful with any system, it’s essential that it fits with your personality. I know that might seem like some sort of touchy, feely nonsense, but it isn’t. Trust me . . . or don’t.

Monthly ETF Rotation System Trading Rules:

- On a monthly basis, rank and order the ETF’s for each system using the 3 month total returns. The two ETF Rotation System portfolios are presented below.

- Invest 50% of desired equity in the top 2 ETF’s if price is trading above the 6 month (120 day) simple moving average. For example, if a $10,000 account was going to commit to two positions and invest 100% in the system, each positions would be $5,000. If only one ETF is trading above the moving average, hold the other position in cash or $SHY.

- Ignore price fluctuations during the month and rank again at the end of the month.

Basic ETF Rotation System Markets:

| Basic ETF Rotation System | Description | Market |

|---|---|---|

| AGG | iShares Core Total US Bond (4-5yr) | US Bonds |

| TLT | iShares Barclays Long-Term Treasury | US Bonds |

| BWX | SPDR Barcap Global Ex-U.S. Bond | International Bonds |

| PCY | Powershares Emerging Markets Bond (7-9 yr) | International Bonds |

| EEM | iShares MSCI Emerging Markets | Emerging Markets Equity |

| EFA | iShares MSCI EAFE | International Equity |

| VEU | Vanguard FTSE All-World ex-US | International Equity |

| DJP | Dow Jones-AIG Commodity Index | Commodities |

| GLD | SPDR Gold Shares | Commodities |

| IWM | iShares Russell 2000 Index Fund | US Small Cap Equities |

| SPY | SPDR S&P 500 Index | US Equities |

| VNQ | Vanguard MSCI U.S. REIT | US Real Estate |

Schwab Commission Free ETF Rotation System Markets:

| Schwab Commission Free ETF Rotation System | Description | Exposure |

|---|---|---|

| SCHB | Schwab US Broad Market ETF | US Equities |

| SCHA | Schwab US Small Cap | US Equities |

| PGX | Powershares Preferred Portfolio | US Preferred Stock |

| SCHF | Schwab International Equity ETF | International Equities |

| SCHE | Schwab Emerging Markets Equity | International Equities |

| SCHC | Schwab International Small Cap Equity | International Equities |

| SCHH | Schwab US REIT ETF | Real Estate (US) |

| RWO | SPDR Global Real Estate ETF | Real Estate (International) |

| SCHZ | Schwab Aggregate Bond ETF | US Bonds |

| SCHR | Schwab Intermediate Term Treasury ETF | US Government Bonds |

| TLO | SPDR Barclays Long Term Treasury ETF | US Government Bonds |

| HYMB | SPDR S&P High Yield Municipal Bond | US Municipal Bonds |

| SCHP | Schwab US TIPS ETF | US Government Bonds |

| PCY | Powershares Emerging Markets Sovereign Debt Portfolio | International Bonds |

| BWX | SPDR Barclays International Treasury Bond ETF | International Bonds |

| USCI | United States Commodity Index | Commodity |

| SGOL | ETFS Physical Swiss Gold Shares | Commodity |

Feel free to email me or leave a comment below if you have any questions about the systems.

Follow me on Twitter. Click here and then follow.

Want to receive updates on ETF Rotation System rankings, positions, and results?

Sign up for my email list and I’ll keep you posted on Trend Following systems and my results.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.