March $RUT Options Butterfly Recap & Analysis

Overview:

Last Monday I closed the March 2015 $RUT Butterfly. I exited the trade a little earlier than I planned partially because I’m in the process of moving and am having a harder time monitoring the markets and my positions. That being said, the trade did okay and, despite some poor market timing on my part, it made money. This post provides a brief overview of the trade and the daily statistics for those of you who are interested in the specifics of trading a Butterfly. Additionally, the post helps me understand areas for improvement.

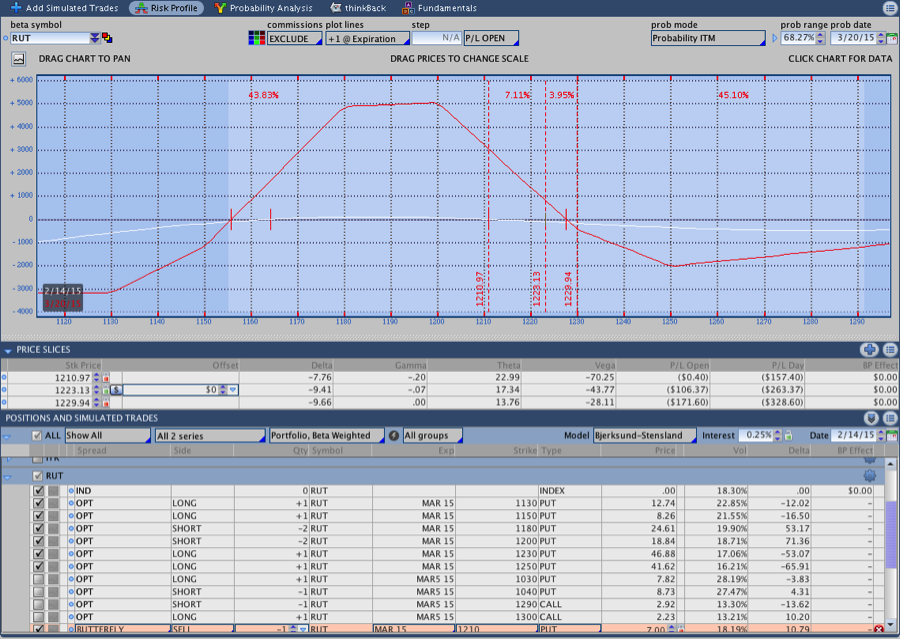

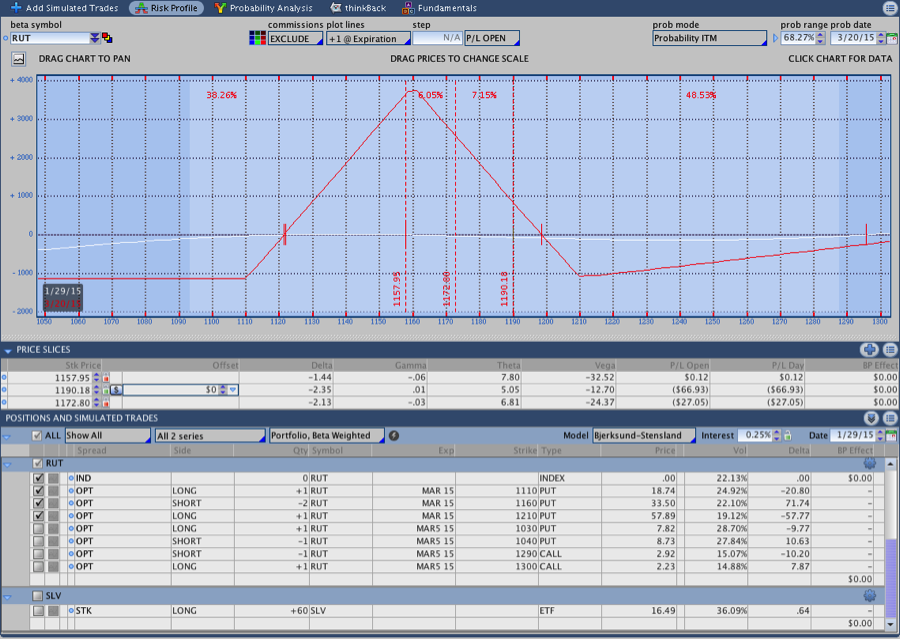

Day 1 – January 29, 2015:

The trade was entered during a range bound period for the Russell 2000 and other equity indexes. The position was somewhat bearish when it was initiated and I did an excellent job of picking a short term bottom for entering a bearish trade. In other words, I was wrong from the start. The image below shows the position at the end of the first day. $RUT closed around 1190 and the trade was entered around 1170. It’s never great to be down money on Day 1.

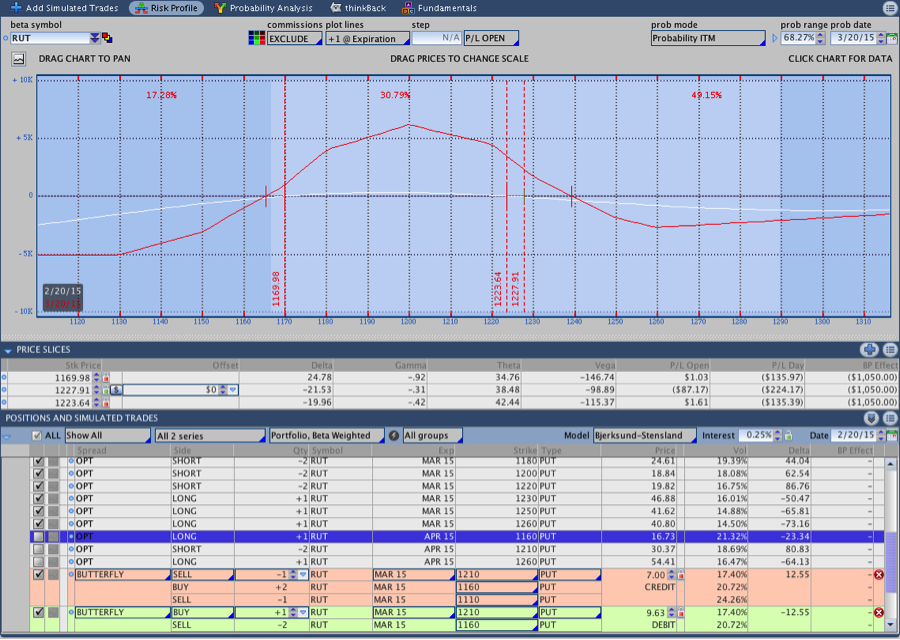

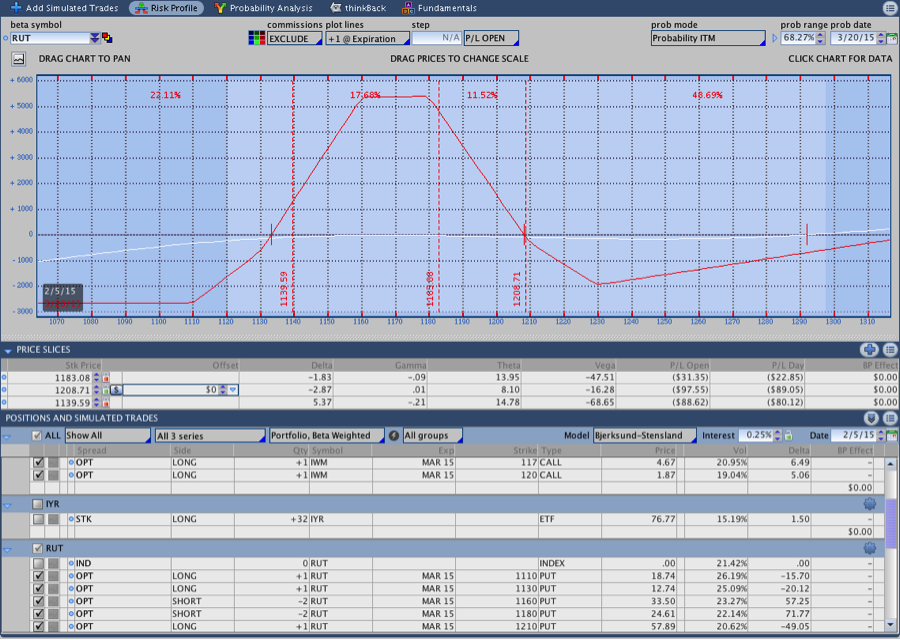

Adjustment #1:

The first adjust I made to the position took place about a week after entry around February 5th. The Russell broke above the 1200 level, which was my first expiration break even point. I adjusted by adding another 50 point wide Butterfly to the position centered at 1180 and buying another $IWM call. The image below shows the position after making the adjustment. At this point, I’m still down money.

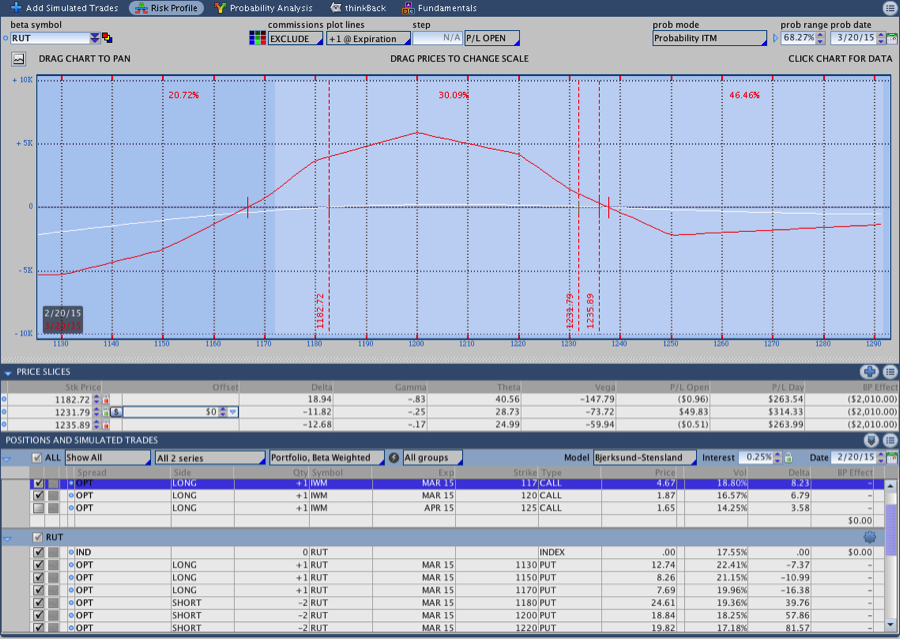

Adjustment #2:

Sure enough, Russell continued higher and a few days later broke through my upside break even and I was forced to adjust again. The next adjustment I made rolled the original 50 point wide 1160 Butterfly up to 1200. That adjustment moved my expiration break even up and essentially maintained my size in the trade.

Adjustment #3:

Another week went by and $RUT was higher again. I was starting to get tired of chasing the market higher and I also thought $RUT “should” pull back. That didn’t happen, but I did add a broken wing butterfly to the position and started to lean heavier short delta. The adjustment added the 1170/1220/1260 Butterfly, which is 50 points wide on the downside and 40 wide on the upside.

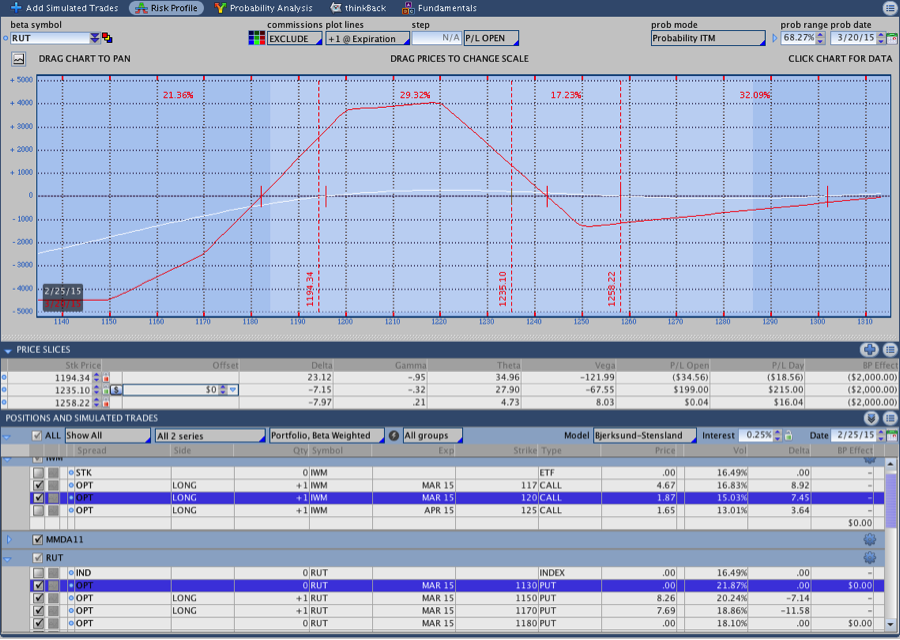

Adjustment #4:

The morning after adding the BWB in Adjustment 3, $RUT sold off and I knew the long puts in the BWB from the day before should be up money. As a result, I decided to roll the 1260 put down to 1250. That adjustment cut my upside risk in the trade and reduced delta. In comparing the image below with the image above, you’ll notice that Delta was cut approximately in half at the expense of a little Theta. My concern at this point in the trade was that $RUT would gap higher and put the position under a good amount of pressure. Even though $RUT seemed extended, the market wasn’t backing off and I was concerned about a gap to the 1250 level.

Adjustment #5 (Partial Close):

A few days went by in the trade and $RUT was creeping higher rather than backing off. I was still concerned about hitting 1250 because it’s an even number and $RUT was only 15 or so points away. As a result, I used an intraday pullback to close out the lowest Butterfly in the position. Specifically I sold the 50 point wide Butterfly centered around 1180. That adjustment gave me a good amount of room to run on the upside and was intended to let me sit in the trade longer. Additionally, the T+Zero line was finally starting to rise and the trade was showing a little profit.

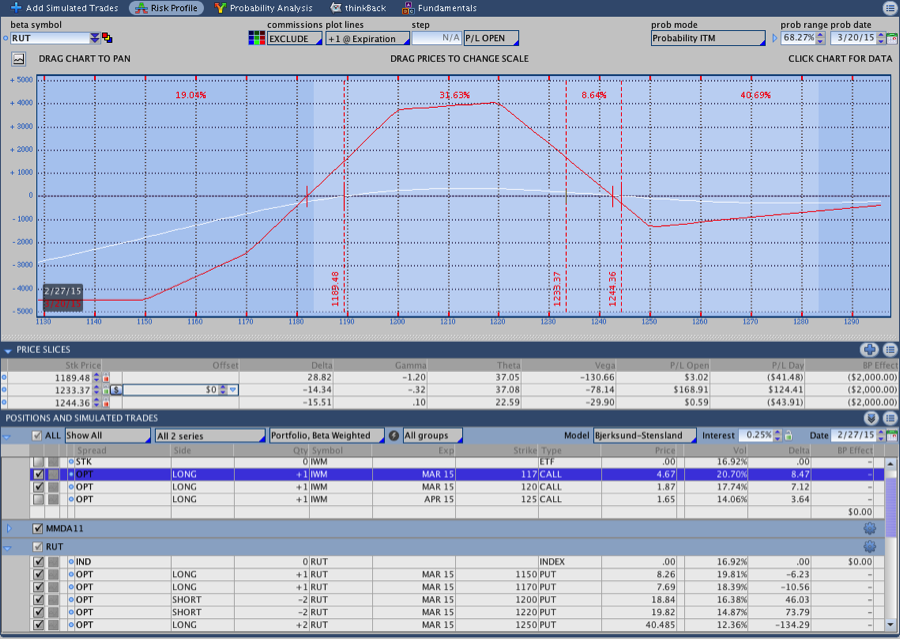

Friday before the full close:

The last image I have of the position was taken the Friday before closing the trade. The long calls were beginning to be less effective on the upside and, as a result, Delta and Gamma were becoming slightly unfavorable. I knew that if I could sit in the trade a little longer some good profit would come into the position; however, I was also having a hard time monitoring the markets and wanted to get out of the position.

The following Monday morning we had a nice pull-back in $RUT that I used as an opportunity to exit. Shortly after the pull-back $RUT pushed up and above the 1240 level and fell back before trading lower. If I had remained in the trade, it would have been a much nicer exit. That being said, the position went fairly smoothly despite poor market timing on my part and was closed for a pre-commission profit of around $254 ($197 net).

The biggest thing I took away from the trade is that some component of market timing is important for the position. For example, if the position was entered at the close on the first day I would have had one fewer adjustment. One fewer adjustment would have saved the position commissions and reduced some of the upside chase. Additionally, staying in the trade longer rather than leaving would have been the right move and adjusting the T+Zero line rather than exiting would have been a better choice. Overall the trade went well and the biggest mistake was exiting early.

Click here to learn about the Premium Course that covers the CIB Trade in Detail

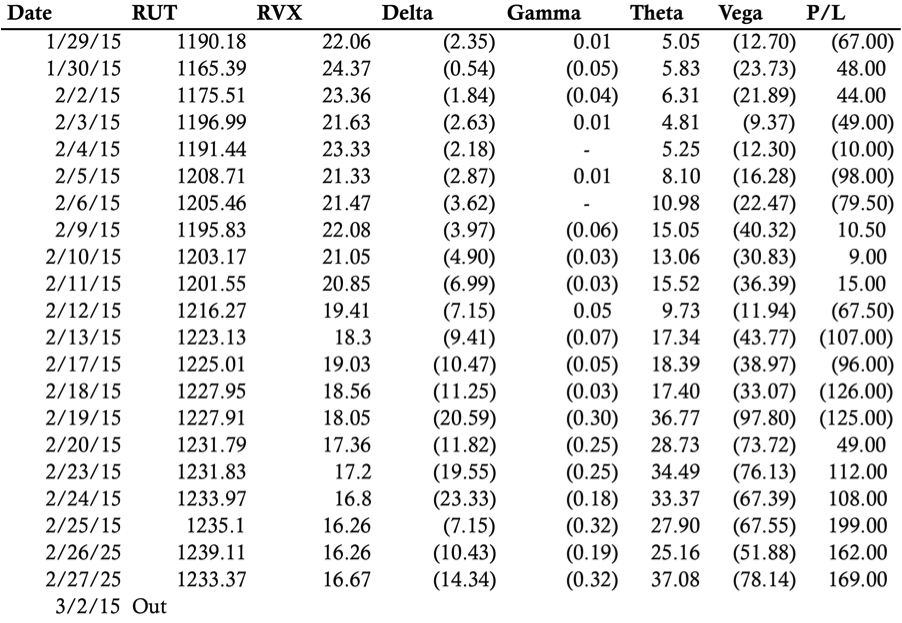

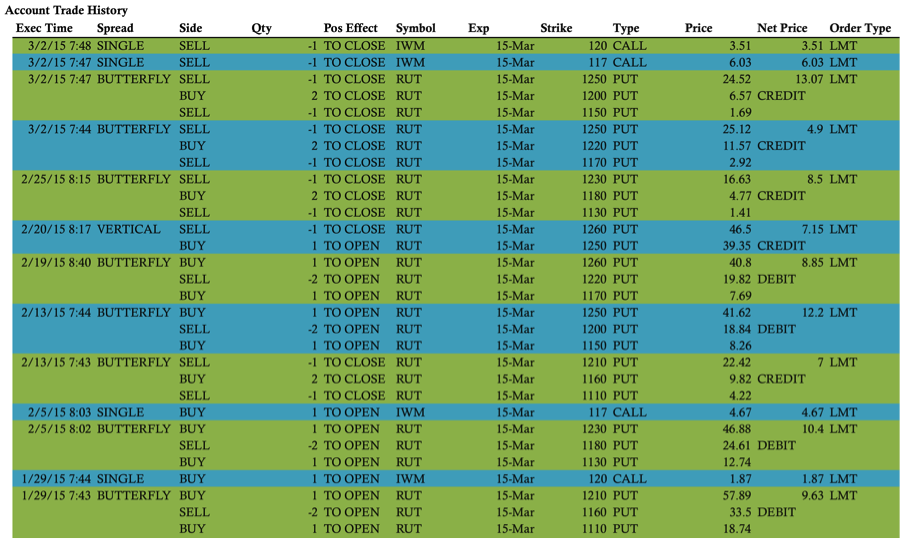

Daily Greeks:

Orders: