A simple tweak that more than doubles the profitability of a credit spread system

I decided to do a comparison of some prior months trades to see if there is anything that could be done differently to improve the bottom line. In general, Theta Trend works when  trends continue or don’t reverse sharply. In thinking about the problem I came up with two things I want to consider. First, what happens when you sell naked options or a slightly wider spread (say 3-5 strikes wide) and second, can we can apply some sort of filter (momentum, moving average, etc) to improve the reliability of the system?

trends continue or don’t reverse sharply. In thinking about the problem I came up with two things I want to consider. First, what happens when you sell naked options or a slightly wider spread (say 3-5 strikes wide) and second, can we can apply some sort of filter (momentum, moving average, etc) to improve the reliability of the system?

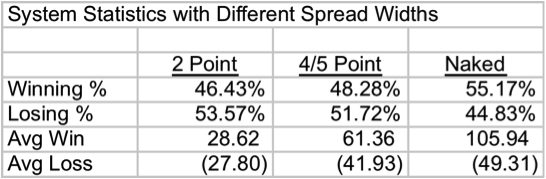

In the video below, I look at the impact of trading naked options and wider credit spreads on the profitability of the system. The table above gives the summary of results for all of the trades from December 2012 through April 2013. In a really interesting play on positive expectancy, the system win rate stays approximately the same and the profit goes up simply by trading a wider credit spread. It’s pretty cool stuff, check out the video below . . .