How Should I Invest Part 2: The Most Powerful Force In Investing

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” -Albert Einstein

Compound Interest is quite possibly the most powerful concept in investing. With compound interest and time, a small investment can grow to an amount beyond what most investors would ever expect. As a result, compound interest should be something all investors deliberately pursue and understand.

Compound interest takes the interest earned on an investment and reinvests the earnings. The result is an initial investment that earns interest and investment earnings that earn interest. On a practical level, interest can take many forms. Interest can be basic interest, dividends, or non-taxable distributions. Non-taxable distributions are things like partnership distributions, which are common with Master Limited Partnerships (MLP’s).

Yield is way to describe the income of an investment. Yield takes the income received divided by the price of the investment, which results in a percentage that can be used as a benchmark for comparing different investments. If our goal is to create regular income, we want to hold investments that generate yield without significant price risk. We can then reinvest the earnings, while continuing to save, and end up with a surprisingly large investment.

The Power of Compounding Savings:

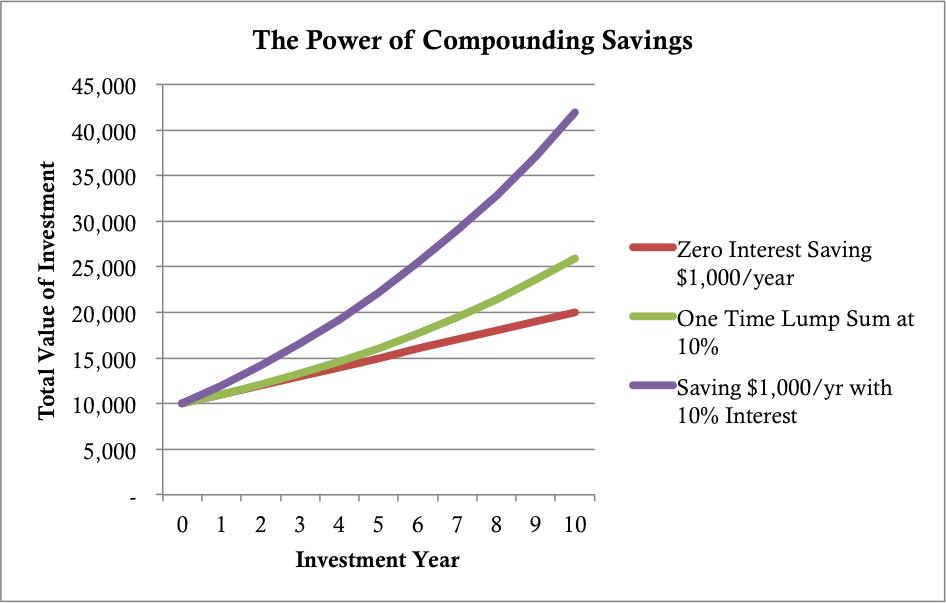

In order to understand the power of compounding, we’ll compare three investment scenarios. All three of the investors begin at year zero with a lump sum of $10,000. However, they make very different choices over the course of 10 years and the value of their investments reflect those choices. One investor saves without interest, another invests at 10% but doesn’t save every year, and the wealthiest investor saves and invests at 10%.

Our first investor, Mr. Red, puts the $10,000 lump sum in an account and diligently saves an additional $1,0oo per year. Unfortunately, Mr. Red is fairly risk adverse (doesn’t want to lose money) and holds the savings in cash. As a result, at the end of 10 years, he has all of the money he started with plus the additional savings for total investment value of $20,000.

The second investor, Mr. Green, decides to invest the $10,000 lump sum in an investment yielding 10% and compound the earnings. However, Mr. Green is more interested in trips and toys and, as a result, doesn’t save another penny over the next 10 years. Mr. Green ends up with an investment value of over $25,000 at the end of 10 years.

Ms. Purple, the wisest investor, both invests the initial $10,000 lump sum and saves an additional $1,000 per year. All of the earnings on her investments compound annually and she ends up with a total investment value of over $40,000 at the end of 10 years. Her out of pocket cash outlay is the same as the first investor or $20,000.

In the examples above, the investors all end up with more than their initial $10,000 investment. However, the one thing we’re discounting is inflation. Inflation robs an investment of purchasing power over time and is something that we have no ability to control. It’s also worth pointing out that, due to inflation, $1 invested at year zero is worth more than $1 invested in year 10. The impact of inflation is a little beyond the scope of this post, but just be aware that it exists.

Why you should always start compounding yesterday:

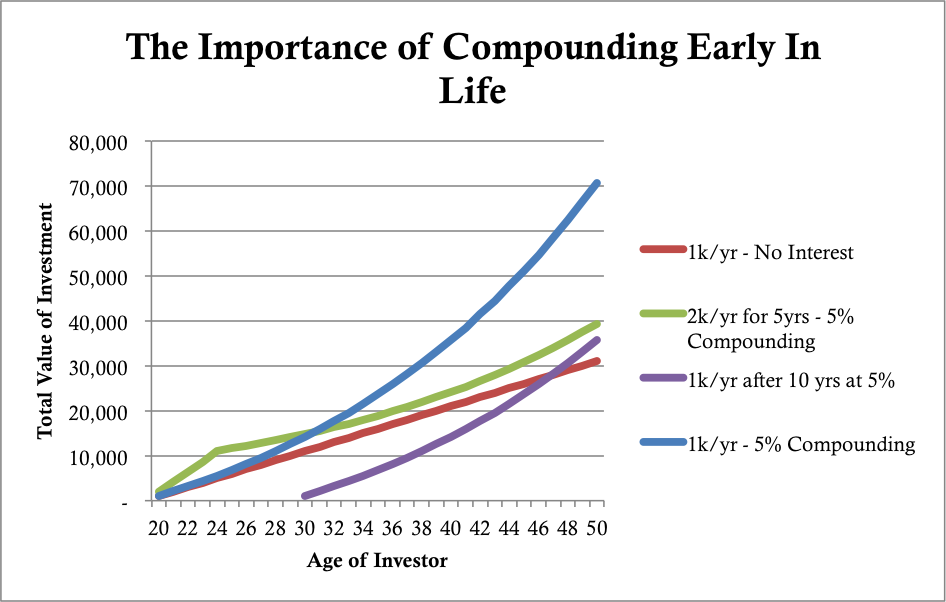

An obvious criticism of the examples above is that most investors will have a hard time finding an investment that yields a steady 10%. In the examples below, we’re going to drop the interest rate down to a more “realistic” 5% and learn about the importance of compounding early in life. As we’ll see, compounding is incredibly powerful, but that power is a function of time.

In the image below, we’re looking at four different investment scenarios. The most important lesson comes from comparing the blue and purple lines. The blue line represents an investor who begins saving $1,000 per year at age 20 and compounds the interest. The purple line represents the same $1,000 per year compounding at 5%, however, the purple investor waits until age 30 to begin saving. At age 50, the early investor has an investment worth slightly over $70,761 while the investor who began at age 30 has around $35,719.

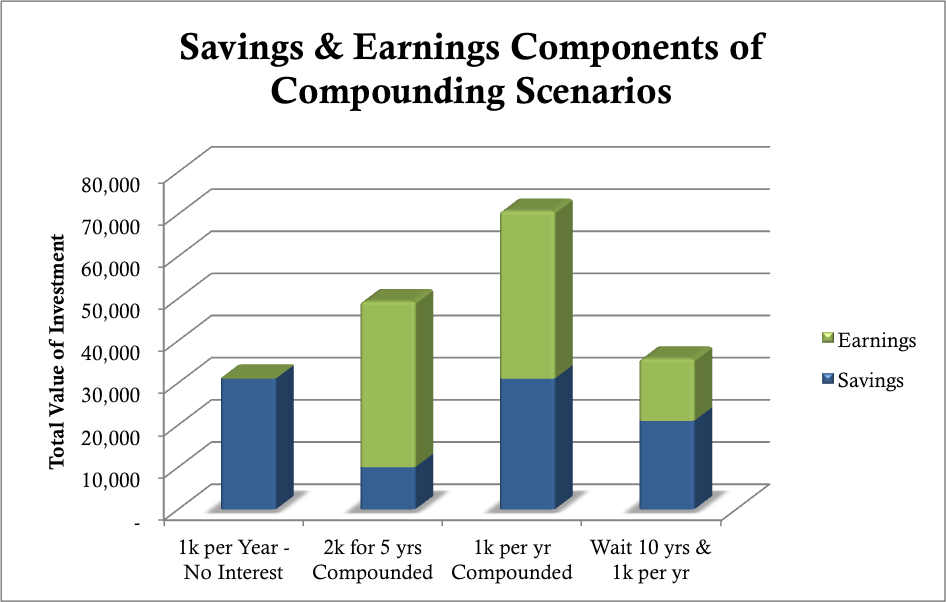

The importance of saving early in life becomes even more apparent when we look at the components of the ending investment. The image below breaks down the four investment scenarios into their savings and earnings components. The investor who waited until age 30 to begin putting away money saved $21,000 out of pocket through age 50. By compounding every year at 5%, the $21,000 investment grew to $35,719 and earned $14,719 in interest.

The investor who began saving 10 years earlier at age 20 saved $31,000 out of pocket. While waiting 10 years and having a $10,000 difference might not seem extremely significant, compounding and saving for an additional 10 years left the early investor with a an investment value of $70,761 and $39,761 in interest.

The darker downside of compounding:

Albert Einstein (quoted above) was a smart dude. He was right about the burden of debt long before debt became as common as it is today. Unfortunately, most people get interest wrong by carrying debt rather than compounding investments. Debt is an immediate burden on money, but it’s also a burden on potential money and the ability to earn compound interest. In order to become financially successful, it’s essential to repurpose money from paying debt to earning compound interest.

That’s great, but how do we earn Compound Interest?

At this point it should be fairly clear that compounding can help us increase the value of our investments significantly beyond our ability to save. Additionally, even if two investors save the same amount, the investor who compounds will end up significantly ahead of the investor who doesn’t compound.

One of the biggest challenges with compound interest is coming up with a way to earn the initial interest that can be reinvested and compounded. In the next post we’re going to take a look at some of the available vehicles for investing. Specifically, we’re going to look at Mutual Funds, Stocks and ETF’s. Once we have a basic understanding of the vehicles, we’ll build a system for investing.

Resources:

Knowing the dividend history of stocks and ETF’s is very import if you’re targeting income based investments. The primary resources I use for dividend information are dividend.com and Nasdaq dividend history.

Want to receive an alert as soon as the next post in the series is published?

Sign up for my email list and I’ll let you know as soon as the next post in the How Should I Invest series is released.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.