How to Trade a Butterfly in a Small (or very small) Account

A while back we discussed some tips for trading options with a small account. This post builds on that material and provides a specific Butterfly trading strategy for small accounts.

A while back we discussed some tips for trading options with a small account. This post builds on that material and provides a specific Butterfly trading strategy for small accounts.

Overview:

If you trade a small account, you probably know that one of the biggest challenges is that commissions eat up a good chunk of your profit on a small options trade. Commission costs are an even bigger issue if you trade ETF’s like SPY or IWM rather than SPX or RUT. Due to the commission burden on small products, smaller traders benefit from strategies that require fewer adjustments, have a higher yield, and risk a small dollar amount.

Note that the reason to risk a small amount per trade is that a small dollar amount can be a significant percentage of equity in a small account. For example, a $100 loss represents 1% of equity in a $10,000 account, 2% in a $5,000 account, 5% in a $2,000 account, and 10% in a $1,000 account.

The Migrating Butterfly strategy below is a strategy that I’ve been developing in one of my very small IRA’s. The goal of the strategy is to risk a relatively low dollar amount per trade, maintain positive theta, and provide a high yield.

Migrating Butterfly Trade Entry:

The trade begins with a slightly bearishly positioned Put Butterfly in SPY with 7 point wide wings. For example, if SPY is trading at 200, I would look at the 191/198/205 Put Butterfly with 45-50 days to expiration. Since the trade is positioned slightly below the money, timing is important. This post discusses some ideas for timing your Butterfly.

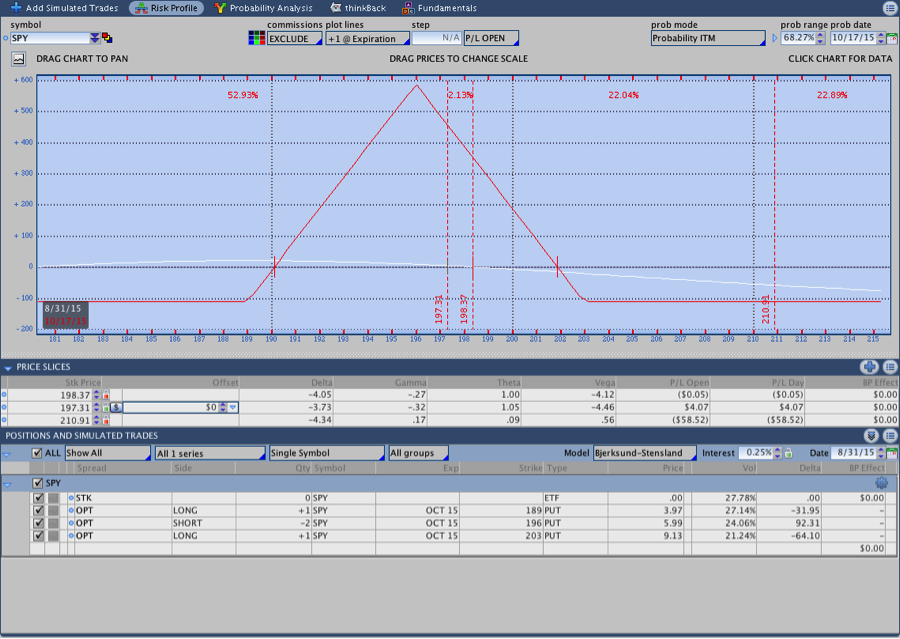

The image below shows the SPY October 2015 Butterfly that I opened on August 31, 2015:

The trade is positioned slightly below the money and, due to skew, the trade will benefit if price trades lower. The trade can be added to once on the upside and then the trade begins a process of rolling up the lower Butterfly. The idea is to keep up with the market and provide a pocket to catch it when it pulls back or stops moving up.

Butterfly Trade Adjustments:

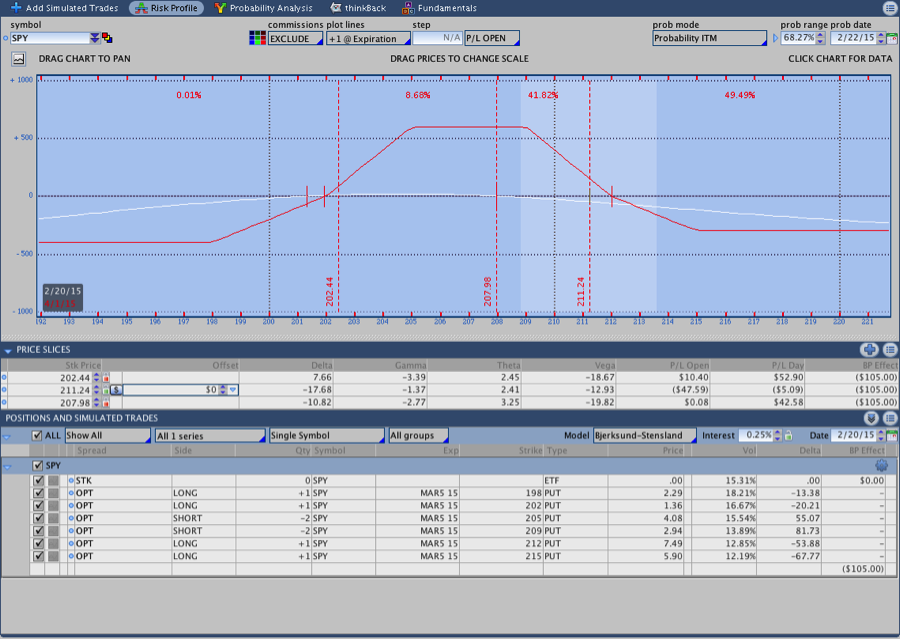

If the market trades strongly in either direction, the trade may require an adjustment. On the upside, I add a second Butterfly to the trade when price trades outside of the expiration break even. If I am uncomfortable with the short delta created by the second Butterfly, I purchase a 7 point by 6 point wide Broken Wing Butterfly (BWB) rather than a balanced 7 point wide Butterfly.

The image below shows my March position after making an upside adjustment with a BWB:

Downside adjustments are a little easier than upside adjustments. The position is short delta when it’s opened and will show a profit before any downside adjustment is necessary. Additionally, the position has a large amount of room on the downside before it gets into trouble. Nevertheless, we need a plan.

On the downside, I roll down the Butterfly to ATM when price trades to within 2-3 points of the lower long leg. The risk in repositioning the Butterfly is that price could reverse direction and trade higher. If the market is in a primary uptrend and reversal is a major concern, using a 7 point by 6 point BWB is an option.

One quick note is that if the initial Butterfly can be taken off for a $75 gain with more than 3 weeks to expiration, I frequently close the position and wait for the next cycle. If the initial Butterfly can be closed for a $50 gain within 10 days of trade entry, I will often take off half of the position if trading more than one Butterfly.

Risk:

- The maximum risk per trade should be roughly equal to the traders average monthly gain.

- My maximum loss is $125 per trade. If I hit a loss of $125 (including adjustments), I shut down the trade.

- My target is $100-$150. I don’t use a firm number and I base my exit decision partially on what is going on in the market.

Entry Rules:

- Initiate around 45 Days to Expiration in SPY or IWM – I prefer SPY for this trade

- Enter the trade when the market is short term overbought and less likely to trend consistently higher.

- Target a purchase price where the maximum risk is 20-30% of the potential reward. In SPY this usually works out to around 7 point wings.

- Generally my short strike is positioned 2 points below the current price in SPY. The reason for a slightly bearish position is self-explanatory if you read this post.

Adjustments:

- The first upside adjustment for the trade takes place when price trades outside of the expiration break even on the upside. At that point, I add another SPY Butterfly positioned roughly 2 points below the current price. You can also use a 7 point by 6 point Broken Wing Butterfly if you’re uncomfortable with the short delta.

- If price violates the upside again, the trade rolls the lower Butterfly up to 2 points below the current SPY price. The end result will usually be two Butterflies that are positioned very close together.

- The rolling process continues on the upside, but the trade should never exceed the maximum loss and commissions should be factored in.

- On the downside, I take off the Butterfly and reposition it ATM when price trades to 2 or 3 points above the lower long leg.

Making it yours:

The guidelines above are rules that I’ve developed by trading the Migrating Butterfly Strategy. As a result, they take into account my personality traits and trade preferences. You might be more or less comfortable with the risk in this trade and choose to modify the rules. That’s completely fine and encouraged.

Ultimately, a trading strategy needs to fit the trader. Over time and by meticulously tracking our trades, we can learn what works, what doesn’t, and where to improve. Always trade with a plan and document what you’re doing, even if you’re “just” trading a single position in a small account.

This post is not a recommendation to take a trade and is provided for educational purposes only.