A Simple $RUT Options Butterfly Adjustment to Cut Delta and Risk

Part of any good options trading plan is knowing when and how you’re going to adjust your positions. However, I don’t always believe in hard rules for options trading. The reality is that the positions and the markets change over time and, in my opinion, that makes it more practical to have guidelines (rather than firm rules) for adjusting options trades. Fortunately for us, the activity in the Russell 2000 ($RUT) last week should help illustrate the value in using guidelines for adjusting trades.

$RUT Options Butterfly Trade:

A few weeks back I initiated a $RUT March 2015 Put Butterfly with a long $IWM call to hedge the upside in the trade. I entered the somewhat bearish trade with $RUT trading at 1172. While I didn’t know it at the time, $RUT was about to head higher and my location in the trade was, well, bad. Honestly, it would have been hard for me to time a worse entry. At any rate, the trade rolled along for about a week before needing an upside adjustment so I added another Butterfly and another long $IWM call. A little more time passed and $RUT continued higher and this time I decided to roll up the initial Butterfly. You can read about that adjustment in this post.

Late last week, $RUT was up again and now at all time highs (dammit). As a result, I added the 1170/1220/1260 Broken Wing Put Butterfly (BWB) to the position to stretch out the expiration break even line and keep Russell trapped. At this point the trade was under 30 days to expiration and I was becoming a little shorter delta than I wanted. This video goes over some of the reasoning behind adding the BWB.

Fortunately for me, the next morning $RUT decided to have a little intraday pullback from around 1230 to 1220. That pullback happened the day after I initiated the BWB.

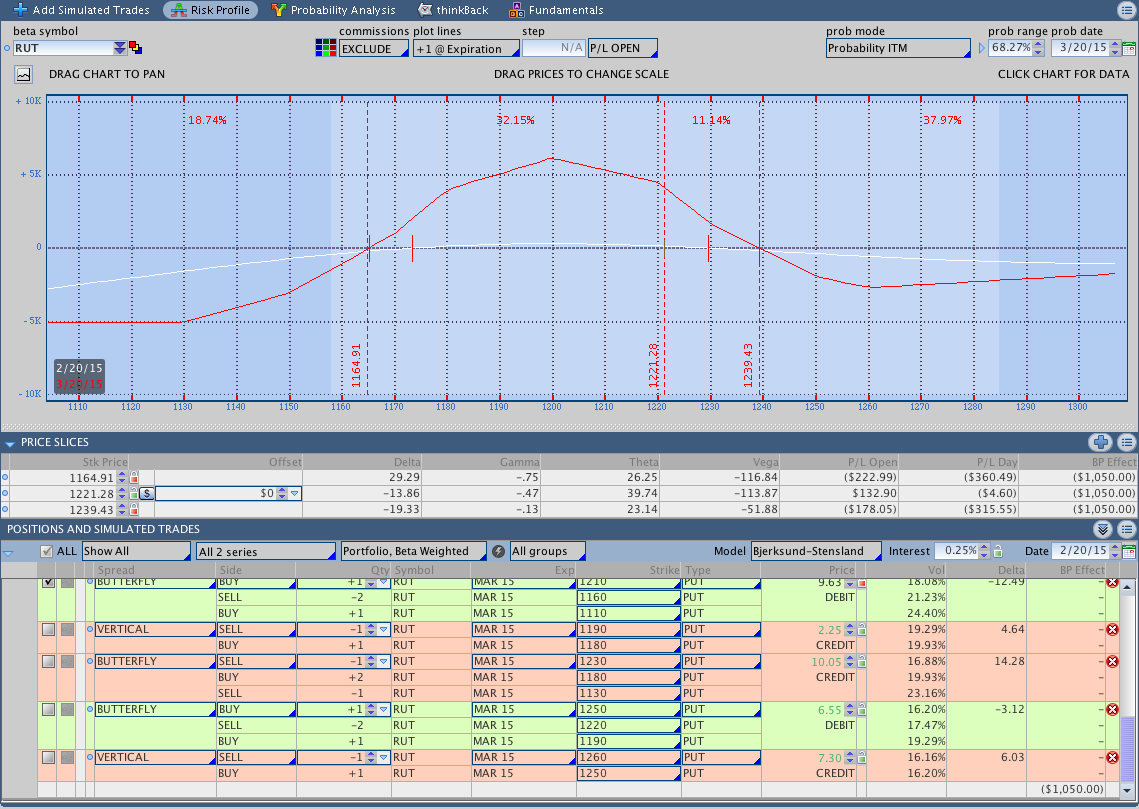

A picture of the position with $RUT around 1220 is shown below:

Since the move down happened shortly after adding the BWB (the next morning), I knew that the long options in the BWB I just added should be up money. At the same time, I was concerned about $RUT springing back to the upside because markets that are trading at all time highs tend to have an upward bias. I quickly looked at my $RUT inventory and decided to use the pullback as an opportunity to cut both my delta and upside risk in the trade by taking off the upper put in the BWB and moving it down 10 points. In other words, I rolled the long 1260 put down to 1250. That move took an in the money put and moved it closer to at the money and cut delta.

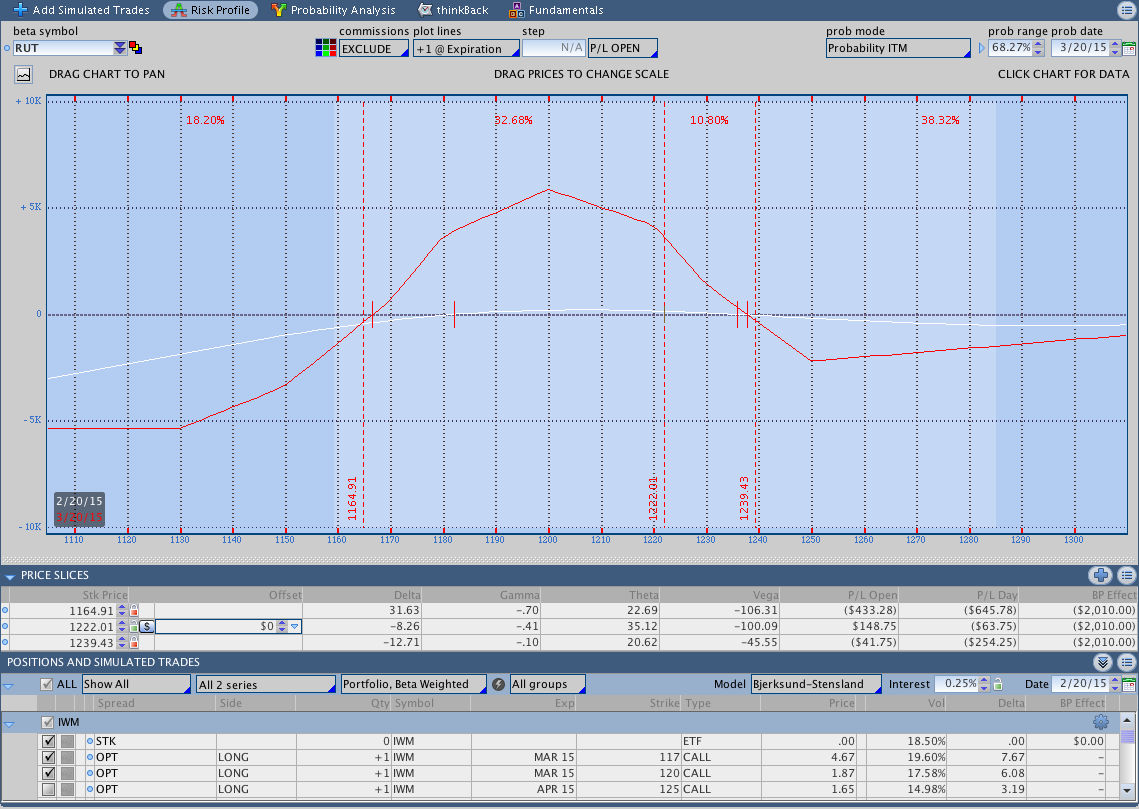

An image of the position after rolling the put is shown below:

The adjustment above cut my short delta from -13 to -8, gamma from -.47 to -.41, which came at the cost of theta falling from 39 to 35. However, the most important part of the adjustment is that it significantly cut my upside risk. As I mentioned in the BWB Adjustment video, my next upside adjustment point was (and is) around 1240. Prior to rolling down the put my T+Zero loss at 1240 was projected to be -$178 and after the roll the T+Zero loss fell to -$41. In other words, rolling down the put allowed me to cut the upside risk in the trade significantly. Lower risk will also make it more comfortable to sit in the position and collect theta as we move closer to expiration.

Adjusting an options trade can serve many purposes, but all good adjustments make it more comfortable to stay in the trade and reduce risk. One of the important things to realize about the adjustment above is that it wasn’t planned or rule based. I made the adjustment based on my market opinion and a lucky turn of events that gave me the opportunity to express that opinion. It’s too early to know if the adjustment was the right move or not, but it did reduce risk and make me more comfortable sitting in the position. In my mind, those things are always good.

If you have any questions about the trade or the adjustments feel free to post them in the comments below.

Click here to follow me on Twitter