A Lesson From Picking Up Pennies In Front of the $SPX Steamroller

Overview:

Short gamma trading strategies are frequently described as picking up pennies in front of a steamroller. While I realize that intuitively it sounds like a bad idea to hang out in front of heavy equipment, I decided to take a look back at 2013 to see what would have happened if I spent the year picking up pennies. I mean, seriously, who just wants buy the S&P?

The System:

The penny picking system tested is an accelerated version of pTheta (my longer term naked option trading system), except it sells weekly options rather than options with 90 days to expiration.

The penny picking system tested is an accelerated version of pTheta (my longer term naked option trading system), except it sells weekly options rather than options with 90 days to expiration.

The penny system sells out of the money vertical spreads in the $SPX every week using 10 delta weekly options with 8 days to expiration. Every Thursday the system sells a vertical spread. The two exceptions to the Thursday rule were July 4th and Thanksgiving; the system sold vertical spreads on Friday in those weeks.

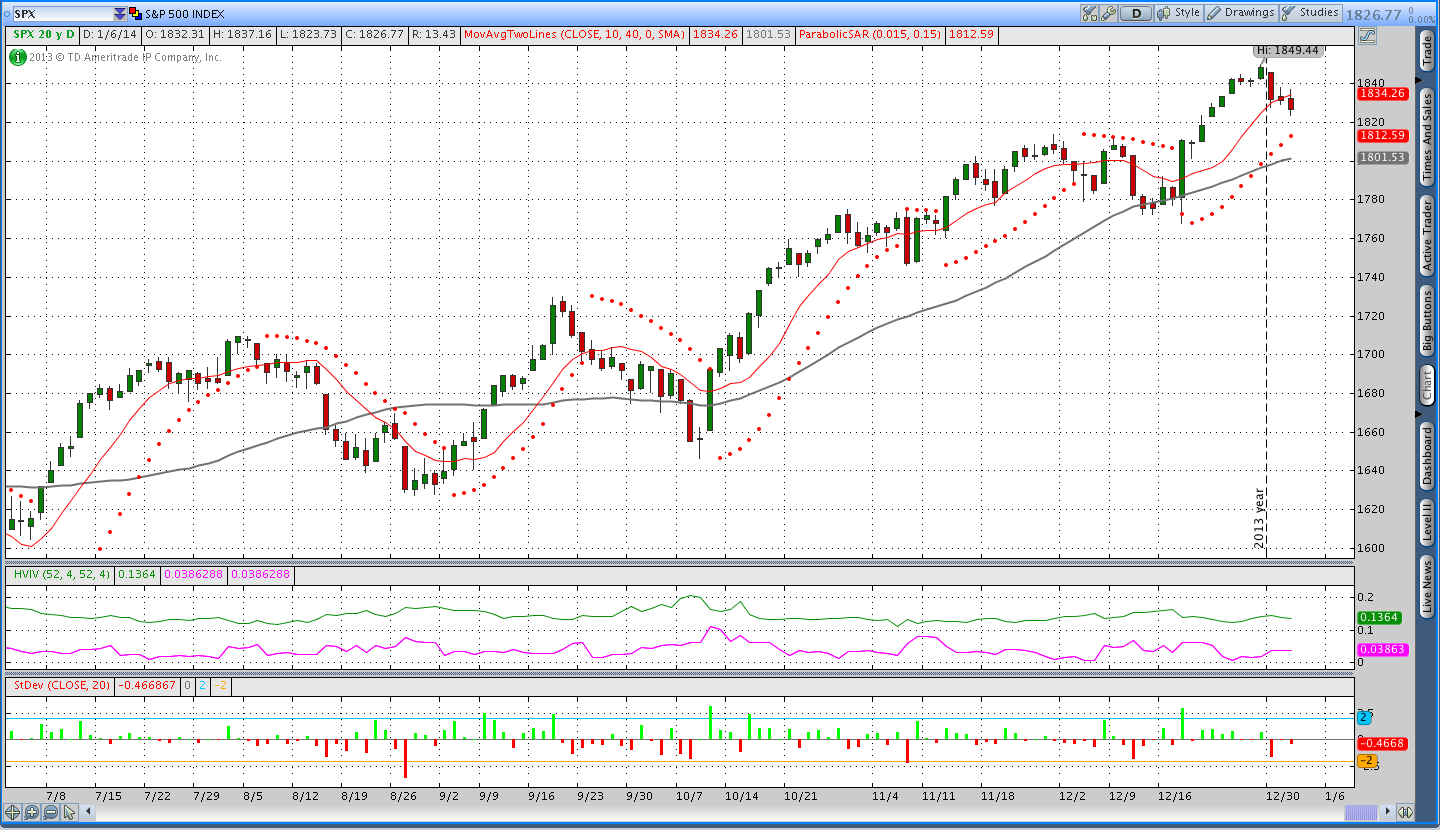

To determine the type of credit spread to sell (call or put), the system uses Parabolic SAR (pSAR) as a trend filter. If price is trading above the daily pSAR, the system sells put spreads below the market and call spreads are sold if price is trading below. I slowed down the default pSAR settings to match my longer term system and used an acceleration factor of .015 and an acceleration limit of .15.

Risk Management *snickers audibly*:

Risk management with the system is a great idea conceptually, but something of an illusion in practice. The system closed trades when either the pSAR was hit or the open loss was equal to 2 time the credit received. For example, if a vertical was sold for .45, the trade was closed if/when the open loss was (.90). The real issue with managing risk is that when the market gaps against the position, there isn’t much that can be done and a larger than desired loss results.

System Stats:

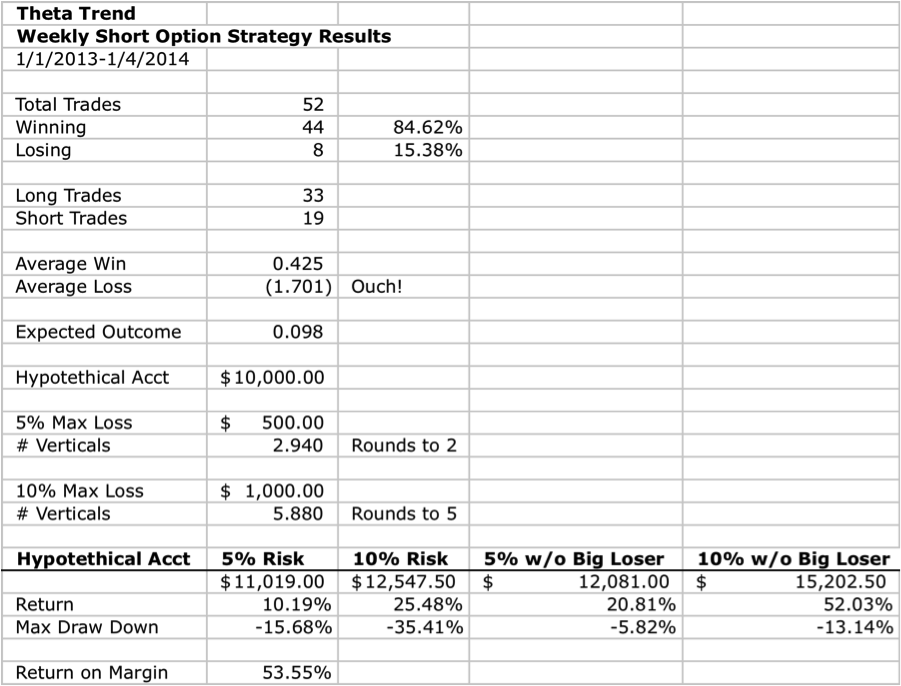

It’s worth noting that in April the system took two large consecutive losses that generated the large drawdown. One of the losing trades represented a loss that was nearly 10 times the initial credit received. The loss was due to a gap lower and steady selling throughout the day so theoretically a slightly better closing price may have been realized, but the results below give a better picture of what could go wrong and I prefer to error on the side of caution.

I present the results below both with and without the largest loss because the impact on the system return is significant. The real lesson is that a high probability of winning trades does not, in and of itself, create a great trading system.

All of the numbers below include a $1.50 per contract commission.

Equity Insights:

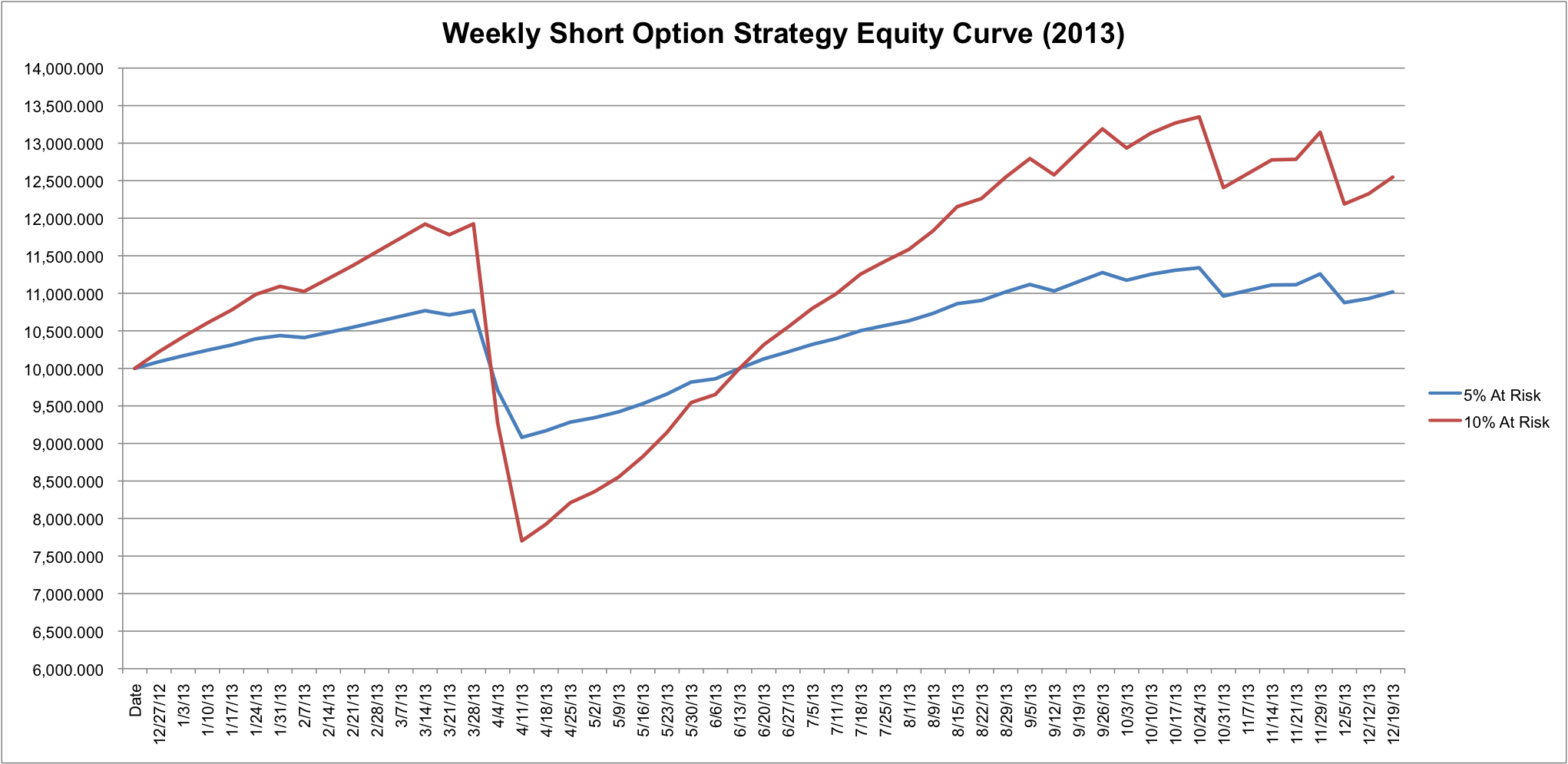

In the sample equity curves below, I took a hypothetical $10,000 account and allocated an initial 5% or 10% to the system. Positions were sized based on an initial account size of $10,000 and the number of contracts was held constant through the year.

Equity Dream:

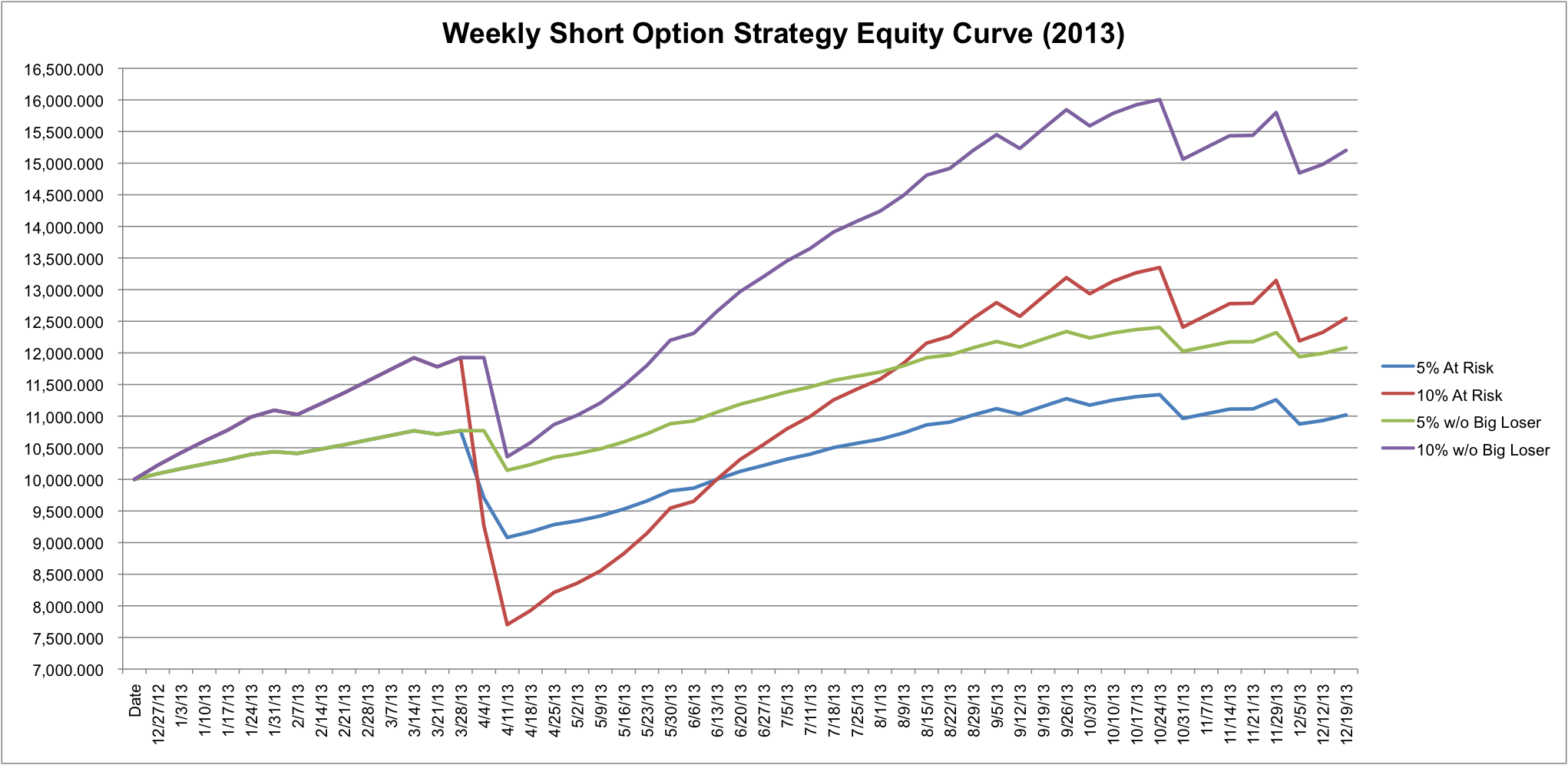

The equity curve below is what happens if you remove the one large loss. Obviously the curve is just an illusion at this point, but the equity growth with a low drawdown is what makes the system so attractive. Dream on . . .

Take Away:

The real issue with this system is that when things go wrong, they go wrong fast and in a big way. There will be times where it’s impossible to manage losing trades (think price gaps) and large losses will occur. Because weekly options have such a short time to expiration and are true gamma queens, a market shock in the wrong direction, especially if it takes place shortly after selling a spread, can be extremely destructive.

When you sell options with a longer time to expiration, you gain the ability to adjust positions and can generally avoid taking the big loss. Weekly options with 8 days to expiration don’t provide quite the same opportunity for adjustment and sometimes it’s best to just be wrong and get out. Going forward I’ll be looking for ways to modify this system and look for ways to avoid the big loss.

Thanks for reading and if you liked this post please share it using one of the social media buttons above.

Great article. So many people get sucked in by weekly options, I’ve had the same conversation with numerous people that goes something along the lines of – “Things were going great, I was making loads of money, then BAM, one losing trade wiped out 6 months worth of profits”.

Weekly options are great, but you have to know the risks before you get involved. I think you’ve illustrated the point brilliantly above.

Thanks! I think the biggest challenge with weekly options is finding a way to manage the risk. Even if you have good intentions of closing a losing trade, the market can take you out on a gap that’s beyond your intended loss. The saying that everything is a tradeoff in options continues to hold true . . .