Low Maintenance, Low Stress Broken Wing Butterfly Trades and Adjustments

Overview:

Lately it seems like there has been a lot of talk about Broken Wing Butterflies in the options world. There are several popular BWB “income” trades like the Rhino, Road Trip, and Kevlar. Those trades are typical income trades where you’re beginning with some initial structure and then adjusting it based on market movement, etc. I’ve looked at all of them and will say that they’re all great trades and have various positive attributes.

While I do like the idea of income trade where you start with the same structure every month, my preference has been to choose a structure depending on my market opinion. I’ve also developed a preference for some longer dated flies when I have no opinion and that gives me something of a “go to” trade that can be adjusted.

As many of you know, I recently started a daily service that provides video, market comments, and trade analysis on an ongoing basis. The purpose of that service is to help you learn to trade by example in real time. The service is based around the Broken Wing Butterfly because I believe the structures are easier to manage making it a great learning trade. This post is designed to give you a little more background on Broken Wing Butterflies and adjustments.

Why Trade BWB’s?

When we look at the initial starting structure for a typical Put BWB, it doesn’t seem like the trade should be all that great. You’re looking at a structure where the upper wing doesn’t offer much (if any) opportunity for profit and there’s a little bucket of decay somewhere below the market.

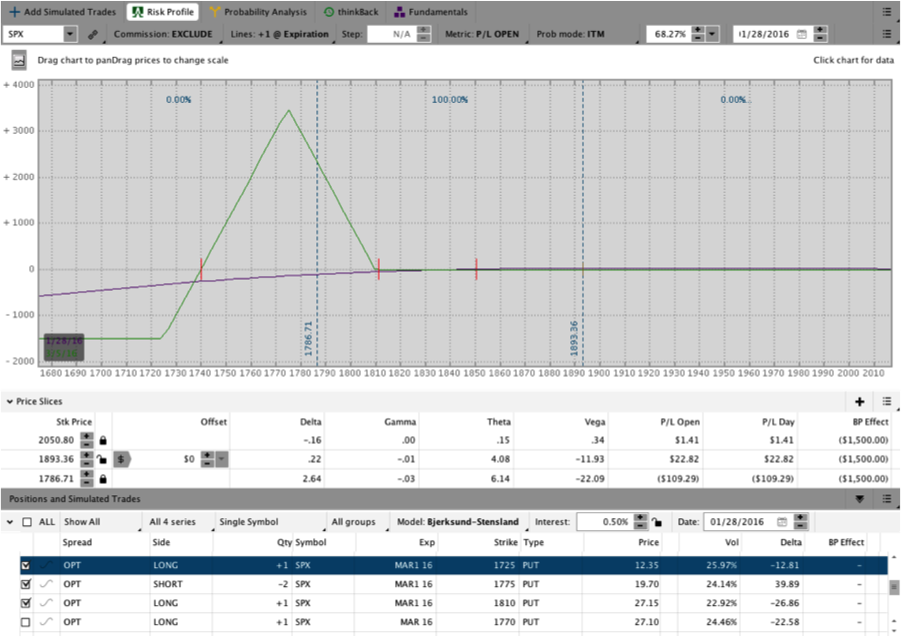

The image below shows a BWB position I traded earlier this year. The specific position was the 1725/1775/1810 SPX Mar1 2016 Put BWB entered for a 0.10 debit on 1/28/2016. In the risk graph, SPX is trading around 1890 and the trade looks to have little to no potential on the upside, right? Wrong.

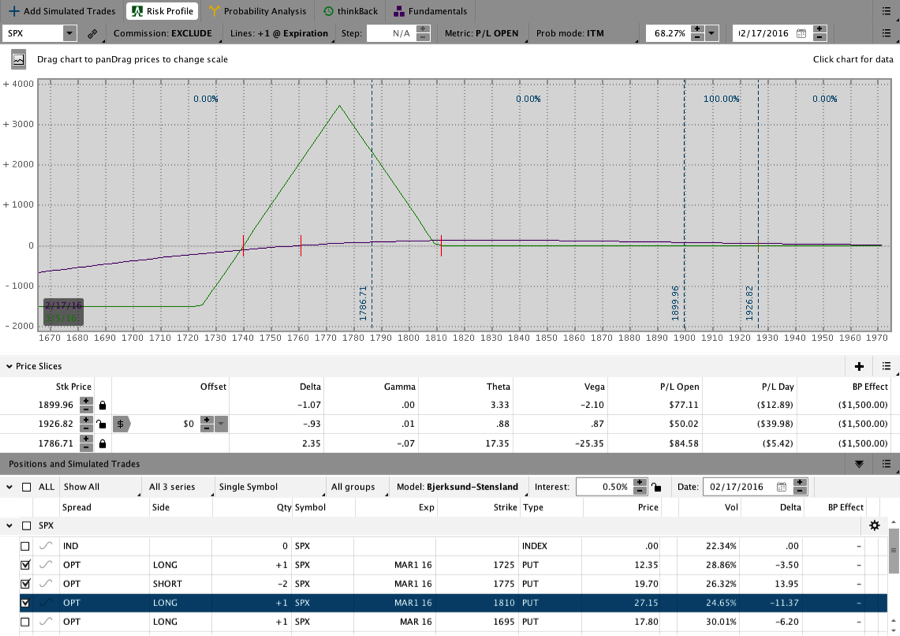

In the risk graph below, we’re looking at the same trade a few weeks later (from 1/28/2016 to 2/17/2016). In the image you can see that the market has gone up slightly (1926 vs 1890), but the trade is showing an open profit of around $50 for one fly or a touch over 3% of capital at risk. Additionally, the market whipped around during the life of the trade, but the trade never took much heat.

Another item to note in the risk graph above is that the range of profit after a couple of weeks in the trade is quite wide. In the image above, the trade is profitable down to about 1760 or over 8% lower. The trade also becomes more profitable on the downside before beginning to lose money. On the upside, the maximum risk is the small debit of 0.10.

Getting the pricing right:

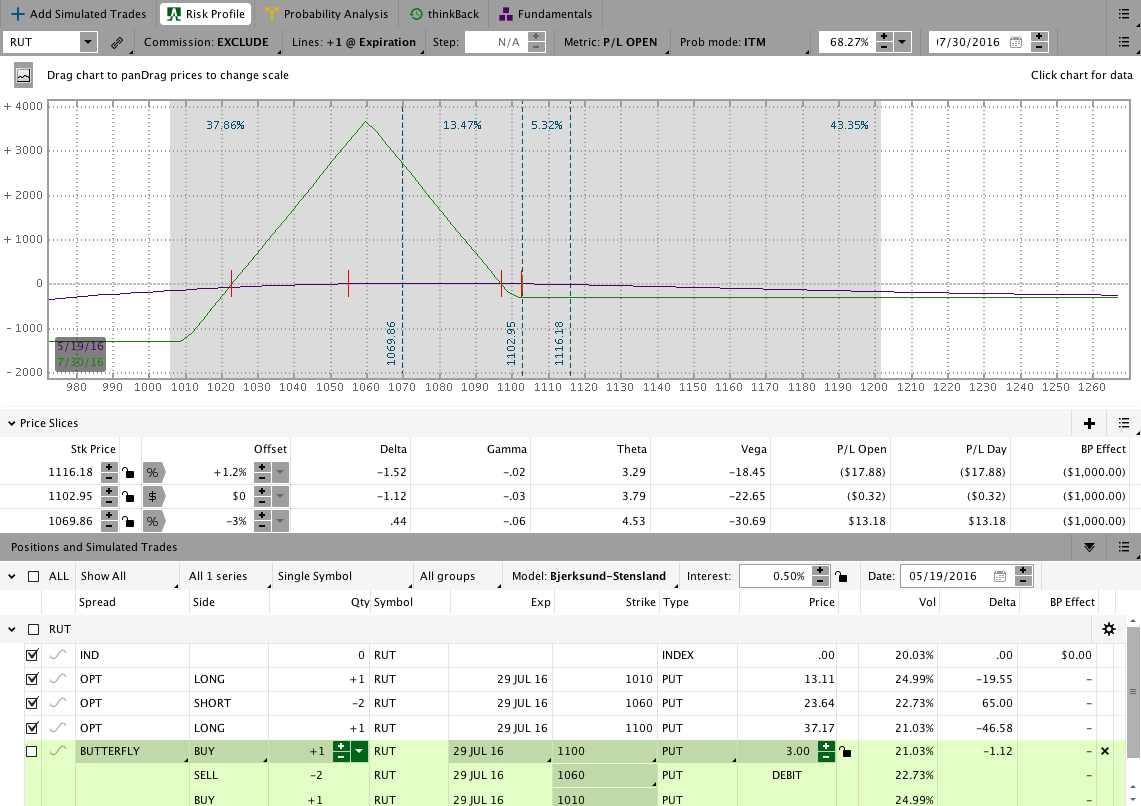

The image above showed a low cost, short term, OTM BWB. More expensive BWB’s, like the one pictured below, have similar characteristics and provide a bit more downside protection early in the trade. The image below shows a RUT BWB with 72 DTE entered on 5/18/2016 (trade is open as of this writing). In the image you can see that RUT was trading around 1100 on entry. What you can’t see is that the market was about to crash upwards over 4% in the next week.

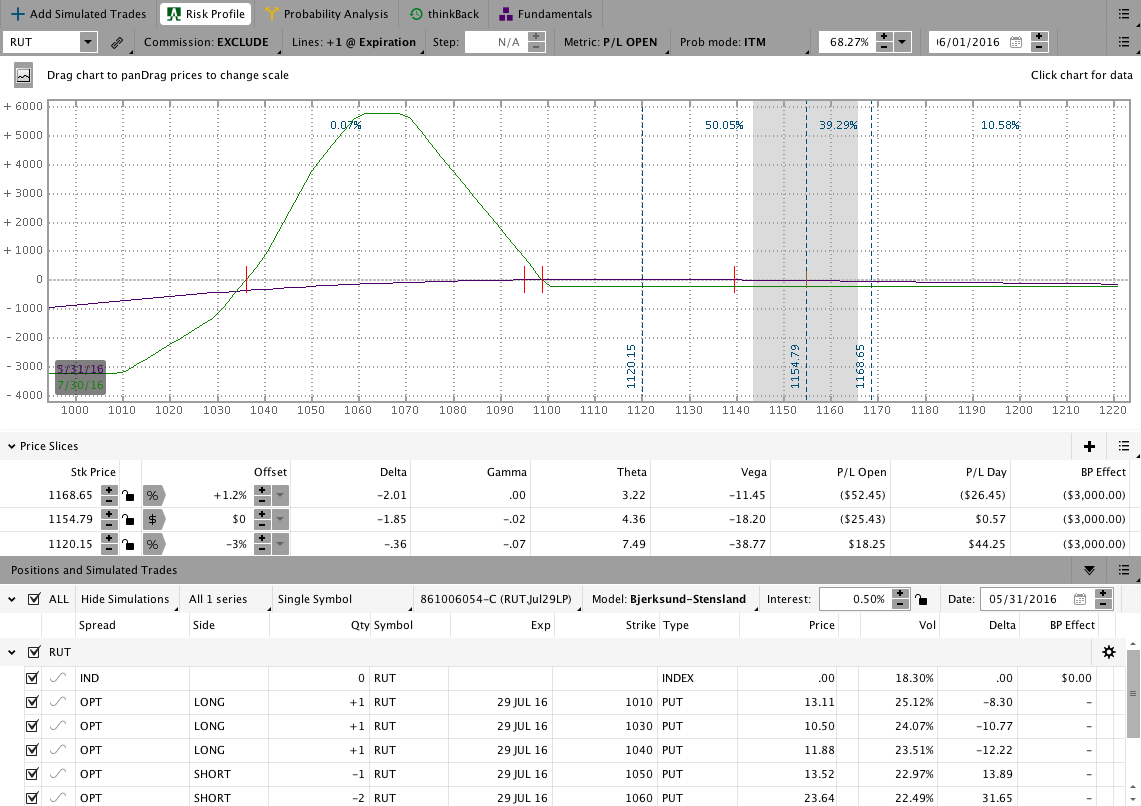

As the market crashed upwards over the next week, the trade was adjusted. Those adjustments initially serve to mitigate the upside loss for the higher debit fly. The image below shows the same trade as of 5/31/2016 after adjustments. Note that the market moved from 1100 to 1154 and the trade is down a negligible $25. The maximum upside loss in the position has also been reduced from $300 to $231. While it is time to consider moving the body of the fly up closer to the market, it’s not urgent and the trade has been able to handle the fast move up with limited pain.

Broken Wing Butterfly Adjustments:

As many options income trader know, defending the upside of trades can be more challenging than the downside. One of the nice things about BWB’s is that upside adjustments are usually less urgent because the gamma is low and the maximum risk is low (depending on your initial structure). Additionally, since the trade begins with a lower potential upside loss, we frequently have better opportunities to adjust the trade on the upside.

Here are a few adjustments for Put BWB trades if the market moves up:

- Scale into the trade by adding another BWB for a small debit or credit – Depending on timing and pricing, we can frequently add a second BWB near the body of the position for a lower cost than the initial trade. If we’re more bullish we can also choose to add a narrower fly for a small credit.

- Sell a vertical spread somewhere in the body of the butterfly – Selling a vertical spread inside the body of the butterfly lifts the upper wing and reduces the maximum loss. If price trades back lower, it may make sense to cover the short vertical.

- Roll the entire structure higher – Rolling higher certainly works, but it may increase the upside risk unless you re-enter with a narrower butterfly.

- Roll down (Reverse Harvey) the upper long put – The Reverse Harvey has a number of applications and it can be used to roll the upper long put long put lower. Note that the adjustment is accomplished by selling a vertical spread so it’s similar to #2 above.

- Do nothing, expire the trade, and take the loss or scratch – If the market has moved significantly higher and you’re in a low cost BWB, it might make sense to just take a small loss or expire the trade.

When the market moves lower, there are a few other adjustments to consider:

- Buy a debit spread to lower the upper wing and raise the lower wing – This is perhaps my least favorite downside adjustment. When the market is moving lower, it sometimes continues. Buying a debit spread has limited value if the market continues.

- Buy a put – While you can certinaly buy a put after the fact, owning units in the case of a crash will be more beneficial. Depending on the size of your trade, it may make more sense to buy unit puts in SPY or IWM rather than SPX or RUT.

- Roll the entire structure lower – Rolling lower is my preferred butterfly adjustment on the downside. In rolling lower we reposition the trade and, due to an increase in IV, may even get a better starting price.

- Close the trade and move on – For the BWB’s we’re discussing where the body is below the market price on entry, the trade will become shorter delta as it progresses. More mature BWB positions will frequently benefit from a pullback and can often be taken off for a profit and sometimes it’s best to take that and move on to the next trade.

Everything is a tradeoff:

Like everything else in options, everything is a tradeoff. If you start with a low cost, put BWB, you’ll be under pressure if the market moves sharply lower immediately after entry. If you start with a more defensive, higher cost, put BWB with more DTE, you might end up chasing and defending if the market moves sharply higher immediately after entry. Spreading out risk across multiples expirations and DTE entries can help smooth the impact of market movement and that’s been my personal trading preference.

Performance Notes:

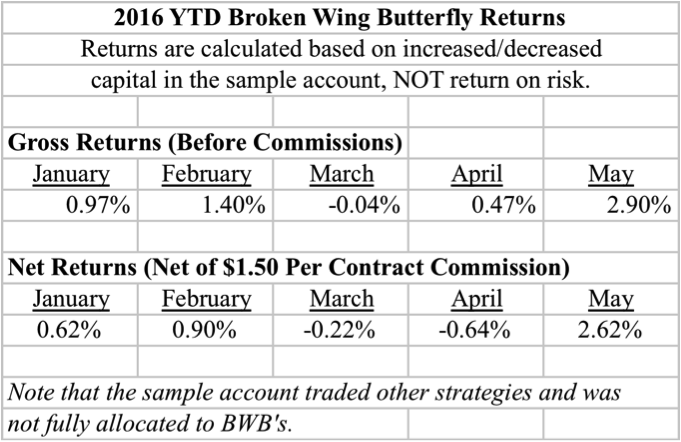

The results below are only for BWB trades this year and returns are calculated based on the whole sample account even though the allocation was less. The point is to look at how the trades performed in various environments.

During January we were able to stay out of trouble on the downside. In March and April, the trades struggled with the big rip higher, but the outcome was more of a scratch. The grinding pullback in May was close to the perfect environment for the trades and we were able to capitalize on that pullback. If you want to look at order specifics, they’re all listed on the Results Tab. I have omitted the CIB and other trades from the results below to better isolate the BWB’s.

If you want to learn to trade Broken Wing Butterflies in real time, check out Theta Trend Daily. Theta Trend Daily is an educational resource with daily market updates and trade alerts for BWB’s. Bonus – It comes with a free trial period!