The Japanese Yen Finally Made a Move – Donchian Channel Breakout

Trade Alert:

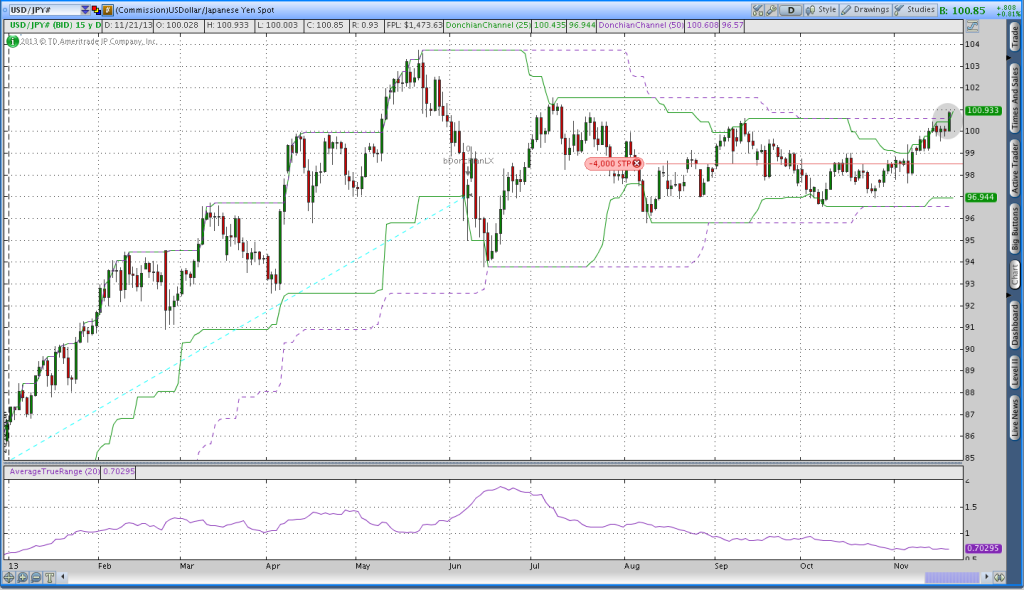

This morning I woke up to an email from the friendly folks at ThinkOrSwim telling me that I was filled on a USD/JPY (Yen) trade while I was asleep. Because Forex is a 24 hour market, I leave good till cancelled orders in for my positions when currency pairs are near the Donchian Breakout levels and I always leave a stop in the market if I’m in the position. The image below shows the Donchian Channel Breakout that I was anticipating a few days ago. At any rate, the Japanese Yen made a new 50 day high last night and I got long. See the full trade details below the chart.

Trade Specifics:

Last night I took a 1% volatility adjusted position in USD/JPY. My initial stop for the Japanese Yen is at 98.52, which is equal to 3 x the average true range of .6953. My initial risk is the position is less than the 1% limit and comes in at about .9% because I round trade lots down when determining position size. I will pyramid into this position once if it goes in my favor at 1.5 x the average true range or up around 101.64. If I pyramid once into the position, my stop will move up and my potential risk will increase to 1.14% of risk equity.

While my initial stop is at 98.52, it will move up as the 25 day Donchian Channel advances. The 25 day Donchian channel is the green line on the chart.

I’m also long the carry trade:

It’s also worth noting that I’m already long the New Zealand Dollar and short Japanese Yen via NZD/JPY. The trade entry last night indicates that the Yen may be getting weaker. For the sake of my positions, I want the Japense Yen to get weaker.

So far the NZD/JPY trade hasn’t moved very far. Fortunately, the trade didn’t reverse after the breakout and as time passed the 25 day low I use for an exit point has moved up. At this point the worst outcome for this trade would be to scratch because my stop level is right around the initial entry point.

Want to become a more successful trader? (not a trick question)

Learn from my mistakes and get a free copy of my easy to follow options trading system!

Click here to get the Theta Trend Options System plus the Trade Tacker I use. Bonus: It’s totally free.