Complete Guide to Tax Efficient Investing With An ETF Rotation System

A little background:

As some of you know, I’m a CPA (Certified Public Accountant) and work as a Tax Accountant by day. In other words, I spend most of my time at work either preparing tax returns, doing tax planning, or coming up with ways to do something market related (aka daydreaming). Sure, you can start yawning now . . . I know I am. At any rate, the reality of Income Tax is that most people want to pay as little Income Tax as possible. While there are certainly illegal ways to go about doing that, there are also certain Fixed Income Investments that aren’t subject to Income Tax. Additionally, as an individuals income goes up and the IRS greets you with a higher tax bracket, the tax benefits of Tax Effective Investing can be significant. This post explains why Tax Effective Investing matters and provides a simple backtested system for Tax Effective Investing.

As some of you know, I’m a CPA (Certified Public Accountant) and work as a Tax Accountant by day. In other words, I spend most of my time at work either preparing tax returns, doing tax planning, or coming up with ways to do something market related (aka daydreaming). Sure, you can start yawning now . . . I know I am. At any rate, the reality of Income Tax is that most people want to pay as little Income Tax as possible. While there are certainly illegal ways to go about doing that, there are also certain Fixed Income Investments that aren’t subject to Income Tax. Additionally, as an individuals income goes up and the IRS greets you with a higher tax bracket, the tax benefits of Tax Effective Investing can be significant. This post explains why Tax Effective Investing matters and provides a simple backtested system for Tax Effective Investing.

Please note that the discussion below isn’t intended to be political. That being said, politicians make decisions that shape the tax code and finding disfavor with the tax code naturally leads to disliking the actions of certain politicians.

This post is a little longer than usual and is broken into parts. In case you want to jump ahead to a particular section, the parts of of the post are:

Part 1 – Thanks Obama! Why Tax Efficient Investing Matters Even More Now

Part 2 – Understanding Equivalent Returns

Part 3 – That’s the problem. What’s the objective?

Part 4 – The Tax Treatment of Fixed Income ETF’s

Part 5 – Creating and Backtesting a Tax Efficient Portfolio

Part 1 – Thanks Obama! Why Tax Efficient Investing Matters Even More Now

The reality of the U.S. Tax Code is that it isn’t set up to benefit working people (employees). Historically, it has been beneficial from a tax standpoint to derive investment income from qualified dividends, long term capital gains, and tax free interest. However, some of the changes that have taken place during the Obama administration are essentially creating penalties for high income individuals with significant investment income. Specifically, I’m talking about the Net Investment Income Tax (NII), which imposes a 3.8% tax on investment income for high income individuals. The current thresholds for the NII Tax are a modified Adjusted Gross Income of $250,000 for married couples and $200,000 for single filers. In other words, you’re likely to pay an additional 3.8% in tax on your investment income if you have adjusted gross income above those levels.

The Net Investment Income Tax is fairly broad and imposes the tax on rental and royalty income, interest, dividends, and even capital gains from the sale of securities. However, Tax Exempt interest is NOT subject to the Net Investment Income Tax. The Net Investment Income Tax matters in a big way for high income individuals because it’s a fairly significant tax increase on investment income. The extremely low taxable yields on most investments make finding a reasonable taxable return even more challenging.

When additional taxes are imposed on most (but not all) types of investment income, a natural incentive is created to seek out alternative investments that aren’t subject to tax. Tax Efficient Investing is the concept of making investment decisions within context of your personal tax situation. For example, this discussion is totally irrelevant if all of your investing is done in a retirement account. However, if you hold investments in taxable accounts and are subject to NII Tax, it is very important to compare the taxable and tax free returns of investment choices.

Part 2 – Understanding Equivalent Returns

In order to understand the impact of Taxes on investment return, we need a way to compare the taxable return on an investment with the tax free return. The equation below gives us a way to compare the Taxable and Tax Free Yields.

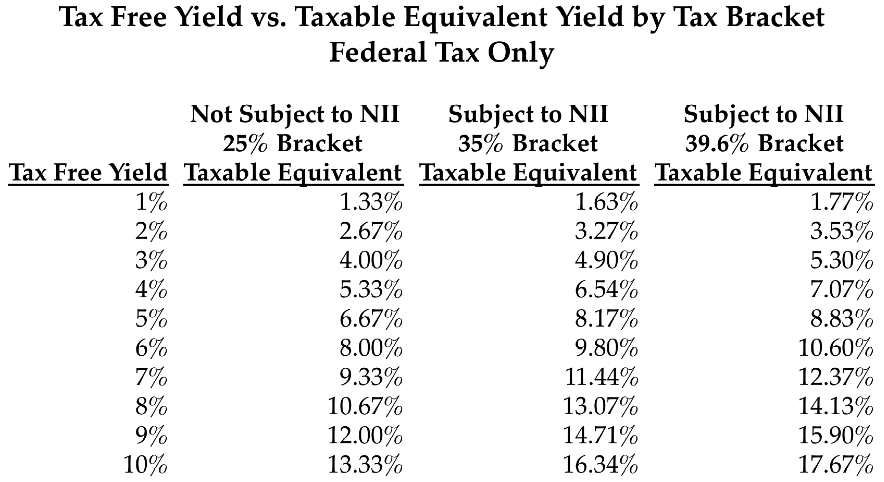

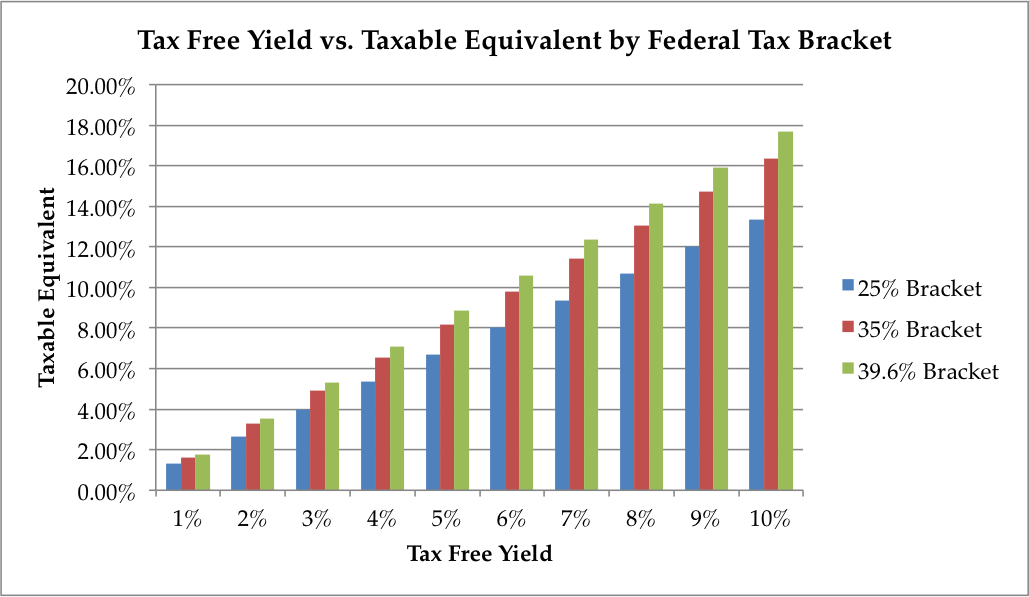

Taxable Yield = Tax Free Yield / 1 – Tax Bracket

In the table and following graph, we take a look at the tax free and taxable equivalent yields for various returns. The take away is that Tax Efficient Investing becomes increasingly beneficial as your tax bracket increases. Additionally, the new Net Investment Income Tax serves to amplify the benefits of Tax Efficient investing. Note that for someone in the 39.6% tax bracket, a 5% Tax Free Yield is the equivalent of earning a Taxable Return of almost 9% and that’s not even considering state tax.

Part 3 – That’s the problem. What’s the objective?

Most people want to pay as little tax as possible. Generally when people are looking for a way to minimize tax in investing they have a high adjusted gross income and they want to generate tax favorable income. Looking back at the table above, we know that tax favorable income becomes more important as your tax rate increases. While Mr. Obama claims that most millionaires are willing, “To step up,” and pay more tax, I haven’t met anyone who “wants” to pay more tax.

When we start talking about income tax, it’s worth noting that people with a tax filing requirement in the U.S. are usually subject to both Federal and State Income tax. There are some states without a state income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, Tennessee), but we’ll concern ourselves with avoiding tax in states that have a state income tax.

How are we going to create income that isn’t subject to tax?

The primary, and most accessible, way to create income without generating tax is to invest in certain types of Bonds. Bonds generally pay interest and that income can be either subject to income tax or not depending on the Bond. Additionally, the interest can be subject to Federal Tax, State Tax, one or the other, or not subject to any tax.

While this post focuses primarily on Municipal Bonds, it’s worth noting that Qualified Dividends are subject to lower tax rates than ordinary interest and dividends. However, Qualified Dividends are subject to the Net Investment Income Tax.

There are a couple of general rules that we should keep in mind going forward:

- US Government Bonds are subject to Federal Tax, but not state tax. If you’re in the 39.6% Tax Bracket, that’s not much of a gift.

- Municipal Bonds are not subject to Federal Tax. Municipal Bonds are not subject to state and local income tax if you are a resident of the state where the Bond is issued. For example, if you are a Los Angeles, CA resident and you receive Tax Free Interest from a California Bond, that interest is not subject to Federal or State Tax.

Simple, right? No, AMT is the Elephant in the Room.

Now that we’ve gotten a general overview of what types of income are taxable and not taxable, it’s worth noting that Alternative Minimum Tax (AMT) can change our assumptions. If an individual is subject to AMT, some tax free interest can be subject to Federal Tax. AMT considerations are beyond the scope of this post, but just know that the picture is less clear if you’re in AMT.

Part 4 – Tax Treatment of Fixed Income ETF’s

One of the great things about the explosion of ETF’s is that investors have access to markets that would have been previously difficult to access. The challenge is understanding the implications of the choices. The table below lists a few popular Fixed Income ETF’s and the tax treatment of those ETF’s. The ETF’s listed are theoretically not subject to Federal Tax, however, AMT and ETF holdings could make them subject to Federal Tax in some situations. With the exception of the California and New York Municipal Bond ETF’s, the ETF’s hold municipal bonds in multiple states. As a result, the state tax treatment varies by state.

| ETF Symbol | Description | Subject to State Tax |

|---|---|---|

| TFI | SPDR Barclays Municipal Bond | Varies |

| SHM | SPDR Nuveen Barclays Capital Short Term Muni Bond ETF | Varies |

| HYMB | SPDR Nuveen S&P High Yield Municipal Bond ETF | Varies |

| PZA | PowerShares National AMT-Gree Municipal Bond Portfolio | Varies |

| ITM | Market Vectors Intermediate Municipal Index ETF | Varies |

| PWZ | PowerShares California AMT-Free Municipal Bond Portfolio | CA Non-Taxable |

| CMF | iShares S&P California Municipal Bond Fund | CA Non-Taxable |

| PZT | PowerShares New York AMT-Free Municipal Bond Portfolio | NY Non-Taxable |

| NYF | iShares S&P New York Municipal Bond Fund | NY Non-Taxable |

Part 5 – Creating a Systematic Tax Efficient ETF Rotation System

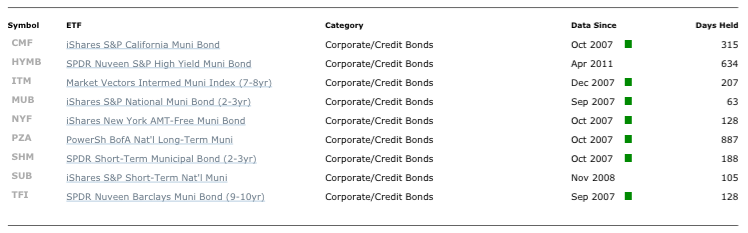

After looking at the ETF’s in the table, most people would be unsure of what to buy, when to buy it, and when to sell it. However, using a simple, rules based approach to investing could potentially address some of those problems.

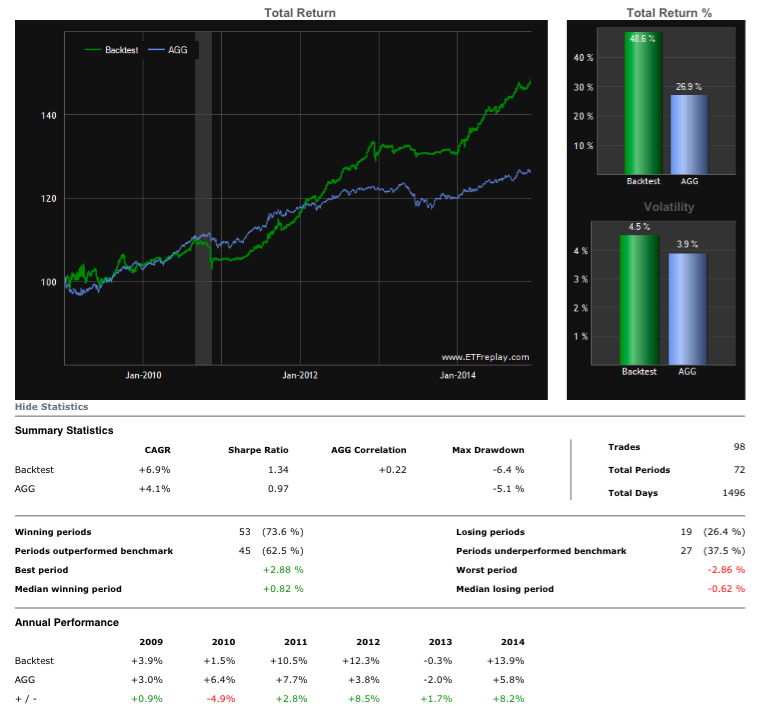

I ran a test below using ETFReplay to validate a rotation system. The biggest challenge with testing this system is that the ETF data available only goes back 6 or so years, which isn’t ideal. The system used all of the ETF’s shown in the table above except it only used one California and one New York ETF. The rules for the rotation system were fairly simple and are as follows:

- Rank the ETF’s based on the 5 month total return and purchase the top 2 performers on a monthly basis.

- Use a 5 month moving average filter to avoid buying into a down market. In other words, if either of the top two ETF’s is trading below the 5 month moving average, that position will be held in cash ($SHY). If both are trading below the 5 month moving average, then both are held in cash.

- Adjust positions (rebalance) to equal 50% of the portfolio every month.

- Ignore all intra-month fluctuations.

An image of system equity over the backtest period is shown below. I used the Aggregate Bond Index ($AGG) as a benchmark because I wanted to see how the system performed compared to bonds in general. It’s worth noting that the system had a CAGR of just under 7%. While 7% might seem like a low return, we need to remember that for someone in the 39.6% tax bracket a 7% tax free return is equivalent to over a 12% taxable return and that’s ignoring state tax.

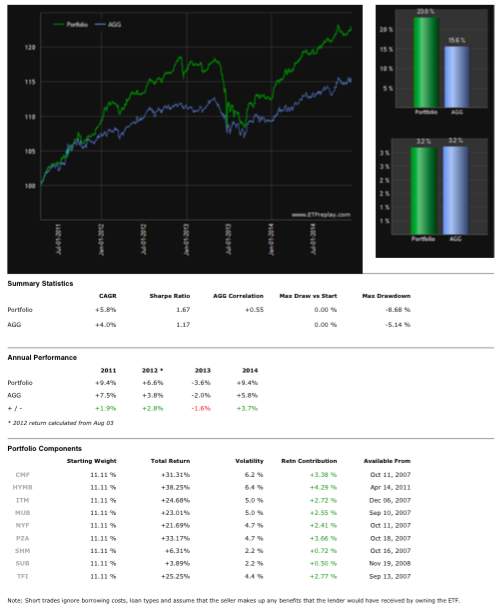

The Municipal Bond ETF Rotation System held the following ETF’s:

Here’s a problem with the Tax Efficient ETF Rotation System:

Perhaps the biggest criticism of the Tax Efficient ETF Rotation System is that investments will be bought and sold. Big deal, right? Wrong. Buying and selling the investments will create capital gains and losses and, if you recall from above, capital gains are subject to the Net Investment Income Tax. As a result, it also makes sense to consider a buy and hold version of the portfolio. Note that I am deliberately avoiding a discussion on Tax Loss Harvesting, but the strategy of realizing losses to offset gains is a significant consideration in Tax Efficient Investing.

The test below looks at a closer to Buy and Hold version of the Tax Efficient ETF Portfolio. This test used the same portfolio and held equally weighted positions that were not rebalanced.

The Bottom Line:

At the end of the day, the U.S. Tax code is complicated and making Tax Effective Investment decisions is even more complicated. Part of the reason for the complexity is that there are Federal and State tax implications for almost all financial and investment decisions. In other words, there are a lot of moving parts and everyone has a unique situation. The Net Investment Income tax makes generating “good” after tax returns difficult for individuals in higher tax brackets, but there are some solutions for avoiding tax.

This post was intended to be an introduction to some of the considerations in Tax Effective Investing, however, it is not intended to be any sort of Tax or Investing Advice. As always, feel free to email your questions to info at thetatrend dot com.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. Thanks for reading!

Want to receive an email every time I post this type of analysis?

Sign up for my email list and I’ll keep you up to date on my latest research, thoughts, and questionable humor.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.