Brief Market Commentary 10/30/15 – $RUT, $RVX

Big Picture:

Today we’re going to have an abbreviated market commentary that only covers Levels of Interest and the December CIB trade. I have plenty of things I’d like to say about CNBC after the GOP debate this week, but I’ll keep those comments to myself for now.

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

—————————–

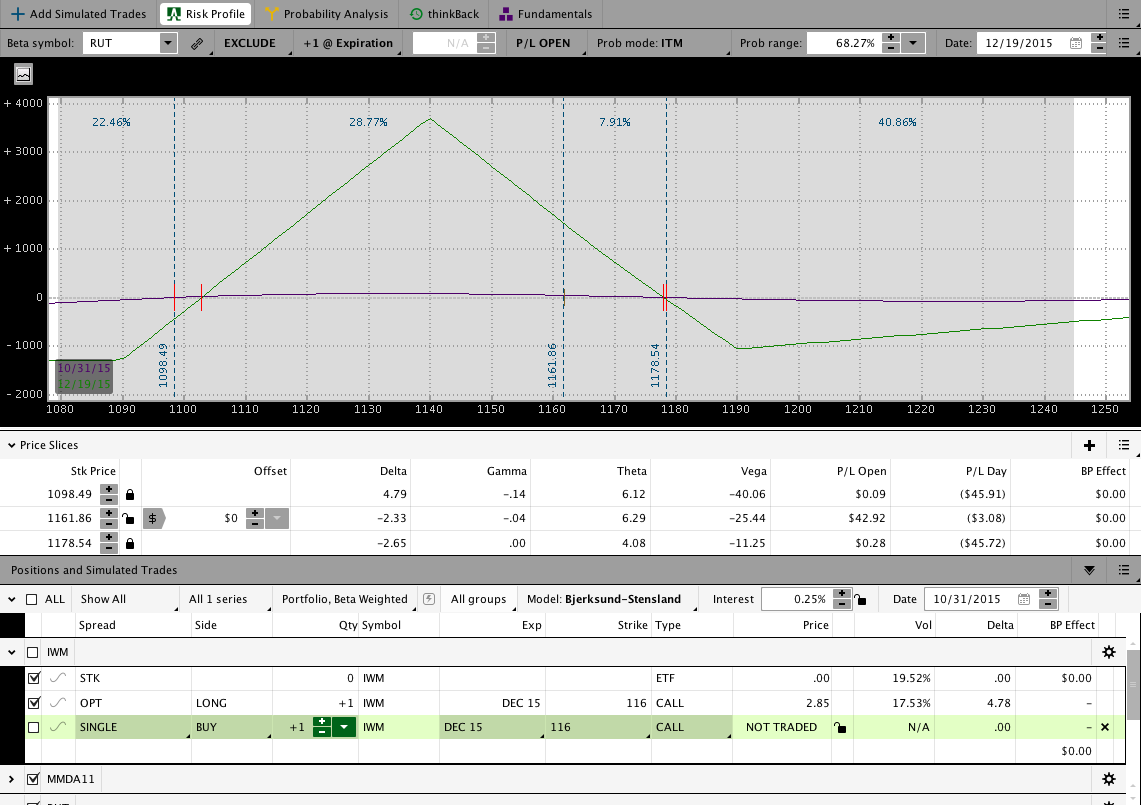

The December CIB looked like it might hit an upside adjustment point this week, but that never occurred. The market came right up to the adjustment point and then backed away. The image below shows the current position as of the close on Friday. This has been the quietest first week a CIB has gone through in a while. I’m definitely not complaining.

Click here to learn about the Premium Course that covers the CIB Trade in Detail

The November Migrating Butterfly in SPY was closed this week for a loss of around $110. SPY constantly challenged this trade and it was time to take it off for the loss.

Looking ahead, etc.:

My main area of concern right now is the upside adjustment level in RUT around 1180. That being said, I wouldn’t be surprised to see the market fail and break down. There’s a lot of indecision right now and having a directional opinion doesn’t make sense until the market gives us a little more direction.

Quick, fast, and brief. Have a good weekend!

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.