An Evolving Focus – Weekend Market Commentary 11/21/2014

Big Picture:

An evolving focus? Yes. As I mentioned a couple of weeks ago, I took a new job that makes it difficult for me to monitor the markets during the day and that’s forcing me to adjust my trading style a little bit. Fortunately, I’m around for the first hour of trading so I’m not totally out of the game. The biggest challenge with my new schedule is that it makes trading the Donchian channel system difficult unless I want to take positions the following morning. The problem with taking positions the following morning is that my trade location can be poor if a fast breakout occurs. However, that limitation does not apply to the Forex markets where I can leave stop orders without worrying about a significant amount of slippage. The logical shift in my mind is to make a move to a rotation system where positions are initiated at predetermined times.

As a sneak peak into 2015, I see myself trading a rotation system in my taxable and retirement accounts, the Donchian channel system on a few Forex markets, and the pTheta system on $SPY. I’ll be discussing the specifics of equity allocations as we go forward into 2015.

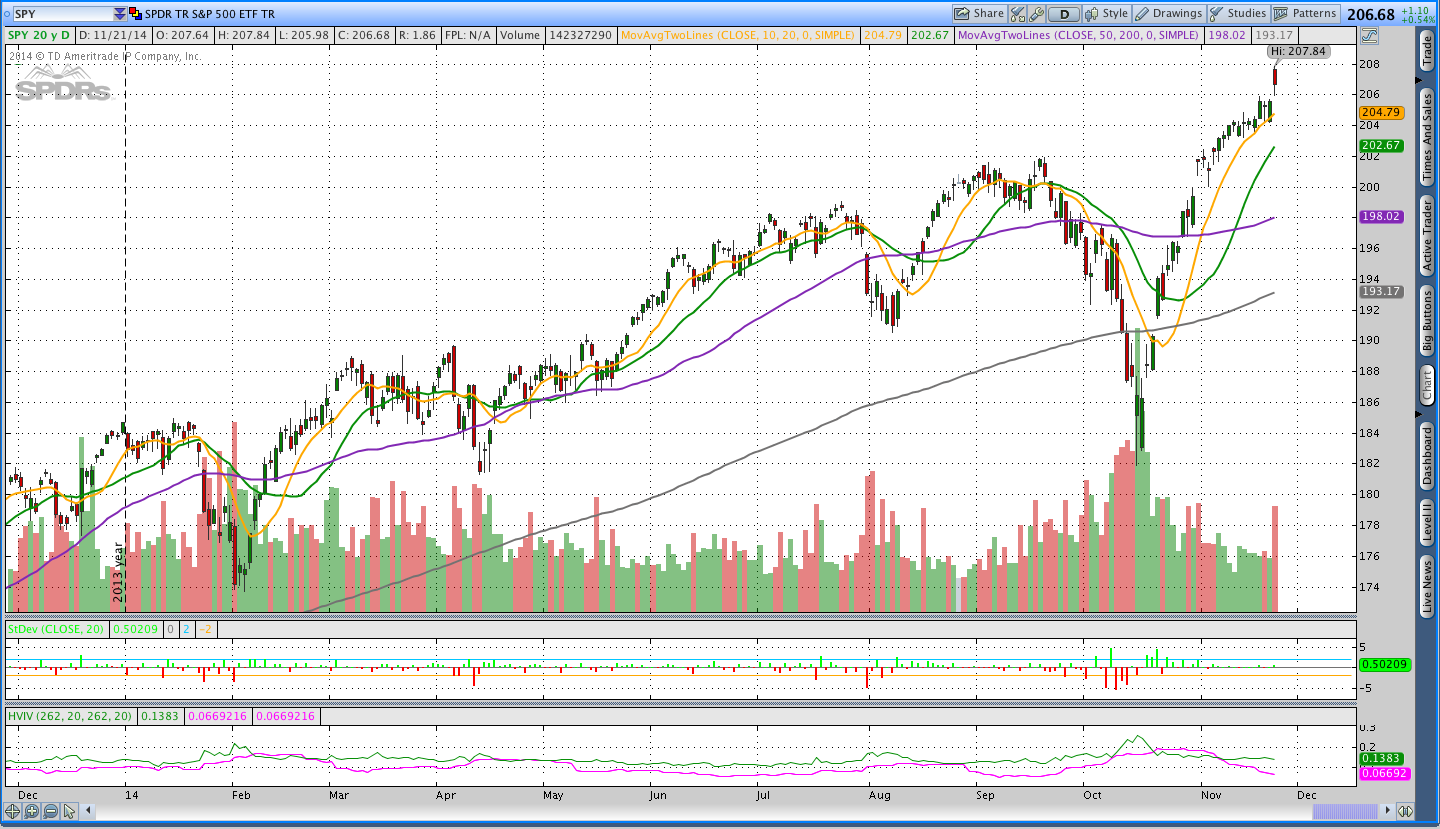

This was a somewhat uneventful week for the markets in terms of moves, but was eventful from a fundamental standpoint. On Thursday night China decided to drop their interest rate slightly and Europe also made a move to ease monetary policy. Those announcements sent equities and the dollar higher and led to a gap higher Friday morning. Equities faded over the course of the day from the gap higher, but $SPY still closed at a new all time high. Right now $SPY looks pretty extended so I wouldn’t be surprised to see a little consolidation as we go into the holiday week. As a reminder, consolidation can take place through price or over time. I’m not anticipating a significant pull-back in price, but the market can do whatever it wants.

Implied Volatility:

Implied volatility was essentially unchanged again this week and is still low.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

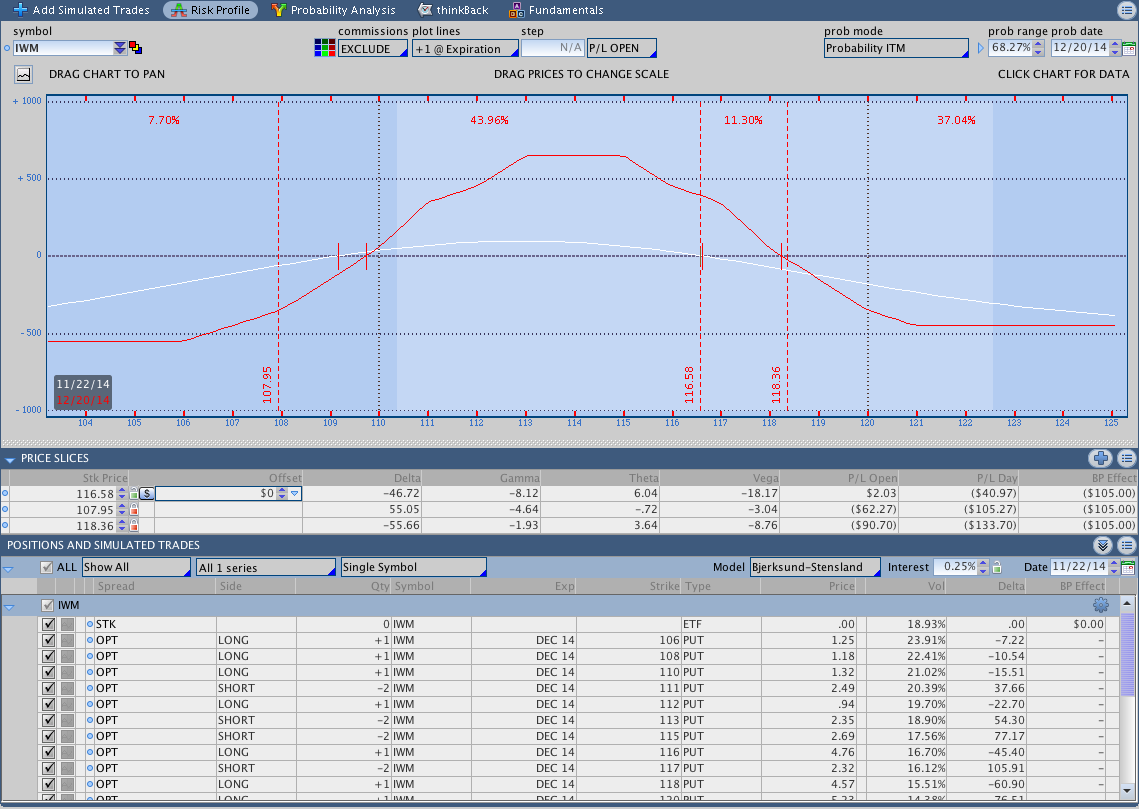

$IWM December 2014 Put Butterfly Update:

The December $IWM Butterfly made it through the uneventful week without any adjustments. $IWM was essentially unchanged this week and now the position has a small open profit. An image of the current position, including all adjustments, is shown below. The thing I don’t care for about non-directional trades is that commissions can become a huge factor on a smaller product like $IWM.

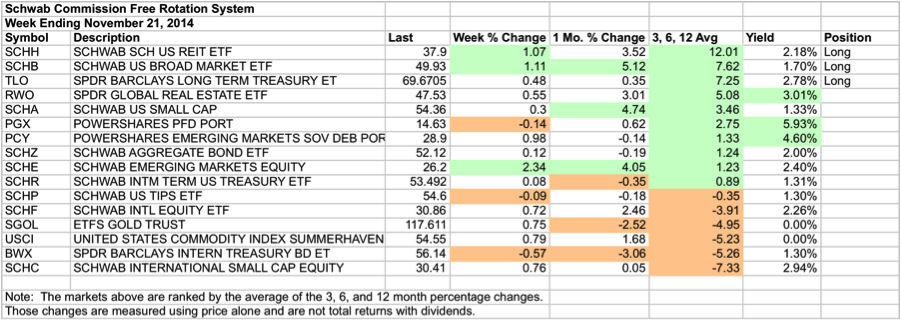

Schwab Commission Free Rotation System:

This is the first week I’ve shown the stats for the Schwab Commission Free ETF Rotation system. If you missed my initial discussion on the system, you should check out this post. I currently have positions in the top 3 markets (SCHH, SCHB, and TLO) and I’m expecting to add to those positions in the first week of December.

The take away from the stats below is that the top 3 markets were strong this week and stocks in general (via $SCHB) continue to be strong. That theme is consistent with what we’ve seen in $SPY and $IWM recently. It’s worth noting that Emerging Markets ($SCHE) seem to be firming up across multiple loopback periods, but still have a ways to go before they break into the top 3.

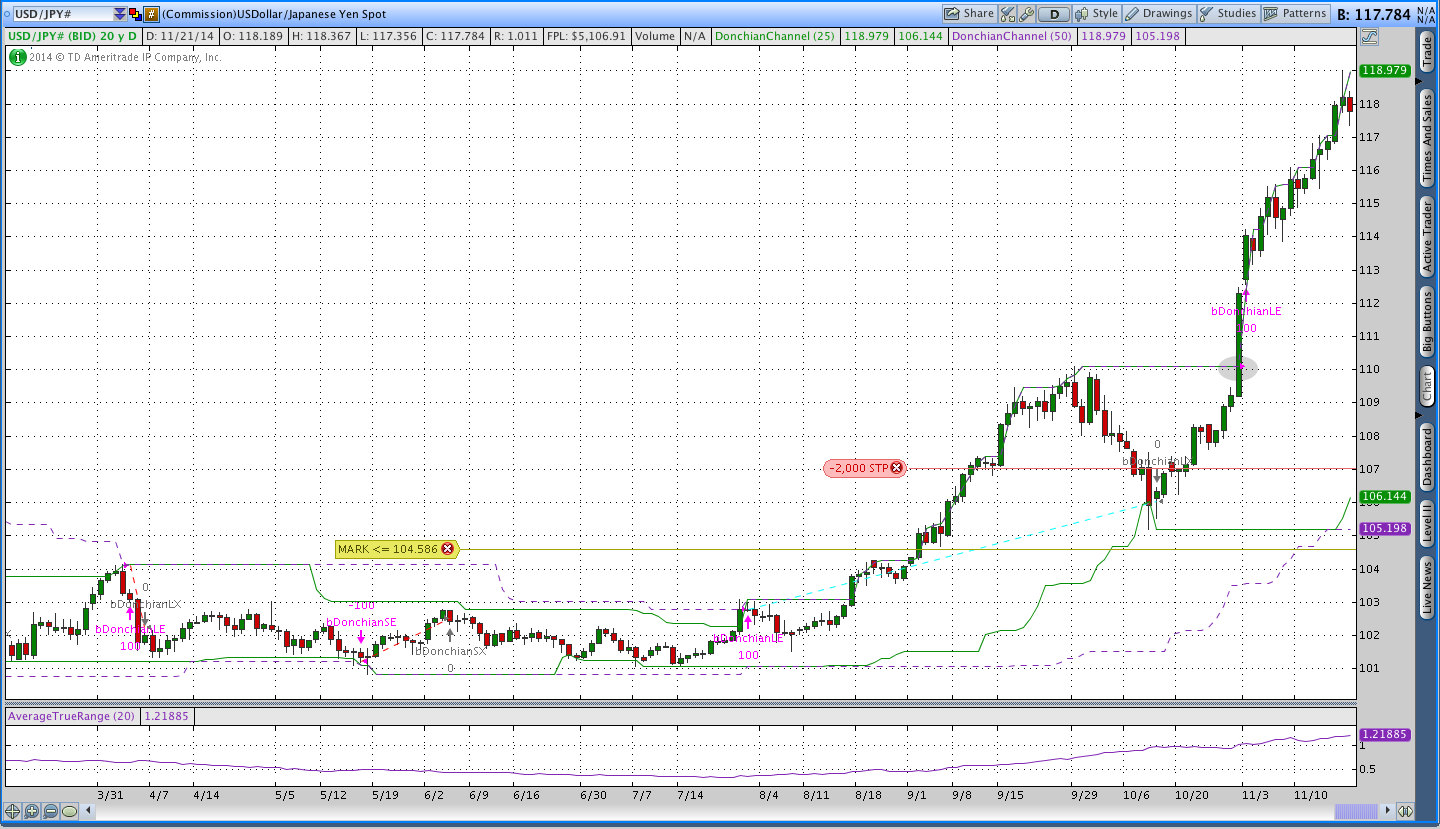

Forex Breakout System Market Stats:

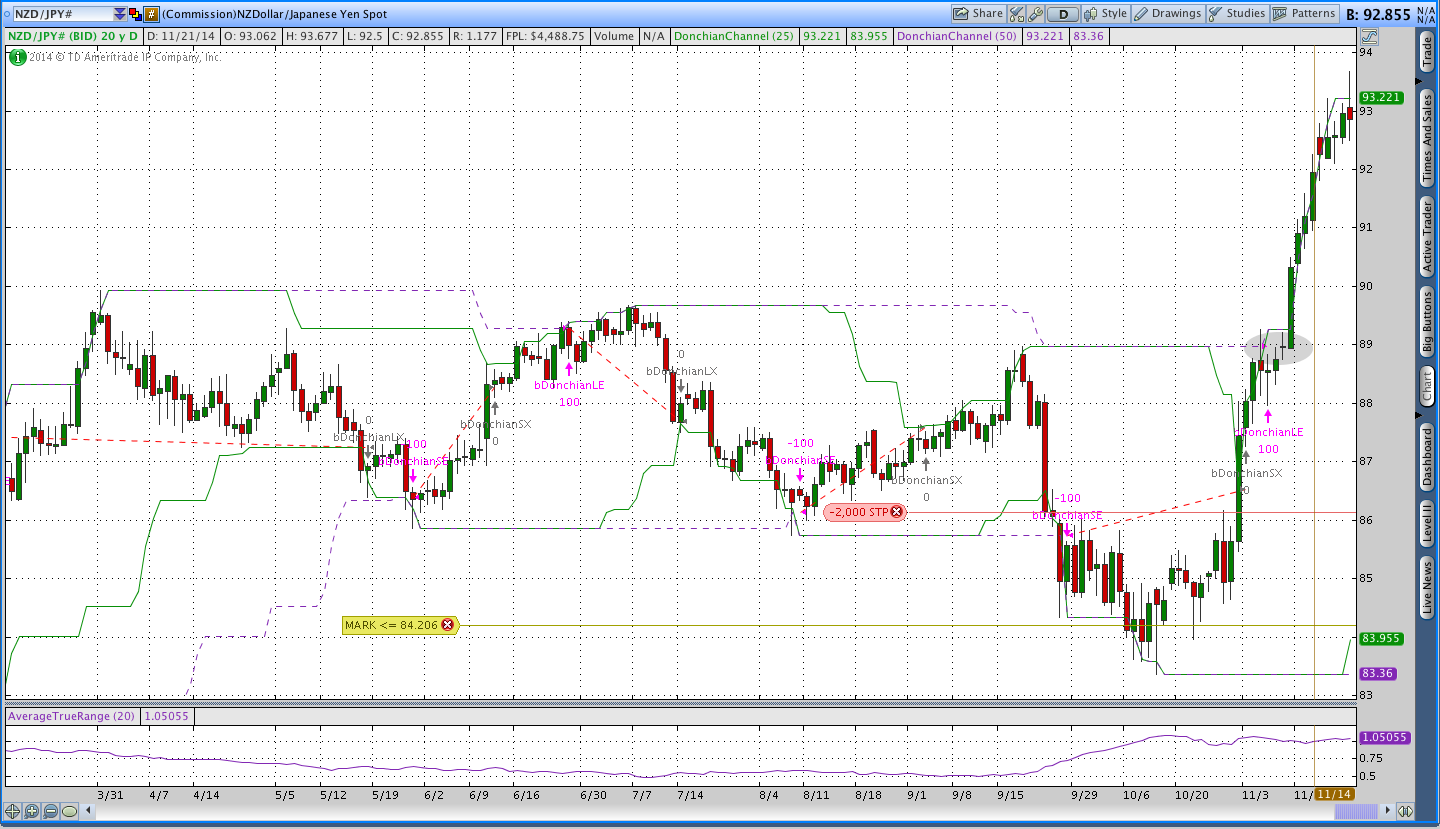

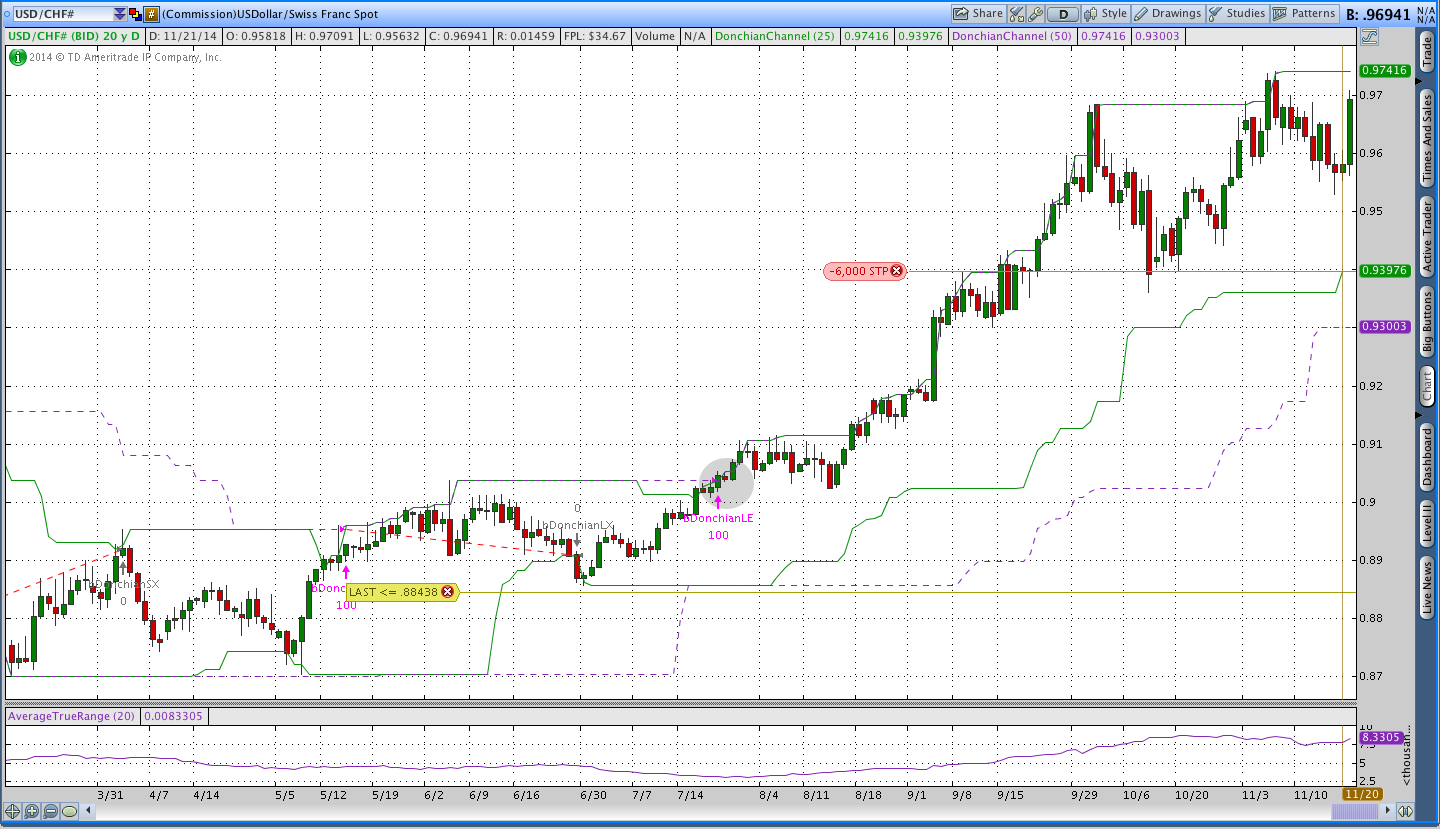

The stats for the Forex markets I trade are shown below. Additionally, I’m including images of the four markets that show trade entry and stop levels. Trading Forex using a mechanical breakout system is something I began doing in 2009 and it has been consistently profitable.

The images below are open trades and are presented without comment. There have been some great moves in the currency markets over the past few months. Shaded ovals indicate my approximate trade entry points. Note that the exact entry prices are disclosed in the Current Inventory section at the bottom of this post.

Trades This Week:

SPY – Sold January 2015 186 Put for .65 (not great location)

Option Inventory:

IWM – Dec 2014 106/111/116 Put Butterfly (bought for 1.03)

IWM – Dec 2014 104/113/114 Put Butterfly (bought for 1.05)

IWM – Dec 2014 109/115/119 Put Butterfly (bought for 1.17)

IWM – Dec 2014 112/117/121 Put Butterfly (bought for .85)

SPY – Short Jan 2015 186 Put (sold for .65)

ETF & Forex Inventory:

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

USD/JPY – Long 2,000 notional units from 110.084

NZD/JPY – Long 2,000 notional units from 89.036

Looking ahead:

We’re going into the Thanksgiving holiday week and I’m not expecting a significant amount of volatility, but the market can (and will) do whatever it wants. $SPY is definitely a little extended and I’m hoping it consolidates or even pulls back slightly. If there is a pullback, I may consider selling a February 2015 Put for the pTheta system.

Next weekend we’ll be through the month of November and I’ll need to update the Rotation System. Right now I have a few positions open for the Schwab Commission Free ETF system, but I’m going to be allocating more equity to the system and adding to those positions. Additionally, I’ll be trading a simple version of the system in the Theta Trend account and taking a position in the top performing ETF. More information on that will show up next weekend . . . Happy Thanksgiving.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.